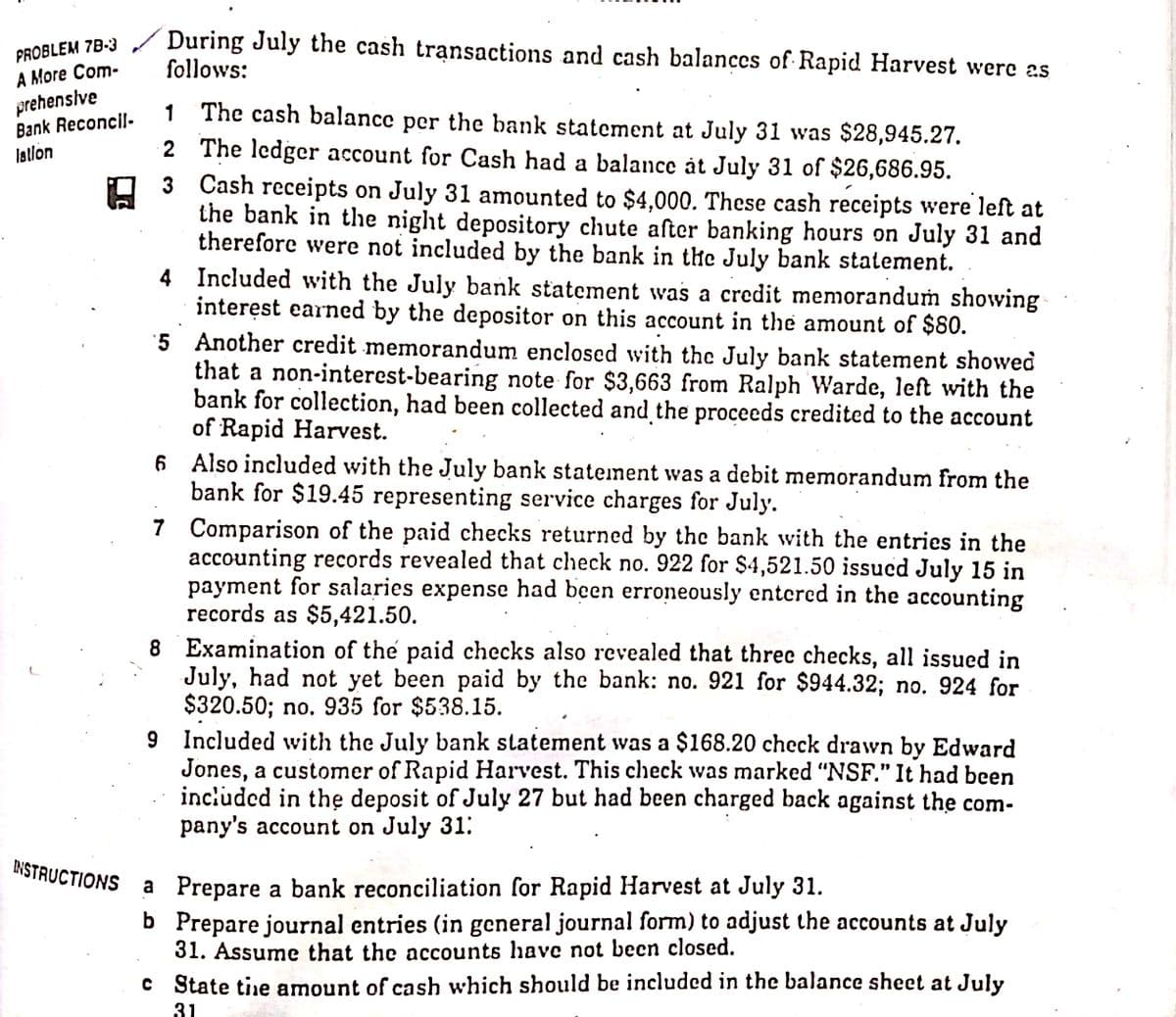

PROBLEM 7B-3 A More Com- During July the cash transactions and cash balances of Rapid Harvest were as follows: prehensive Bank Reconcil- The cash balance per the bank statement at July 31 was $28,945.27. 2 The ledger account for Cash had a balance àt July 31 of $26,686.95. 3 Cash receipts on July 31 amounted to $4,000. These cash receipts were left at the bank in the night depository chute after banking hours on July 31 and therefore were not included by the bank in the July bank statement. 4 Included with the July bank statement was a credit memoranduṁ showing interęst earned by the depositor on this account in the amount of $80. '5 Another credit memorandum enclosed with the July bank statement showed that a non-interest-bearing note for $3,663 from Ralph Warde, left with the bank for collection, had been collected and the proceeds credited to the account of Rapid Harvest. 6 Also included with the July bank statement was a debit memorandum from the bank for $19.45 representing service charges for July. 7 Comparison of the paid checks returned by the bank with the entries in the accounting records revealed that check no. 922 for $4,521.50 issucd July 15 in payment for salaries expense had been erroneously entered in the accounting records as $5,421.50. 1 Istlon 8 Examination of the paid checks also revealed that threc checks, all issued in July, had not yet been paid by the bank: no. 921 for $944.32; no. 924 for $320.50; no. 935 for $538.15. 9 Included with the July bank statement was a $168.20 check drawn by Edward Jones, a customer of Rapid Harvest. This check was marked "NSF." It had been included in the deposit of July 27 but had been charged back against the com- pany's account on July 31: INSTRUCTIONS a Prepare a bank reconciliation for Rapid Harvest at July 31. b Prepare journal entries (in general journal form) to adjust the accounts at July 31. Assume that the accounts have not becn closed. c State tine amount of cash which should be included in the balance sheet at July

PROBLEM 7B-3 A More Com- During July the cash transactions and cash balances of Rapid Harvest were as follows: prehensive Bank Reconcil- The cash balance per the bank statement at July 31 was $28,945.27. 2 The ledger account for Cash had a balance àt July 31 of $26,686.95. 3 Cash receipts on July 31 amounted to $4,000. These cash receipts were left at the bank in the night depository chute after banking hours on July 31 and therefore were not included by the bank in the July bank statement. 4 Included with the July bank statement was a credit memoranduṁ showing interęst earned by the depositor on this account in the amount of $80. '5 Another credit memorandum enclosed with the July bank statement showed that a non-interest-bearing note for $3,663 from Ralph Warde, left with the bank for collection, had been collected and the proceeds credited to the account of Rapid Harvest. 6 Also included with the July bank statement was a debit memorandum from the bank for $19.45 representing service charges for July. 7 Comparison of the paid checks returned by the bank with the entries in the accounting records revealed that check no. 922 for $4,521.50 issucd July 15 in payment for salaries expense had been erroneously entered in the accounting records as $5,421.50. 1 Istlon 8 Examination of the paid checks also revealed that threc checks, all issued in July, had not yet been paid by the bank: no. 921 for $944.32; no. 924 for $320.50; no. 935 for $538.15. 9 Included with the July bank statement was a $168.20 check drawn by Edward Jones, a customer of Rapid Harvest. This check was marked "NSF." It had been included in the deposit of July 27 but had been charged back against the com- pany's account on July 31: INSTRUCTIONS a Prepare a bank reconciliation for Rapid Harvest at July 31. b Prepare journal entries (in general journal form) to adjust the accounts at July 31. Assume that the accounts have not becn closed. c State tine amount of cash which should be included in the balance sheet at July

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter5: Internal Control And Cash

Section: Chapter Questions

Problem 5.5.3C

Related questions

Question

Transcribed Image Text:During July the cash transactions and cash balances of Rapid Harvest were as

follows:

PROBLEM 78-3

A More Com-

prehensive

Bank Reconcil.

latlon

1 The cash balance per the bank statement at July 31 was $28,945.27.

2 The ledger account for Cash had a balance àt July 31 of $26,686.95.

3 Cash receipts on July 31 amounted to $4,000. These cash receipts were left at

the bank in the night depository chute after banking hours on July 31 and

therefore were not included by the bank in the July bank statement.

4 Included with the July bank statement was a credit memoranduṁ showing

interęst earned by the depositor on this account in the amount of $80.

'5 Another credit memorandum enclosed with the July bank statement showed

that a non-interest-bearing note for $3,663 from Ralph Warde, left with the

bank for collection, had been collected and the proceeds credited to the account

of Rapid Harvest.

6 Also included with the July bank statement was a debit memorandum from the

bank for $19.45 representing service charges for July.

7 Comparison of the paid checks returned by the bank with the entries in the

accounting records revealed that check no. 922 for $4,521.50 issucd July 15 in

payment for salaries expense had been erroneously entcred in the accounting

records as $5,421.50.

8 Examination of the paid checks also revealed that three checks, all issued in

July, had not yet been paid by the bank: no. 921 for $944.32; no. 924 for

$320.50; no. 935 for $538.15.

9 Included with the July bank statement was a $168.20 check drawn by Edward

Jones, a customer of Rapid Harvest. This check was marked "NSF." It had been

included in thẹ deposit of July 27 but had been charged back against the com-

pany's account on July 31:

INSTRUCTIONS

a Prepare a bank reconciliation for Rapid Harvest at July 31.

b Prepare journal entries (in general journal form) to adjust the accounts at July

31. Assume that the accounts have not becn closed.

c State tie amount of cash which should be included in the balance sheet at July

31

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning