camdenccinstructure.com/courses/3788/asSignments/35976 Waterway Industries is contemplating the replacement of an old machine with a new one. The following information has been gathered: Old Machine New Machine $900000 $450000 Price 135000 Accumulated Depreciation -0- 10 years 0- Remaining useful life -0- 10 years Useful life Annual operating costs $360000 $270000 If the old machine is replaced, it can be sold for $36000. The company uses straight-line depreciation with a zero salvage value for all of its assets Which of the following amounts is relevant to the replacement decision? O $135000 O$90000 O$315000 $450000

camdenccinstructure.com/courses/3788/asSignments/35976 Waterway Industries is contemplating the replacement of an old machine with a new one. The following information has been gathered: Old Machine New Machine $900000 $450000 Price 135000 Accumulated Depreciation -0- 10 years 0- Remaining useful life -0- 10 years Useful life Annual operating costs $360000 $270000 If the old machine is replaced, it can be sold for $36000. The company uses straight-line depreciation with a zero salvage value for all of its assets Which of the following amounts is relevant to the replacement decision? O $135000 O$90000 O$315000 $450000

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter12: Differential Analysis And Product Pricing

Section: Chapter Questions

Problem 12.2.2P: Differential analysis report for machine replacement proposal Catalina Tooling Company is...

Related questions

Question

Transcribed Image Text:camdenccinstructure.com/courses/3788/asSignments/35976

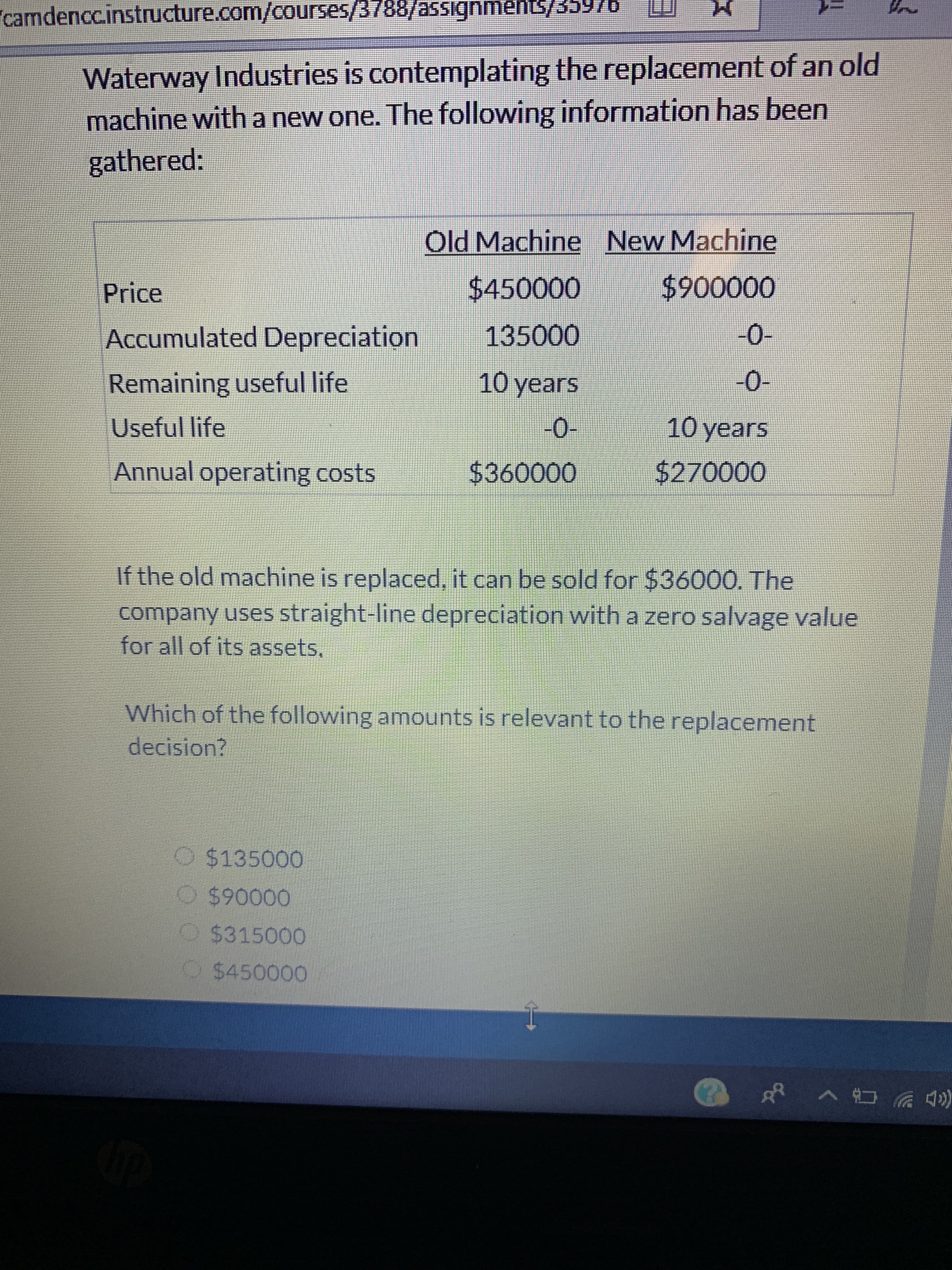

Waterway Industries is contemplating the replacement of an old

machine with a new one. The following information has been

gathered:

Old Machine New Machine

$900000

$450000

Price

135000

Accumulated Depreciation

-0-

10 years

0-

Remaining useful life

-0-

10 years

Useful life

Annual operating costs

$360000

$270000

If the old machine is replaced, it can be sold for $36000. The

company uses straight-line depreciation with a zero salvage value

for all of its assets

Which of the following amounts is relevant to the replacement

decision?

O $135000

O$90000

O$315000

$450000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning