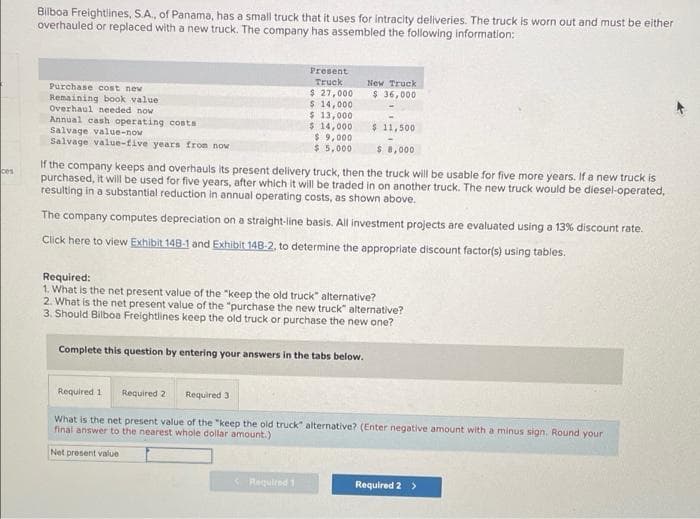

Bilboa Freightlines, SA, of Panama, has a small truck that it uses for intracity deliveries. The truck is worn out and must be eithen overhauled or replaced with a new truck. The company has assembled the following information: Present Truck New Truck Purchase cost new $ 36,000 Remaining book value Overhaul needed now Annual cash operating costs Salvage value-now Salvage value-five years from now $ 27,000 $ 14,000 $ 13,000 $ 14,000 $ 9,000 $ 5,000 $ 11,500 $ 8,000 If the company keeps and overhauls its present delivery truck, then the truck will be usable for five more years. If a new truck is purchased, It will be used for five years, after which it will be traded in on another truck. The new truck would be diesel-operated, resulting in a substantial reduction in annual operating costs, as shown above. The company computes depreciation on a straight-line basis. All investment projects are evaluated using a 13% discount rate. Click here to view Exhibit 148-1 and Exhibit 148-2, to determine the appropriate discount factor(s) using tables. Required: 1. What is the net present value of the "keep the old truck" alternative? 2. What is the net present value of the "purchase the new truck" alternative? 3. Should Bilboa Freightlines keep the old truck or purchase the new one? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 What is the net present value of the "keep the old truck" alternative? (Enter negative amount with a minus sign. Round your final answer to the nearest whole dollar amount.) Net present value Required 1 Required 2 >

Bilboa Freightlines, SA, of Panama, has a small truck that it uses for intracity deliveries. The truck is worn out and must be eithen overhauled or replaced with a new truck. The company has assembled the following information: Present Truck New Truck Purchase cost new $ 36,000 Remaining book value Overhaul needed now Annual cash operating costs Salvage value-now Salvage value-five years from now $ 27,000 $ 14,000 $ 13,000 $ 14,000 $ 9,000 $ 5,000 $ 11,500 $ 8,000 If the company keeps and overhauls its present delivery truck, then the truck will be usable for five more years. If a new truck is purchased, It will be used for five years, after which it will be traded in on another truck. The new truck would be diesel-operated, resulting in a substantial reduction in annual operating costs, as shown above. The company computes depreciation on a straight-line basis. All investment projects are evaluated using a 13% discount rate. Click here to view Exhibit 148-1 and Exhibit 148-2, to determine the appropriate discount factor(s) using tables. Required: 1. What is the net present value of the "keep the old truck" alternative? 2. What is the net present value of the "purchase the new truck" alternative? 3. Should Bilboa Freightlines keep the old truck or purchase the new one? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 What is the net present value of the "keep the old truck" alternative? (Enter negative amount with a minus sign. Round your final answer to the nearest whole dollar amount.) Net present value Required 1 Required 2 >

Chapter10: Capital Budgeting: Decision Criteria And Real Option

Section: Chapter Questions

Problem 17P

Related questions

Question

Transcribed Image Text:Bilboa Freightlines, S.A., of Panama, has a small truck that it uses for intracity deliveries. The truck is worn out and must be either

overhauled or replaced with a new truck. The company has assembled the following information:

Present

TEuck

$ 27,000

$ 14,000

$ 13,000

$ 14,000

$ 9,000

$ 5,000

New Truck

Purchase cost new

Remaining book value

Overhaul needed now

Annual cash operating costs

Salvage value-now

Salvage value-five years from now

$ 36,000

$ 11,500

$ 8,000

If the company keeps and overhauls its present delivery truck, then the truck will be usable for five more years. If a new truck is

purchased, it will be used for five years, after which it will be traded in on another truck. The new truck would be diesel-operated,

resulting in a substantial reduction in annual operating costs, as shown above.

ces

The company computes depreciation on a straight-line basis. All investment projects are evaluated using a 13% discount rate.

Click here to view Exhibit 148-1 and Exhibit 148-2, to determine the appropriate discount factor(s) using tables.

Required:

1. What is the net present value of the "keep the old truck" alternative?

2. What is the net present value of the "purchase the new truck" alternative?

3. Should Bilboa Freightlines keep the old truck or purchase the new one?

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Required 3

What is the net present value of the "keep the old truck" alternative? (Enter negative amount with a minus sign. Round your

final answer to the nearest whole dollar amount.)

Net present value

Required 1

Required 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning