Can you change the payoffs in the table to the right so that the firms choose to invest in safety? Each firm must consider how safe to make its plant. Extra safety is costly. Safety investments-sprinkler systems, color-coded switches. ire extinguishers-by one firm provide an externality to other firms: That firm's lower incidence of accidents reduces the wage that all irms in the industry must pay. Because each firm bears the full cost of its safety investments but derives only some of the benefits, the Firms underinvest in safety. t will be a Nash equilibrium for both firms to invest in safety if OA. the payoffs for both firms investing increase to $750 and the payoffs for both firms not investing decrease to $50. OB. the payoffs for both firms investing go to 50. OC. the payoffs for both firms investing increase to $750. OD. the payoffs for both firms investing increase to $350 and the payoffs for both firms not investing decrease to $50. OE. the payoffs for both firms not investing go to SD.

Can you change the payoffs in the table to the right so that the firms choose to invest in safety? Each firm must consider how safe to make its plant. Extra safety is costly. Safety investments-sprinkler systems, color-coded switches. ire extinguishers-by one firm provide an externality to other firms: That firm's lower incidence of accidents reduces the wage that all irms in the industry must pay. Because each firm bears the full cost of its safety investments but derives only some of the benefits, the Firms underinvest in safety. t will be a Nash equilibrium for both firms to invest in safety if OA. the payoffs for both firms investing increase to $750 and the payoffs for both firms not investing decrease to $50. OB. the payoffs for both firms investing go to 50. OC. the payoffs for both firms investing increase to $750. OD. the payoffs for both firms investing increase to $350 and the payoffs for both firms not investing decrease to $50. OE. the payoffs for both firms not investing go to SD.

Managerial Economics: A Problem Solving Approach

5th Edition

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Chapter16: Bargaining

Section: Chapter Questions

Problem 16.1IP

Related questions

Question

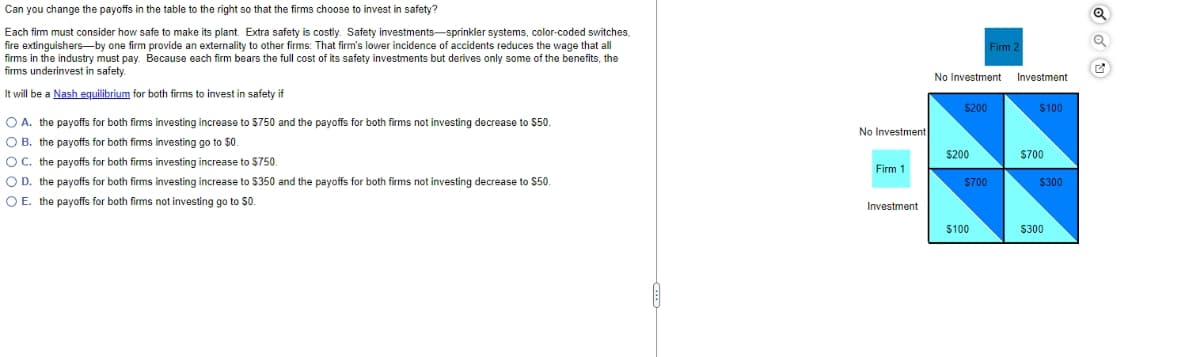

Transcribed Image Text:Can you change the payoffs in the table to the right so that the firms choose to invest in safety?

Each firm must consider how safe to make its plant. Extra safety is costly. Safety investments-sprinkler systems, color-coded switches.

fire extinguishers-by one firm provide an externality to other firms: That firm's lower incidence of accidents reduces the wage that all

firms in the industry must pay. Because each firm bears the full cost of its safety investments but derives only some of the benefits, the

firms underinvest in safety.

It will be a Nash equilibrium for both firms invest safety if

O A. the payoffs for both firms investing increase to $750 and the payoffs for both firms not investing decrease to $50.

O B. the payoffs for both firms investing go to $0.

OC. the payoffs for both firms investing increase to $750.

O D. the payoffs for both firms investing increase to $350 and the payoffs for both firms not investing decrease to $50.

O E. the payoffs for both firms not investing go to $0.

No Investment

Firm 1

Investment

No Investment Investment

$200

$200

$700

Firm 2

$100

$100

$700

$300

$300

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning