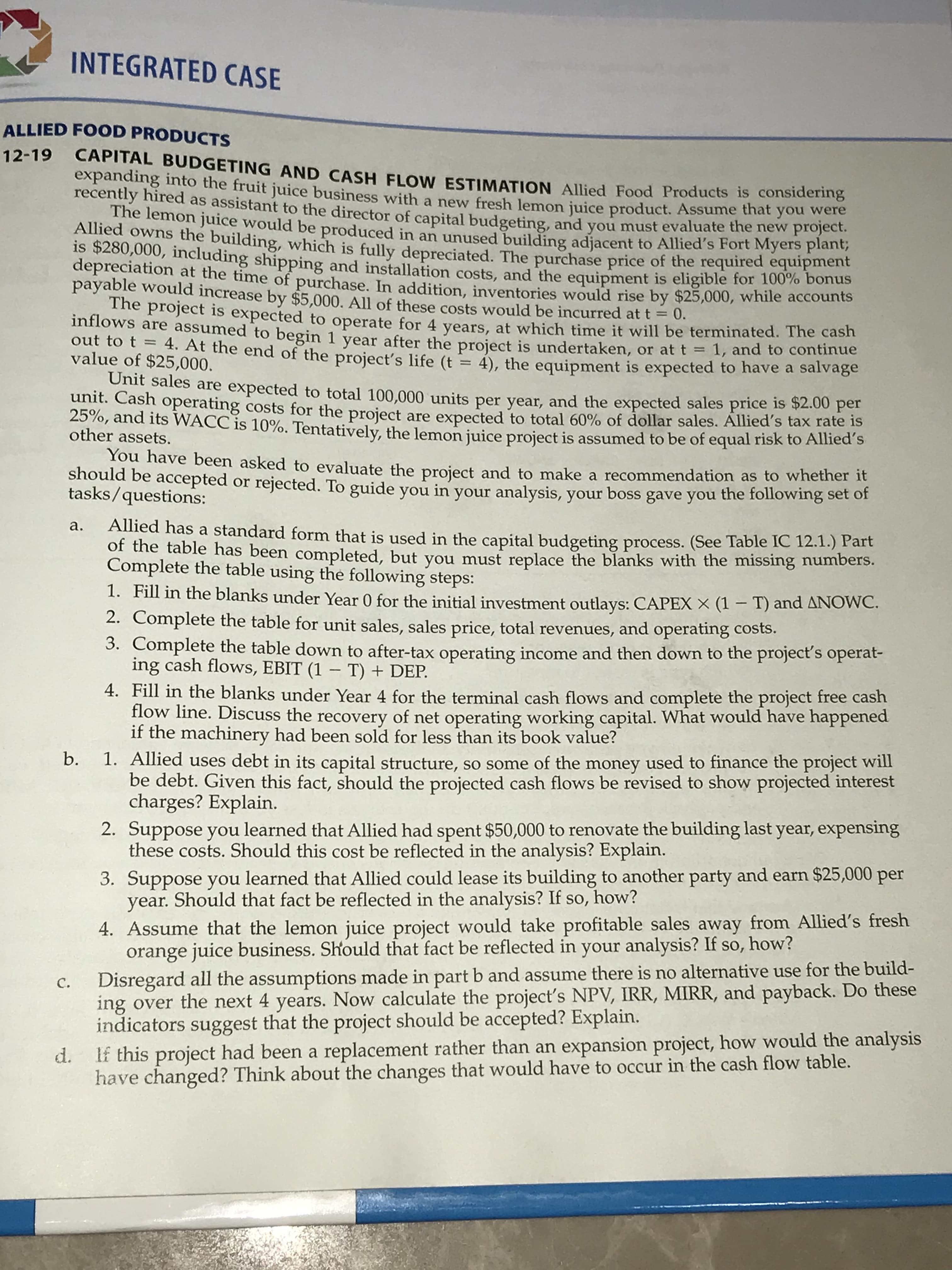

CAPITAL BUDGETING AND CASH FLOW ESTIMATION Allied Food Products is considering expanding into the fruit juice business with a new fresh lemon juice product. Assume that you were recently hired as assistant to the director of capital budgeting, and you must evaluate the new project. The lemon juice would be produced in an unused building adjacent to Allied's Fort Myers plane, Allied owns the building, which is fully depreciated. The purchase price of the required equiphiente is $280,000, including shipping and installation costs, and the equipment is eligjble for 190% PONYS depreciation at the time of nurcho

CAPITAL BUDGETING AND CASH FLOW ESTIMATION Allied Food Products is considering expanding into the fruit juice business with a new fresh lemon juice product. Assume that you were recently hired as assistant to the director of capital budgeting, and you must evaluate the new project. The lemon juice would be produced in an unused building adjacent to Allied's Fort Myers plane, Allied owns the building, which is fully depreciated. The purchase price of the required equiphiente is $280,000, including shipping and installation costs, and the equipment is eligjble for 190% PONYS depreciation at the time of nurcho

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter12: Capital Investment Analysis

Section: Chapter Questions

Problem 6E: Cash payback method Lily Products Company is considering an investment in one of two new product...

Related questions

Question

Please answer part b

Transcribed Image Text:CAPITAL BUDGETING AND CASH FLOW ESTIMATION Allied Food Products is considering

expanding into the fruit juice business with a new fresh lemon juice product. Assume that you were

recently hired as assistant to the director of capital budgeting, and you must evaluate the new project.

The lemon juice would be produced in an unused building adjacent to Allied's Fort Myers plane,

Allied owns the building, which is fully depreciated. The purchase price of the required equiphiente

is $280,000, including shipping and installation costs, and the equipment is eligjble for 190% PONYS

depreciation at the time of nurcho

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning