Concept explainers

Review of Basic Capital Budgeting Procedures

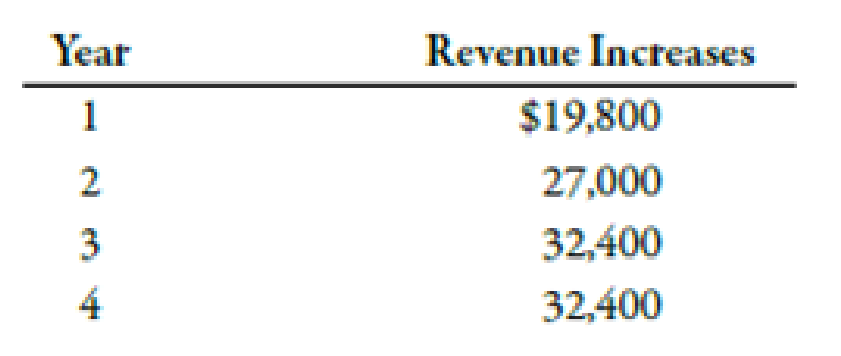

Dr. Whitley Avard, a plastic surgeon, had just returned from a conference in which she learned of a new surgical procedure for removing wrinkles around eyes, reducing the time to perform the normal procedure by 50%. Given her patient-load pressures. Dr. Avard is excited to try out the new technique. By decreasing the time spent on eye treatments or procedures, she can increase her total revenues by performing more services within a work period. In order to implement the new procedure, special equipment costing $74,000 is needed. The equipment has an expected life of 4 years, with a salvage value of $6,000. Dr. Avard estimates that her cash revenues will increase by the following amounts:

She also expects additional cash expenses amounting to $3,000 per year. The cost of capital is 12%. Assume that there are no income taxes.

Required:

- 1. Compute the payback period for the new equipment.

- 2. Compute the ARR. Round the percentage to two decimal places.

- 3. CONCEPTUAL CONNECTION Compute the

NPV andIRR for the project. Use 14% as your first guess for IRR. Should Dr. Avard purchase the new equipment? Should she be concerned about payback or the ARR in making this decision? - 4. CONCEPTUAL CONNECTION Before finalizing her decision. Dr. Avard decided to call two plastic surgeons who have been using the new procedure for the past 6 months. The conversations revealed a somewhat less glowing report than she received at the conference. The new procedure reduced the time required by about 25% rather than the advertised 50%. Dr. Avard estimated that the net operating cash flows of the procedure would be cut by one-third because of the extra time and cost involved (salvage value would be unaffected). Using this information, recompute the NPV of the project. What would you now recommend?

Trending nowThis is a popular solution!

Chapter 12 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

- Maggie's Resorts was wondering how to use capital budgeting to decide if their $7,943,000 expansion of its number of bungalows is a good investment. Management for Maggie's Resorts developed the following estimates for the expansion:Maggie's Resorts Number of additional guests per day 540 Average number of days guests will stay 15 Useful life of the expansion in years 16 Average cash spent per day by guest $285 Average variable costs per day for each guest $95 Cost of the expansion $7,943,000 Discount rate 11% Maggie's Resorts uses straight-line depreciation and expects the expansion to have a residual value of $1,072,000 at the end of its 16 year life.(Round your answers to two decimal places when needed and use rounded answers for all future calculations).1. Compute the average annual net cash flow from the expansion. Additional Guest per day X Average cash spent by each guest per day X Number of days guests will stay = Average Annual Cash Inflow X X…arrow_forwardMaggie's Resorts was wondering how to use capital budgeting to decide if their $7,952,000 expansion of its number of bungalows is a good investment. Management for Maggie's Resorts developed the following estimates for the expansion:Maggie's Resorts Number of additional guests per day 520 Average number of days guests will stay 16 Useful life of the expansion in years 15 Average cash spent per day by guest $260 Average variable costs per day for each guest $90 Cost of the expansion $7,952,000 Discount rate 11% Maggie's Resorts uses straight-line depreciation and expects the expansion to have a residual value of $1,051,000 at the end of its 15 year life.(Round your answers to two decimal places when needed and use rounded answers for all future calculations).1. Compute the average annual net cash flow from the expansion. Additional Guest per day X Average cash spent by each guest per day X Number of days guests will stay = Average Annual Cash Inflow X X…arrow_forwardMaggie's Resorts was wondering how to use capital budgeting to decide if their $7,952,000 expansion of its number of bungalows is a good investment. Management for Maggie's Resorts developed the following estimates for the expansion: Maggie's Resorts Number of additional guests per day 520 Average number of days guests will stay 16 Useful life of the expansion in years 15 Average cash spent per day by guest $260 Average variable costs per day for each guest $90 Cost of the expansion $7,952,000 Discount rate 11% Maggie's Resorts uses straight-line depreciation and expects the expansion to have a residual value of $1,051,000 at the end of its 15 year life. Calculate the ARR. (Amount Invested + Residual Value) / 2 = Average amount invested + / 2 = Average Annual Operating Income / Average Amount Invested = ARR (%) / = (Round your answers to two decimal places when needed and use rounded answers for all future calculations).arrow_forward

- Case Study: Your company needs to take another capital budgeting consideration regardingexpansion of seafood product market. Your Financial Team was assigned the job to evaluate thepotential risks of a new project. In the new project, the company will launch a new product line thatis expected to boost the sales by 10%. The new project is expected to generate an annual sale of3,500,000 units for an average price of $3.50 per unit for 5 years. The new investment projectrequires your company to buy a new assembly line with initial cost of $1,250,000, a residual valueof $250,000 at the end of the project. The company will need to add $160,000 in working capitalwhich is expected to be fully retrieved at the end of the project. Other information is availablebelow:Depreciation method: straight lineVariable cost per unit: $1.2Cash fixed costs per year: $50,000Corporate marginal tax: 30%Discount rate:11%Your Finance Department conducted some economics forecast and estimated that in the…arrow_forwardKen Allen, capital budgeting analyst for Bally Gears, Inc., has been asked to evaluate a proposal. The manager of the automotive division believes that replacing therobotics used on the heavy truck gear line will produce total benefits of $516,000 (in today's dollars) over the next 5 years. The existing robotics would produce benefits of $387,000 (also in today's dollars) over that same timeperiod. An initial cash investment of $206,400 would be required to install the new equipment. The manager estimates that the existing robotics can be sold for $72,000. Show how Ken will apply marginal cost-benefit analysis What should Ken recommend that the company do? Why?A. Replace the existing robotics because the net profit is negative.B. do not replace the existing robotics because the net profit is negative. What factors besides the costs and benefits should be considered before the final decision is made? Other factors that should be considered before the final decision is made are:…arrow_forwardBudgeting for a Service Firm Refer to the AccuTax Inc. example in the chapter. One of thepartners is planning to retire at the end of the year. May Higgins, the sole remaining partner, plansto add a manager at an annual salary of $90,000. She expects the manager to work, on average, 45hours a week for 45 weeks per year. She plans to change the required staff time for each hour spentto complete a tax return to the following:Business ReturnComplex IndividualReturnSimple IndividualReturnPartner 0.3 hour 0.05 hour —Manager 0.2 hour 0.15 hour —Senior consultant 0.5 hour 0.40 hour 0.2 hourConsultant — 0.40 hour 0.8 hourThe manager is salaried and earns no overtime pay. Senior consultants are salaried but receivetime and a half for any overtime worked. The firm plans to keep all the senior consultants and adjustthe number of consultants as needed including employing part-time consultants, who also are paidon an hourly basis. Higgins has also decided to have five supporting staff at $40,000…arrow_forward

- Using Capital BudgetingTen years ago Kramer Company, of which you are controller, bought machinery at a cost of $250,000. The purchase was made at the insistence of the production manager. The machinery is now worthless, and the production manager believes that it should be replaced. He gives you the following analysis, which he says verifies the correctness of the decision to buy the machinery ten years ago. He bases his statement on the 21% return he calculated, which is higher than the 16% cutoff rate of return.Required: Do you agree that the investment was wise? Why or why not?arrow_forwardCapital Budgeting. Return on Investment, Residual Income Simmons Company is a merchandiser with multiple store locations. One of its store managers is considering a shift in her store’s product mix in anticipation of a strengthening economy. Her store would invest $800,000 in more expensive merchandise (an increase in its working capital) with the expectation that it would increase annual sales and variable expenses by $400,000 and $250,000, respectively for three years. At the end of the three-year period, the store manager believes that the economic surge will subside; therefore, she will release the additional investment in working capital. The store manager’s pay raises are largely determined by her store’s return on investment (ROI), which has exceeded 22% each of the last three years. Required: 1. Assuming the company’s discount rate is 16%, calculate the net present value of the store manager’s investment opportunity. 2. Calculate the annual margin, turnover, and return on…arrow_forwardCAPITAL BUDGETING AND CASH FLOW ESTIMATION Allied Food Products is considering expanding into the fruit juice business with a new fresh lemon juice product. Assume that you were recently hired as assistant to the director of capital budgeting, and you must evaluate the new project. The lemon juice would be produced in an unused building adjacent to Allied’s Fort Myers plant; Allied owns the building, which is fully depreciated. The purchase price of the required equipment is $280,000, including shipping and installation costs, and the equipment is eligible for 100% bonus depreciation at the time of purchase. In addition, inventories would rise by $25,000, while accounts payable would increase by $5,000. All of these costs would be incurred at t = 0. The project is expected to operate for 4 years, at which time it will be terminated. The cash inflows are assumed to begin 1 year after the project is undertaken, or at t = 1, and to continue out to t = 4. At the end of the project’s life…arrow_forward

- Chapter : Budgeting South Hampton University is preparing its budget for the upcoming academic year. This is a specialised private university that charges fees for all degree courses. Currently, 30,000 students are enrolled on campus. However, the university is forecasting a 5 per cent growth in student numbers in the coming year, despite an increase in fees to $3,000 per subject. The following additional information has been gathered from an examination of university records and conversations with university managers: South Hampton is planning to award scholarships to 200 students, which will cover their fees. The average class has 80 students, and the typical student takes 4 subjects per semester. South Hampton operates 2 semesters per year. The average academic staff salary is $120,000 per annum including on-costs. South Hampton’s academic staff are evaluated on the basis of teaching, research, administration and professional/community service. Each of the academic staff teaches…arrow_forwardProject 2- Capital Budgeting John is considering opening a hotdog stand on Michigan Avenue. John’s market research shows that the clientele is young professionals, typically without children, who like the traditional aspect of eating hotdogs, but also relish his gourmet, specially manufactured low-fat hotdogs and the healthy side dishes his stand also sells. John's overall plan is to get the stand up and running for five years, and then sell the stand off to a new owner and retire to Florida. John estimates that the cost of starting up a stand will be as follows: Purchase of retail kiosk (mobile retail food outlet) $500,000 Specialized kitchen equipment $50,000 Installation of the kitchen equipment $10,000 Furniture and fittings $50,000 John estimates that annual operating costs for his stand as follows: Kitchen and service staff (5 people)- total of $200,000 per year License and rent costs $150,000 Raw materials: -Hotdogs- $2 per hotdog. Raw material price per burger goes…arrow_forwardCapital budgeting methods, no income taxes. City Hospital, a nonprofit organization, estimates that it can save $28,000 ayear in cash operating costs for the next 10 years if it buys a special-purpose eyetesting machine at a cost of $110,000. Noterminal disposal value is expected. City Hospital’s required rate of return is 14%. Assume all cash ows occur at year-endexcept for initial investment amounts. City Hospital uses straight-line depreciation.1. Calculate the following for the special-purpose eye-testing machine:a. Net present valueb. Payback periodc. Internal rate of returnd. Accrual accounting rate of return based on net initial investmente. Accrual accounting rate of return based on average investment2. What other factors should City Hospital consider in deciding whether to purchase the special-purpose eye-testingmachine?arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College