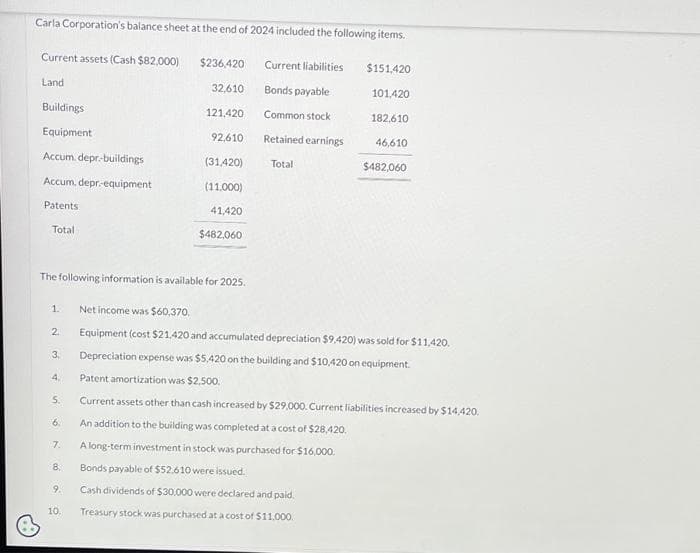

Carla Corporation's balance sheet at the end of 2024 included the following items. Current assets (Cash $82,000) Land Buildings Equipment Accum. depr-buildings Accum, depr-equipment Patents Total 1. 4. 5. 6. The following information is available for 2025. 7. 8. $236,420 9. 32,610 10. 121,420 92,610 (31,420) (11.000) 41,420 $482,060 Current liabilities Bonds payable Common stock Retained earnings Net income was $60,370. 2 Equipment (cost $21,420 and accumulated depreciation $9,420) was sold for $11.420. 3. Depreciation expense was $5,420 on the building and $10,420 on equipment. Patent amortization was $2,500. Total $151,420 101,420 182,610 46,610 $482,060 Current assets other than cash increased by $29,000. Current liabilities increased by $14,420. An addition to the building was completed at a cost of $28,420. A long-term investment in stock was purchased for $16,000. Bonds payable of $52.610 were issued. Cash dividends of $30.000 were declared and paid. Treasury stock was purchased at a cost of $11.000.

Carla Corporation's balance sheet at the end of 2024 included the following items. Current assets (Cash $82,000) Land Buildings Equipment Accum. depr-buildings Accum, depr-equipment Patents Total 1. 4. 5. 6. The following information is available for 2025. 7. 8. $236,420 9. 32,610 10. 121,420 92,610 (31,420) (11.000) 41,420 $482,060 Current liabilities Bonds payable Common stock Retained earnings Net income was $60,370. 2 Equipment (cost $21,420 and accumulated depreciation $9,420) was sold for $11.420. 3. Depreciation expense was $5,420 on the building and $10,420 on equipment. Patent amortization was $2,500. Total $151,420 101,420 182,610 46,610 $482,060 Current assets other than cash increased by $29,000. Current liabilities increased by $14,420. An addition to the building was completed at a cost of $28,420. A long-term investment in stock was purchased for $16,000. Bonds payable of $52.610 were issued. Cash dividends of $30.000 were declared and paid. Treasury stock was purchased at a cost of $11.000.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter21: The Statement Of Cash Flows

Section: Chapter Questions

Problem 9E: Partially Completed Spreadsheet Hanks Company has prepared the following changes in account balances...

Related questions

Question

please answer do not image.

Transcribed Image Text:Carla Corporation's balance sheet at the end of 2024 included the following items.

Current assets (Cash $82,000)

Land

Buildings

Equipment

Accum. depr-buildings

Accum. depr-equipment

Patents

Total

1.

2

3.

The following information is available for 2025.

4.

5.

6.

7.

8.

9.

$236,420

10.

32,610

121,420

92,610

(31,420)

(11.000)

41,420

$482,060

Current liabilities

Bonds payable

Common stock

Retained earnings

Total

$151,420

101,420

182,610

46,610

$482,060

Net income was $60,370.

Equipment (cost $21,420 and accumulated depreciation $9,420) was sold for $11,420.

Depreciation expense was $5,420 on the building and $10,420 on equipment.

Patent amortization was $2,500.

Current assets other than cash increased by $29,000. Current liabilities increased by $14,420.

An addition to the building was completed at a cost of $28,420.

A long-term investment in stock was purchased for $16,000.

Bonds payable of $52.610 were issued.

Cash dividends of $30,000 were declared and paid.

Treasury stock was purchased at a cost of $11,000.

Transcribed Image Text:7

vongjodien que

eTextbook and Media.

List of Accounts

and Equipment

||||

110

Liabilities and Stockholders' Equity

Liabilities and Stockholders' Equity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,