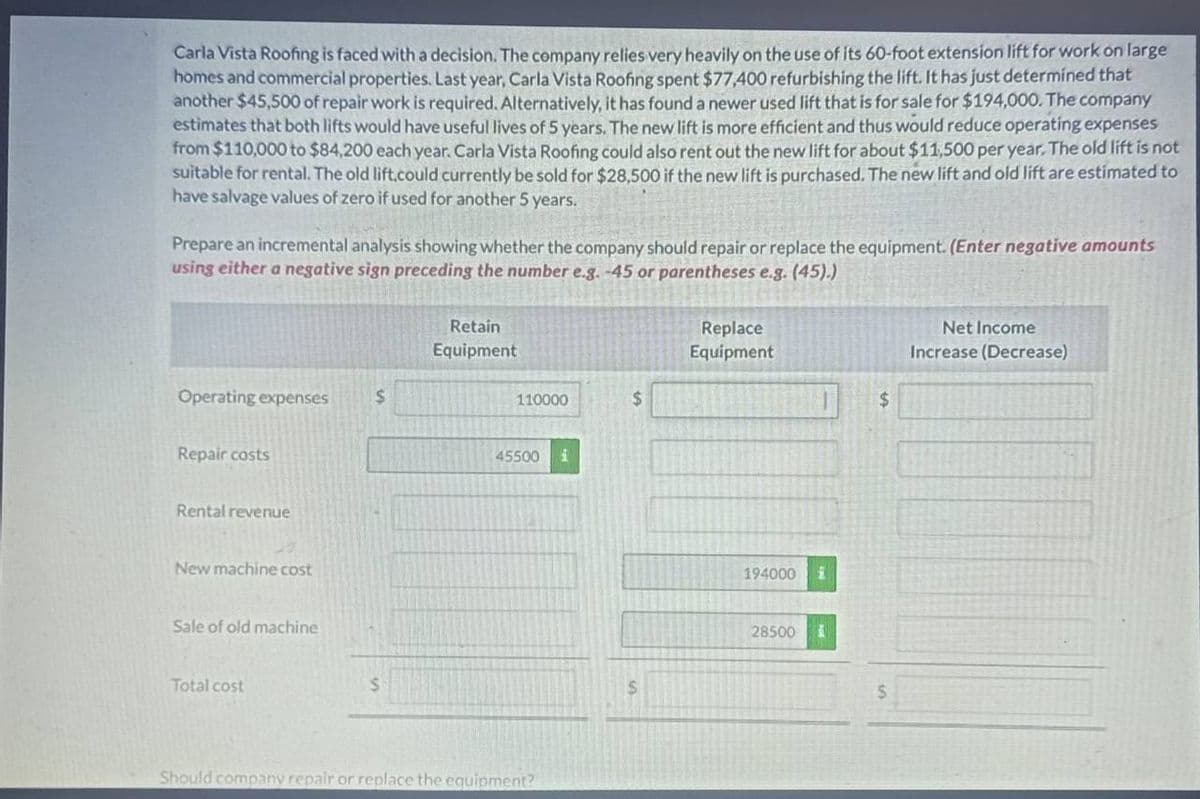

Carla Vista Roofing is faced with a decision. The company relies very heavily on the use of its 60-foot extension lift for work homes and commercial properties. Last year, Carla Vista Roofing spent $77,400 refurbishing the lift. It has just determined another $45,500 of repair work is required. Alternatively, it has found a newer used lift that is for sale for $194,000. The co estimates that both lifts would have useful lives of 5 years. The new lift is more efficient and thus would reduce operating e from $110,000 to $84,200 each year. Carla Vista Roofing could also rent out the new lift for about $11,500 per year. The o suitable for rental. The old lift.could currently be sold for $28,500 if the new lift is purchased. The new lift and old lift are es have salvage values of zero if used for another 5 years. Prepare an incremental analysis showing whether the company should repair or replace the equipment. (Enter negative a using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Retain Equipment Operating expenses $ Replace Equipment Net Income Increase (Decrease) 110000 $ $

Carla Vista Roofing is faced with a decision. The company relies very heavily on the use of its 60-foot extension lift for work homes and commercial properties. Last year, Carla Vista Roofing spent $77,400 refurbishing the lift. It has just determined another $45,500 of repair work is required. Alternatively, it has found a newer used lift that is for sale for $194,000. The co estimates that both lifts would have useful lives of 5 years. The new lift is more efficient and thus would reduce operating e from $110,000 to $84,200 each year. Carla Vista Roofing could also rent out the new lift for about $11,500 per year. The o suitable for rental. The old lift.could currently be sold for $28,500 if the new lift is purchased. The new lift and old lift are es have salvage values of zero if used for another 5 years. Prepare an incremental analysis showing whether the company should repair or replace the equipment. (Enter negative a using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Retain Equipment Operating expenses $ Replace Equipment Net Income Increase (Decrease) 110000 $ $

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter11: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 10P: St. Johns River Shipyards welding machine is 15 years old, fully depreciated, and has no salvage...

Related questions

Question

Transcribed Image Text:Carla Vista Roofing is faced with a decision. The company relies very heavily on the use of its 60-foot extension lift for work on large

homes and commercial properties. Last year, Carla Vista Roofing spent $77,400 refurbishing the lift. It has just determined that

another $45,500 of repair work is required. Alternatively, it has found a newer used lift that is for sale for $194,000. The company

estimates that both lifts would have useful lives of 5 years. The new lift is more efficient and thus would reduce operating expenses

from $110,000 to $84,200 each year. Carla Vista Roofing could also rent out the new lift for about $11,500 per year. The old lift is not

suitable for rental. The old lift.could currently be sold for $28,500 if the new lift is purchased. The new lift and old lift are estimated to

have salvage values of zero if used for another 5 years.

Prepare an incremental analysis showing whether the company should repair or replace the equipment. (Enter negative amounts

using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).)

Operating expenses $

Repair costs

Rental revenue

New machine cost

Sale of old machine

Total cost

$

Retain

Equipment

Replace

Equipment

110000

$

45500

Should company repair or replace the equipment?

$

194000 i

28500

Net Income

Increase (Decrease)

$

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College