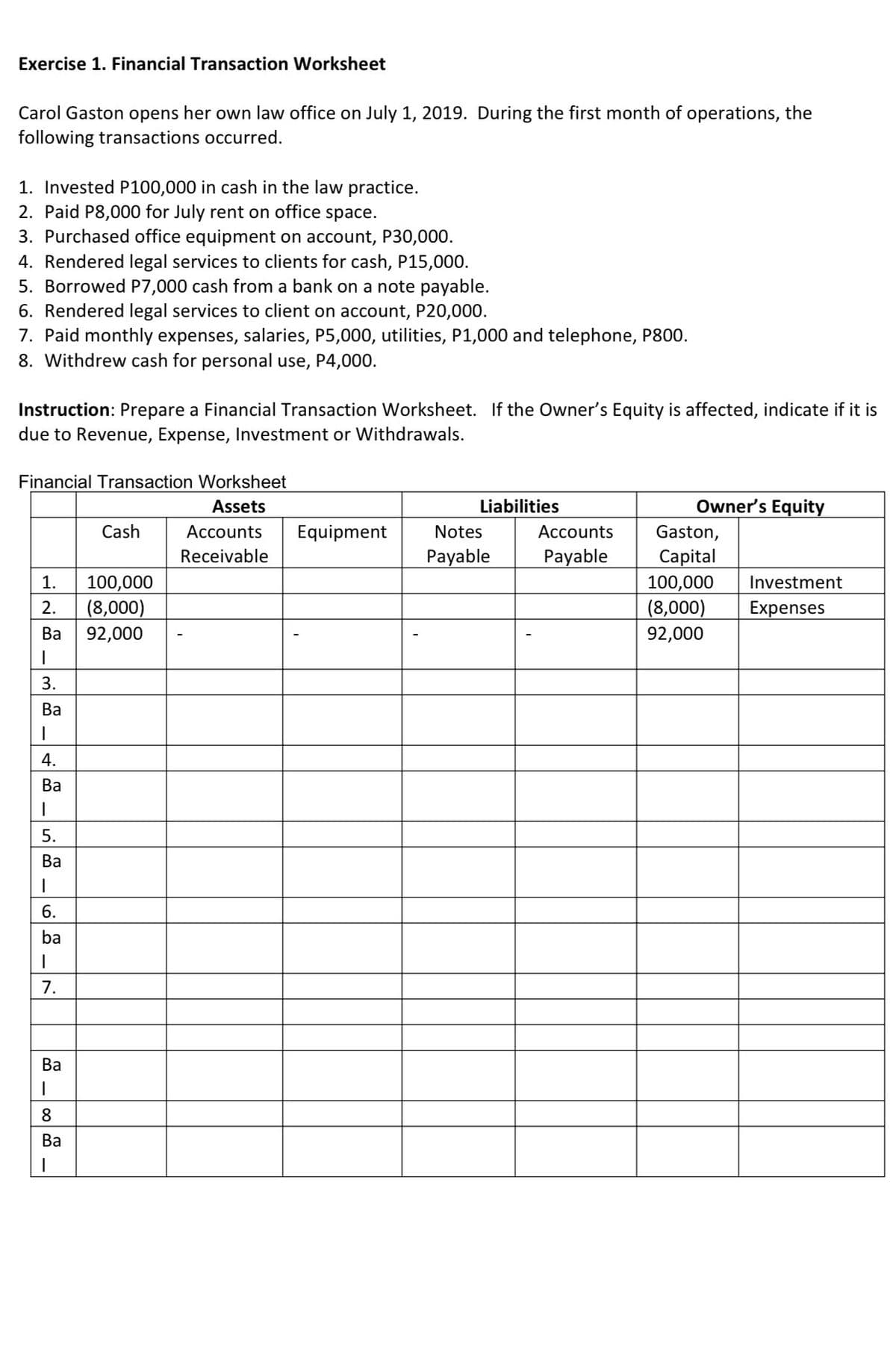

Carol Gaston opens her own law office on July 1, 2019. During the first month of operations, the following transactions occurred. 1. Invested P100,000 in cash in the law practice. 2. Paid P8,000 for July rent on office space. 3. Purchased office equipment on account, P30,000. 4. Rendered legal services to clients for cash, P15,000. 5. Borrowed P7,000 cash from a bank on a note payable. 6. Rendered legal services to client on account, P20,000. 7. Paid monthly expenses, salaries, P5,000, utilities, P1,000 and telephone, P800. 8. Withdrew cash for personal use, P4,000. Instruction: Prepare a Financial Transaction Worksheet. If the Owner's Equity is affected, indicate if it is due to Revenue, Expense, Investment or Withdrawals.

Q: Silawing current-year purchases and sales for its only product. Date January 1 January 10 March 14 M...

A: The LIFO and FIFO method are one of the most important method of Inventory management. The FIFO meth...

Q: ShoeZoo, Inc. is an athletic shoe and apparel company that is struggling to compete with much larger...

A: The Board of Directors (BOD) is an elected group of individuals who have been assigned roles, respon...

Q: Waling-waling Company had 6,400 units of work-in-process inventory in department A on October 1, 202...

A: The equivalent units are calculated on the basis of percentage of the work completed during the peri...

Q: Gardner Company produces 18-ounce boxes of a wheat cereal in three departments: mixing, cooking, and...

A: Journal entries should be used to keep track of financial transactions. In the second step of the ac...

Q: Compute the market share, indicate if favorable/(unfavorable). *The activity driver for conversion c...

A: Given projected sale units = 8,100 Projected total market units = 54,000 Actual sale units = 8,400 A...

Q: On January 2, 2013, Phillips Corporation purchase 80% of signage Company's outstanding shares for P6...

A: Introduction IFRS 3 provides two options of measuring non-controlling interest in an acquiree: ...

Q: Explain what is the risk component of financial assets.

A: A Financial Asset is any asset that is a) cash b) An equity instrument of another entity c) A contr...

Q: A distraught employee, Fang W. Arson, put a torch to manufacturing plant on a blustery February 26 T...

A: The statement of cost of goods sold is calculated as difference between sales revenue and gross prof...

Q: a.) At what amount should Prince of Wales record the building on July 1,2020? b.) What is the annual...

A: Calculation of lease liability, this the amount which Prince of Wales should record. Lease Term 1...

Q: ! Required information [The following information applies to the questions displayed below.] Stephan...

A: The amount which a person can reduce from gross income in called deduction. It is mainly used in tax...

Q: The following data were taken from the records of Winner Company for the month of October: Work in p...

A: the material cost is the cost that has been incurred in production of the goods.while the conversion...

Q: A company is considering the opportunity to invest into a new 12- year project: manufacturing and se...

A: A financial break even is a point of units sold where profit after tax is equal to $0.

Q: Relax Spa Company is engaged in providing facial and body treatment in a spa centre. Customers are ...

A: 9) No entry is required in this case because the equipment is purchased for personal use shall not b...

Q: Alfa INC began January 2021 with 20 units of iron inventory that cost 15 euro each. During January, ...

A: In FIFO method , The inventory bought first are sold first. In LIFO method , the inventory bought la...

Q: Martin Farley and Ashley Clark formed a limited liability company with an operating agreement that p...

A: Revenue is defined as the amount of income made by normal business operations and is computed by add...

Q: roblem 3: On January 1, 2012, Enrich Company purchased a machine under the following terms: a. ...

A: Cost of Machine: In this case, the cost of the machine would be a down payment and present Value of ...

Q: Nico Manufacturing Company applies process costing in the manufacture of its best-seller Manufacturi...

A: Total cost of units transferred to department 2 comprises of beginning inventory cost and cost of fr...

Q: 1. _____ are controls that do not rely on the client's information technology (IT) environment for t...

A: Solution Note : Dear student as per the Q&A guideline we are required to answer the first questi...

Q: 2020 2019 Cash $1,800 $1,130 Receivables 1,770 1,320 Inventory 1,560 ...

A: Statement of cash flow is the cash book in detailed version which shows the receipts and payments of...

Q: PB7-2 (Algo) Evaluating the Income Statement and Income Tax Effects of Lower of Cost or Market/Net R...

A:

Q: On December 31, 2019, the statement of financial position of BRY Partnership shows the following dat...

A: Solution Working note Amount available for distribution to partners Cash 1500000 Cash from...

Q: Engr. Roque owner of the HarRoqe’s Ice Plant is monitoring the cashflow of the plant. Based on the f...

A: Break-even point = Fixed costs / Contribution per unit Contribution per unit = Selling price per uni...

Q: As of December 31, 2020, Yahiko, Konan, and Nagato have capital balances of P240,000, P370,000, and ...

A: Bonus to Nagato = Profit × rate 100 + rate = P120,000 × 20120 = P20,000

Q: Anchor, inc, reports pretax financial income of $100,000 for 2020, S120,000 for 2021, and for 2022. ...

A: Determination of taxable income 2020 2021 2022 Pretax Financial income $100,000 $120,000 $14...

Q: PROBLEM 3 For each of the following, determine the missing amounts Sales COGS Gross Profit Operating...

A: Gross profit = Sales - Cost of goods sold Net Income = Gross profit - Operating expenses

Q: Question Content Area Equivalent Units of Production The Converting Department of Hopkinsville Compa...

A: Solution:- Calculation of Number of Equivalent units of production as follows under:- Note:- 1) 30% ...

Q: The capital accounts of Lorraine Grecco and Carrie Rosenfeld have balances of $64,000 and $99,000, r...

A: We know that, all the incomes and expenses accounts have to be closed to the income statement. But...

Q: ne growth effect that applying the same interest rate has on an account over a period of time is cll...

A: Solution Concept Compound interest means the concept where the interest is charged on interest + pri...

Q: PARE Company produces and sells a special powder named "CC". Actual and Proj and contribution margin...

A: Market share (MS) refers to the aggregate sales % (percentage) within the industry generated through...

Q: 4. What is the amount of pre-acquisition earnings on the acquisition date consolidated income statem...

A: pre-acquisition earnings osf subsidary Sales 60000 Less: cost of goods sold (12000) Less :...

Q: Account Name Debit Credit Sales 750,000 Sales Returns and Allowances 15,000 Sales Discounts 10,000 P...

A: Lets understand the basics. Profit means a all the income less all the expense during the period. Fo...

Q: Current Year Previous Year Amount Percentage Income Statement Sales Revenue 118,000 $ 53,600 64,400 ...

A: The horizontal analysis of financial statements is made to compare the data of current year to previ...

Q: Abbe Company uses activity-based costing. The company has two products: A and B. The annual producti...

A: Overhead is a term used to describe ongoing business expenses that are not directly related to the c...

Q: If a bond issuer incurs a loss on bond redemption, the loss is reported on the income statement unde...

A: Revenue - It is amount of income earned through sales of goods or services . Cost of goods sold - I...

Q: Explain the call-put parity relation and how it is justified?

A: call-put parity relation 1. It shows the prices of calls and puts , consistency of underlying assets...

Q: Net income $127,530 Enterest expense 11,093 Average total assets 2,069,000

A: Return on assets is calculated by dividing Earning before interest and taxes by average total assets...

Q: Sunset Products manufactures skateboards. The following transactions occurred in March. ...

A: The question is based on the concept of Cost Accounting.

Q: Condensed financial data of Novak Company for 2020 and 2019 are presented below. NOVAK COMPANY COMP...

A: The cash flow statement (CFS) is a financial statement that summarizes the flow of cash and cash equ...

Q: Enumerate at least 5 violations on required disclosures in the Notes to Financial Statements.

A: The answer for the question on violation on required disclosures in the Notes to financial statement...

Q: PROBLEM 2 (Cost of Goods Sold). For each of the following, determine the missing amounts. Beginning ...

A: Cost of Goods Available for Sale = Beginning Inventory + Purchases Cost of Goods Sold = Cost of Goo...

Q: Fill in the missing information on the paystub below, Remember you do non have to complete any YD ca...

A: Pay stubs are also known as check stubs. It represents itemize the details of earning of an employee...

Q: Abednego Company purchased equity investments held for trading on January 1, 2020. Market – (12/31/2...

A: In case of equity investments held for trading , they should be reported at market value as at year ...

Q: a. Provide the journal entry for the asset revaluation. If an amount box does not require an entry, ...

A: Downward revaluation means decrease in value of the fixed asset. Downward revaluation is credited to...

Q: Question 15 of 20 <. -/5 View Policies Current Attempt in Progress The following information is avai...

A: Prior Period Errors - Prior periods errors are the errors that happened in the prior period and the ...

Q: Mandarin Manufacturing Company uses a process cost system with FIFO method of costing to account for...

A: in process costing , the product are manufacture by passing through different process . the labour c...

Q: Required: Compute the sales manager's bonus and the income tax expense for the Walbrook Company. Rou...

A: Solution:- Given, Income before bonus an tax = $400,000 Tax rate = 40% Bonus rate = 10%

Q: The stockholders' equity accounts of Concord Corporation on January 1, 2022, were as follows. Prefer...

A:

Q: Group 6 i. International Standard on Auditing 200 states that “independence enhances the auditor’...

A: An audit is a physical inventory check followed by an examination or inspection of various books of ...

Q: For the month of January 2022, PBB Company reported the following production data for Finishing Depa...

A:

Q: Information about the ending inventories of Charleston Chair Company, who applies the LIFO method, i...

A: LCM ( Lower of Cost or Market) rule is a method of valuing inventory in the books of accounts. Under...

I'LL UPVOTE IF IT IS COMPLETE. THANK YOU

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- The transactions completed by PS Music during June 2019 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the business's operations: July 1. Peyton Smith made an additional investment in PS Music by depositing 5,000 in PS Music's checking account. 1. Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music: store. Paid rent for July, 1,750. 1. Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2. Received 1,000 cash from customers on account. 3. On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for SO hours per month for a monthly fee of 3,600. Any additional hours beyond SO will be billed to KXMD at 40 per hour. In accordance with the contract, Peyton received 7,200 from KXMD as an advance payment for the first two months. 3. Paid 250 to creditors on account. 4. Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5. Purchased office equipment on account from Office Mart, 7,500. 8. Paid for a newspaper advertisement, 200. 11. Received 1,000 for serving as a disc jockey for a party. 13. Paid 700 to a local audio electronics store for rental of digital recording equipment. 11. Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on Page 2 of the two-column journal: 16. Received 2,000 for serving as a disc jockey for a wedding reception. 18. Purchased supplies on account, 850. July 21. Paid 620 to Upload Music for use of its current music demos in making various music sets. 22. Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23. Served as disc jockey for a party for 2,500. Received 750, with the remainder due August 4, 2019. 27. Paid electric bill, 915. 28. Paid wages of 1,200 to receptionist and part-time assistant. 29. Paid miscellaneous expenses, 540. 30. Served as a disc jockey for a charity ball for 1,500. Received 500, with the remainder due on August 9, 2019. 31. Received 3,000 for serving as a disc jockey for a party. 31. Paid 1,400 royalties (music expense) to National Music Clearing for use of various artists' music during July. 31. Withdrew l,250 cash from PS Music for personal use. PS Music's chart of accounts and the balance of accounts as of July 1, 2019 (all normal balances), are as follows: 11 Cash 3,920 12 Accounts receivable 1,000 14 Supplies 170 15 Prepaid insurance 17 Office Equipment 21 Accounts payable 250 23 Unearned Revenue 31 Peyton smith, Drawing 4,000 32 Fees Earned 500 41 Wages Expense 6,200 50 Office Rent Expense 400 51 Equipment Rent Expense 800 52 Utilities Expense 675 53 Supplies Expense 300 54 music Expense 1,590 55 Advertising Expense 500 56 Supplies Expense 180 59 Miscellaneous Expense 415 Instructions 1.Enter the July 1, 2019, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column and place a check mark () in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2.Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3.Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4.Prepare an unadjusted trial balance as of July 31, 2019.Kelly Pitney began her consulting business, Kelly Consulting, on April 1, 2019. The accounting cycle for Kelly Consulting for April, including financial statements, was illustrated in this chapter. During May, Kelly Consulting entered into the following transactions: May 3. Received cash from clients as an advance payment for services to be provided and recorded it as unearned fees, 4,500. 5. Received cash from clients on account, 2,450. 9. Paid cash for a newspaper advertisement, 225. 13. Paid Office Station Co. for part of the debt incurred on April 5, 640. 15. Provided services on account for the period May 115, 9,180. 16. Paid part-time receptionist for two weeks' salary including the amount owed on April 30, 750. 17. Received cash from cash clients for fees earned during the period May 116, 8,360. Record the following transactions on Page 6 of the journal: 20. Purchased supplies on account, 735. 21. Provided services on account for the period May 1620, 4,820. 25. Received cash from cash clients for fees earned for the period May 1723, 7,900. 27. Received cash from clients on account, 9,520. 28. Paid part-time receptionist for two weeks' salary, 750. 30. Paid telephone bill for May, 260. 31. Paid electricity bill for May, 810. 31. Received cash from cash clients for fees earned for the period May 2631, 3,300. 31. Provided services on account for the remainder of May, 2,650. 31. Kelly withdrew 10,500 for personal use. Instructions 1.The chart of accounts for Kelly Consulting is shown in Exhibit 9, and the post-closing trial balance as of April 30, 2019, is shown in Exhibit 17. For each account in the post-closing trial balance, enter the balance in the appropriate Balance column of a four-column account. Date the balances May 1, 2019, and place a check mark () in the Posting Reference column Journalize each of the May transactions in a two column Journal starting on Page 5 of the journal and using Kelly Consulting's chart of accounts. (Do not insert the account numbers in the journal at this time.) 2.Post the journal to a ledger of four-column accounts. 3Prepare an unadjusted trial balance. 4.At the end of May, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6). a.Insurance expired during May is 275. b.Supplies on hand on May 3 1 are 715. c.Depreciation of office equipment for May is 330. d.Accrued receptionist salary on May 31 is 325. e.Rent expired during May is 1,600. f.Unearned fees on May 31 are 3,210. 5.(Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. 6.Journalize and post the adjusting entries. Record the adjusting entries on Page 7 of the journal. 7.Prepare an adjusted trial balance. 8.Prepare an income statement, a statement of owner's equity, and a balance sheet. 9.Prepare and post the closing entries. Record the closing entries on Page 8 of the journal. Indicate closed accounts by inserting a line in both Balance columns opposite the closing entry. 10.Prepare a post-closing trial balance.The transactions completed by PS Music during June 2018 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the businesss operations: July 1. Peyton Smith made an additional investment in PS Musk in exchange for common stock by depositing 5,000 in PS Music s checking account. 1. Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music store. Paid rent for July, 1,750. 1. Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2. Received 1,000 on account. 3. On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for 80 hours per month for a monthly fee of 3,600. Any additional hours beyond 80 will be billed to KXMD at 40 per hour. In accordance with the contract, Peyton received 7,200 from KXMD as an advance payment for the first two months. 3. Paid 250 on account. 4. Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5. Purchased office equipment on account from Office Mart, 7,500. 8. Paid for a newspaper advertisement, 200. 11. Received 1,000 for serving as a disc jockey for a party. 13. Paid 700 to a local audio electronics store for rental of digital recording equipment. 14. Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on lage 2 of the two-column journal: 16. Received 2,000 for serving as a disc jockey for a wedding reception. 18. Purchased supplies on account, 850. 21. Paid 620 to Upload Music for use of its current music demos in making various music sets. 22. Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23. Served as disc jockey for a party for 2,500. Received 750, with the remainder due August 4, 2018. 27. Paid electric bill, 915. 28. Paid wages of 1,200 to receptionist and part-time assistant. 29. Paid miscellaneous expenses, 540. 30. Served as a disc jockey for a charity ball for 1,500. Received 500, with the remainder due on August 9, 2018. 31. Received 3,000 for serving as a disc jockey for a party. July 31. Paid 1,400 royalties (music expense) to National Music Clearing for use of various artists music during July. 31. Paid dividends, 1,250. PS Musics chart of accounts and the balance of accounts as of July 1, 2018 (all normal balances), are as follows: 11 Cash 3,920 41 Fees Earned 6,200 12 Accounts Receivable 1,000 50 Wages Expense 400 14 Supplies 170 51 Office Rent Expense 800 15 Prepaid Insurance 52 Equipment Rent Expense 675 17 Office Equipment 53 Utilities Expense 300 21 Accounts Payable 250 54 Music Expense 1,590 23 Unearned Revenue 55 Advertising Expense 500 31 Common Stock 4,000 56 Supplies Expense 180 33 Dividends 500 59 Miscellaneous Expense 415 Instructions 1. Enter the July 1, 2018, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column, and place a check mark () in the Posting Reference column. {Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2. Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3. Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance as of July 31, 2018.

- EFFECTS OF TRANSACTIONS (BALANCE SHEET ACCOUNTS) Jon Wallace started a business. During the first month (March 20--), the following transactions occurred. Show the effect of each transaction on the accounting equation: Assets= Liabilities + Owners Equity. After each transaction, show the new account totals. (a) Invested cash in the business, 30,000. (b) Bought office equipment on account, 4,500. (c) Bought office equipment for cash, 1,600. (d) Paid cash on account to supplier in transaction (b), 2,000. EFFECTS OF TRANSACTIONS (REVENUE, EXPENSE, WITHDRAWALS) This exercise is an extension of Exercise 2-3B. Lets assume Jon Wallace completed the following additional transactions during March. Show the effect of each transaction on the basic elements of the expanded accounting equation: Assets = Liabilities + Owners Equity (Capital Drawing + Revenues Expenses). After transaction (k), report the totals for each element. Demonstrate that the accounting equation has remained in balance. (e) Performed services and received cash, 3,000. (f) Paid rent for March, 1,000. (g) Paid March phone bill, 68. (h) Jon Wallace withdrew cash for personal use, 800. (i) Performed services for clients on account, 900. (j) Paid wages to part-time employee, 500. (k) Received cash for services performed on account in transaction (i), 500.Journal entries and trial balance On August 1, 20Y7, Rafael Masey established Planet Realty, which completed the following transactions during the month: a. Rafael Masey transferred cash from a personal bank account to an account to be used for the business in exchange for common stock, 17,500. b. Purchased supplies on account, 2,300. c. Earned sales commissions, receiving cash, 13,300. d. Paid rent on office and equipment for the month, 3,000. e. Paid creditor on account, 1,150. f. Paid dividends, 1,800. g. Paid automobile expenses (including rental charge) for month, 1,500, and miscellaneous expenses, 400. h. Paid office salaries, 2,800. i. Determined that the cost of supplies used was 1,050. Instructions 1. Journalize entries for transactions (a) through (i), using the following account titles: Cash, Supplies, Accounts Payable, Common Stock, Dividends, Sales Commissions, Rent Expense, Office Salaries Expense, Automobile Expense, Supplies Expense, Miscellaneous Expense. Journal entry explanations may be omitted. 2. Prepare T accounts, using the account titles in (1). Post the journal entries to these accounts, placing the appropriate letter to the left of each amount to identify the transactions. Determine the account balances, after all posting is complete. Accounts containing only a single entry do not need a balance. 3. Prepare an unadjusted trial balance as of August 31, 20Y7. 4. Determine the following: a. Amount of total revenue recorded in the ledger. b. Amount of total expenses recorded in the ledger. c. Amount of net income for August. 5. Determine the increase or decrease in retained earnings for August.Brief Exercise 2-30 Transaction Analysis Galle Inc. entered into the following transactions during January. Borrowed $50,000 from First Street Bank by signing a new payable. Purchased $25,000 of equipment for cash. (Continued) Paid $500 to landlord for rent for January. Performed services for customers on account, $10,000. Collected $31000 from customers for services performed in Transaction d. Paid salaries of $2,500 for the current month. Required: Show the effect of each transaction using the following model.

- Journal entries and trial balance On October 1, 20Y6, Jay Crowley established Affordable Realty, which completed the following transactions during the month: a. Jay Crowley transferred cash from a personal bank account to an account to be used for the business in exchange for common stock, 40,000. b. Paid rent on office and equipment for the month, 4,800. c. Purchased supplies on account, 2,150. d. Paid creditor on account, 1,100. e. Earned sales commissions, receiving cash, 18,750. f. Paid automobile expenses (including rental charge) for month, 1,580, and miscellaneous expenses, 800. g. Paid office salaries, 3,500. h. Determined that the cost of supplies used was 1,300. i. Paid dividends, 1,500. Instructions 1. Journalize entries for transactions (a) through (i), using the following account titles: Cash, Supplies, Accounts Payable, Common Stock, Dividends, Sales Commissions, Rent Expense, Office Salaries Expense, Automobile Expense, Supplies Expense, Miscellaneous Expense. Explanations may be omitted. 2. Prepare T accounts, using the account titles in (1). Post the journal entries to these accounts, placing the appropriate letter to the left of each amount to identify the transactions. Determine the account balances after all posting is complete. Accounts containing only a single entry do not need a balance. 3. Prepare an unadjusted trial balance as of October 31, 20Y6. 4. Determine the following: a. Amount of total revenue recorded in the ledger. b. Amount of total expenses recorded in the ledger. c. Amount of net income for October. 5. Determine the increase or decrease in retained earnings for October.The transactions completed by PS Music during June 20Y5 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the businesss operations: July 1. Peyton Smith made an additional investment in PS Music in exchange for common stock by depositing 5,000 in PS Musics checking account. 1. Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music store. Paid rent for July, 1,750. 1. Paid a premium of 2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period. 2. Received 1,000 on account. 3. On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for 80 hours per month for a monthly fee of 3,600. Any additional hours beyond 80 will be billed to KXMD at 40 per hour. In accordance with the contract, Peyton received 7,200 from KXMD as an advance payment for the first two months. 3. Paid 250 on account. 4. Paid an attorney 900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.) 5. Purchased office equipment on account from Office Mart, 7,500. 8. Paid for a newspaper advertisement, 200. 11. Received 1,000 for serving as a disc jockey for a party. 13. Paid 700 to a local audio electronics store for rental of digital recording equipment. 14. Paid wages of 1,200 to receptionist and part-time assistant. Enter the following transactions on Page 2 of the two-column journal: 16. Received 2,000 for serving as a disc jockey for a wedding reception. 18. Purchased supplies on account, 850. 21. Paid 620 to Upload Music for use of its current music demos in making various music sets. 22. Paid 800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July. 23. Served as disc jockey for a party for 2,500. Received 750, with the remainder due August 4, 20Y5. 27. Paid electric bill, 915. 28. Paid wages of 1,200 to receptionist and part-time assistant. 29. Paid miscellaneous expenses, 540. 30. Served as a disc jockey for a charity ball for 1,500. Received 500, with the remainder due on August 9, 20Y5. 31. Received 3,000 for serving as a disc jockey for a party. 31. Paid 1,400 royalties (music expense) to National Music Clearing for use of various artists music during July. 31. Paid dividends, 1,250. PS Musics chart of accounts and the balance of accounts as of July 1, 20Y5 (all normal balances), are as follows: Instructions 1. Enter the July 1, 20Y5, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column, and place a check mark () in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.) 2. Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting journal entry explanations. 3. Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance as of July 31, 20Y5.Using the income statement for Adventure Travel Service shown in Practice Exercise 1-4A, prepare a statement of owners equity for the year ended April 30, 2019. Jerome Foley, the owner, invested an additional 60,000 in the business during the year and withdrew cash of 40,000 for personal use. Jerome Foley, capital as of May 1, 2018, was 1,020,000.

- Brief Exercise 2-2? Events and Transactions Several events are listed below. Paid $30,000 for land. Purchased office supplies for cash. Perfumed consulting services for a client with the amount to be collected in 30 days. Signed a contract to perform consulting services over the next 6 months. Required: For each of the events, identify which ones qualify for recognition in the financial statements. If an event does not qualify for recognition, explain why.On October 1, 2019, Jay Pryor established an interior decorating business, Pioneer Designs. During the month, Jay completed the following transactions related to the business: Oct. 1. Jay transferred cash from a personal bank account to an account to be used for the business, 18,000. 4.Paid rent for period of October 4 to end of month, 3,000. 10.Purchased a used truck for 23,750, paying 3,750 cash and giving a note payable for the remainder. 13.Purchased equipment on account, 10,500. 14.Purchased supplies for cash, 2,100. 15.Paid annual premiums on property and casualty insurance, 3,600. 15.Received cash for job completed, 8,950. Enter the following transactions on Page 2 of the two-column journal: 21.Paid creditor a portion of the amount owed for equipment purchased on October 13, 2,000. 24.Recorded jobs completed on account and sent invoices to customers, 14,150. 26.Received an invoice for truck expenses, to be paid in November, 700. 27.Paid utilities expense, 2,240. 27.Paid miscellaneous expenses, 1,100. Oct. 29. Received cash from customers on account, 7,600. 30.Paid wages of employees, 4,800. 31.Withdrew cash for personal use, 3,500. Instructions 1. Journalize each transaction in a two-column journal beginning on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) Journal entry explanations may be omitted. 2. Post the journal to a ledger of four-column accounts, inserting appropriate posting references as each item is posted. Extend the balances to the appropriate balance columns after each transaction is posted. 3. Prepare an unadjusted trial balance for Pioneer Designs as of October 31, 2019. 4. Determine the excess of revenues over expenses for October. 5. Can you think of any reason why the amount determined in (4) might not be the net income for October?Comprehensive problem 1 Kelly Pitney began her consulting business, Kelly Consulting, on April 1, 2016. The accounting cycle for Kelly Consulting for April, including financial statements, was illustrated in this chapter. During May, Kelly Consulting entered into the following transactions: May 3. Received cash from clients as an advance payment for services to be provided and recorded it as unearned fees, 4,500. 5. Received cash from clients on account, 2,450. 9. Paid cash for a newspaper advertisement. 225. 13. Paid Office Station Co. for part of the debt incurred on April 5, 640. 15. Recorded services provided on account for the period May 1-15; 9,180. 16. Paid part-time receptionist for two weeks salary including the amount owed on April 30, 750. 17. Recorded cash from cash clients for fees earned during the period May 1-16, 8,360. Record the following transactions on Page 6 of the journal: 20. Purchased supplies on account, 735. 21. Recorded services provided on account for the period May 16-20, 4,820. 25. Recorded cash from cash clients for fees earned for the period May 17-23, 7,900. 27. Received cash from clients on account, 9,520. 28. Paid part-time receptionist for two weeks salary, 750. 30. Paid telephone bill for May, 260. 31. Paid electricity bill for May, 810. 31. Recorded cash from cash clients for fees earned for the period May 26-31, 3,300. 31. Recorded services provided on account for the remainder of May, 2,650. 31. Paid dividends, 10,500. Instructions 1. The chart of accounts for Kelly Consulting is shown in Exhibit 9, and the post-closing trial balance as of April 30, 2016, is shown in Exhibit 17. For each account in the post-closing trial balance, enter the balance in the appropriate Balance column of a four-column account. Date the balances May 1, 2016, and place a check mark () in the Posting Reference column. Journalize each of the May transactions in a two- column journal starting on Page 5 of the journal and using Kelly Consultings chart of accounts. (Do not insert the account numbers in the journal at this time.) 2. Post the journal to a ledger of four-column accounts. 3. Prepare an unadjusted trial balance. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6). a. Insurance expired during May is 275. b. Supplies on hand on May 31 are 715. c. Depreciation of office equipment for May is 330. d. Accrued receptionist salary on May 31 is 325. e. Rent expired during May is 1,600. f. Unearned fees on May 31 are 3,210. 5. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. 6. Journalize and post the adjusting entries. Record the adjusting entries on Page 7 of the journal. 7. Prepare an adjusted trial balance. 8. Prepare an income statement, a retained earnings statement, and a balance sheet. 9. Prepare and post the closing entries. Record the closing entries on Page 8 of the journal. (Income Summary is account 34 in the chart of accounts.) Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. 10. Prepare a post-closing trial balance.