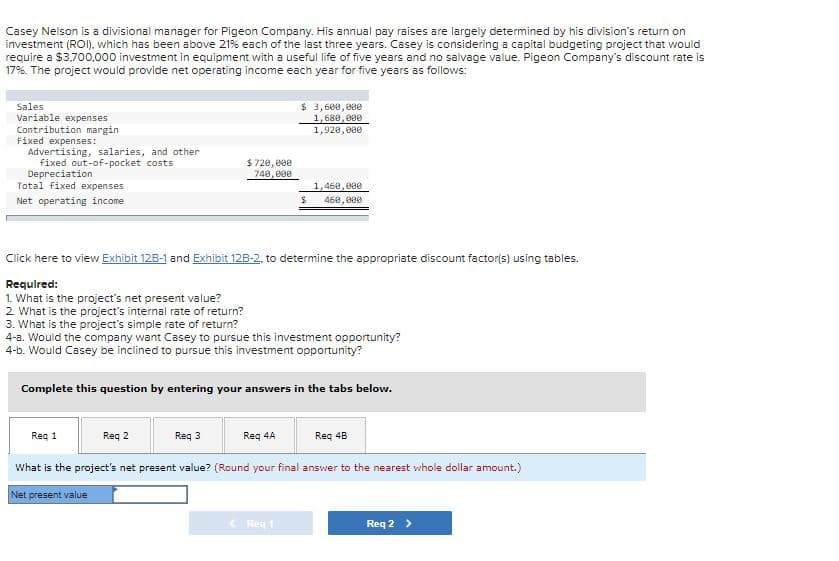

Casey Nelson is a divisional manager for Pigeon Company. His annual pay raises are largely determined by his division's return on investment (ROI). which has been above 21% each of the last three years. Casey is considering a capital budgeting project that would require a $3.700,000 investment in equipment with a useful life of five years and no salvage value. Pigeon Company's discount rate is 17%. The project would provide net operating income each year for five years as follows: $ 3,600, 00e 1,680, 000 1,920,000 Sales Variable expenses Contribution margin Fixed expenses: Advertising, salaries, and other fixed out-of-pocket costs Depreciation Total fixed expenses $720, eee 748,e0e 1,468,000 460, 00e Net operating income Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using tables. Required: 1. What is the project's net present value? 2 What is the project's internal rate of return? 3 What is the oroiect's simple rate of return?

Casey Nelson is a divisional manager for Pigeon Company. His annual pay raises are largely determined by his division's return on investment (ROI). which has been above 21% each of the last three years. Casey is considering a capital budgeting project that would require a $3.700,000 investment in equipment with a useful life of five years and no salvage value. Pigeon Company's discount rate is 17%. The project would provide net operating income each year for five years as follows: $ 3,600, 00e 1,680, 000 1,920,000 Sales Variable expenses Contribution margin Fixed expenses: Advertising, salaries, and other fixed out-of-pocket costs Depreciation Total fixed expenses $720, eee 748,e0e 1,468,000 460, 00e Net operating income Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using tables. Required: 1. What is the project's net present value? 2 What is the project's internal rate of return? 3 What is the oroiect's simple rate of return?

Chapter18: The Management Of Accounts Receivable And Inventories

Section: Chapter Questions

Problem 10P

Related questions

Question

100%

Transcribed Image Text:Casey Nelson is a divisional manager for Pigeon Company. His annual pay raises are largely determined by his division's return on

investment (ROI). which has been above 21% each of the last three years. Casey is considering a capital budgeting project that would

require a $3.700.000 investment in equipment with a useful life of five years and no salvage value. Pigeon Company's discount rate is

17%. The project would provide net operating income each year for five years as follows:

Sales

Variable expenses

Contribution margin

Fixed expenses:

Advertising, salaries, and other

fixed out-of-pocket costs

Depreciation

Total fixed expenses

$ 3,600, 00e

1,680, 080

1,928, 000

$720, 000

740,e00

1,460,000

460, 000

Net operating income

Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using tables.

Requlred:

1. What is the project's net present value?

2 What is the project's internal rate of return?

3. What is the project's simple rate of return?

4-a. Would the company want Casey to pursue this investment opportunity?

4-b. Would Casey be inclined to pursue this investment opportunity?

Complete this question by entering your answers in the tabs below.

Req 1

Req 2

Req 3

Req 4A

Reg 48

What is the project's net present value? (Round your final answer to the nearest whole dollar amount.)

Net present value

<Req 1

Req 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning