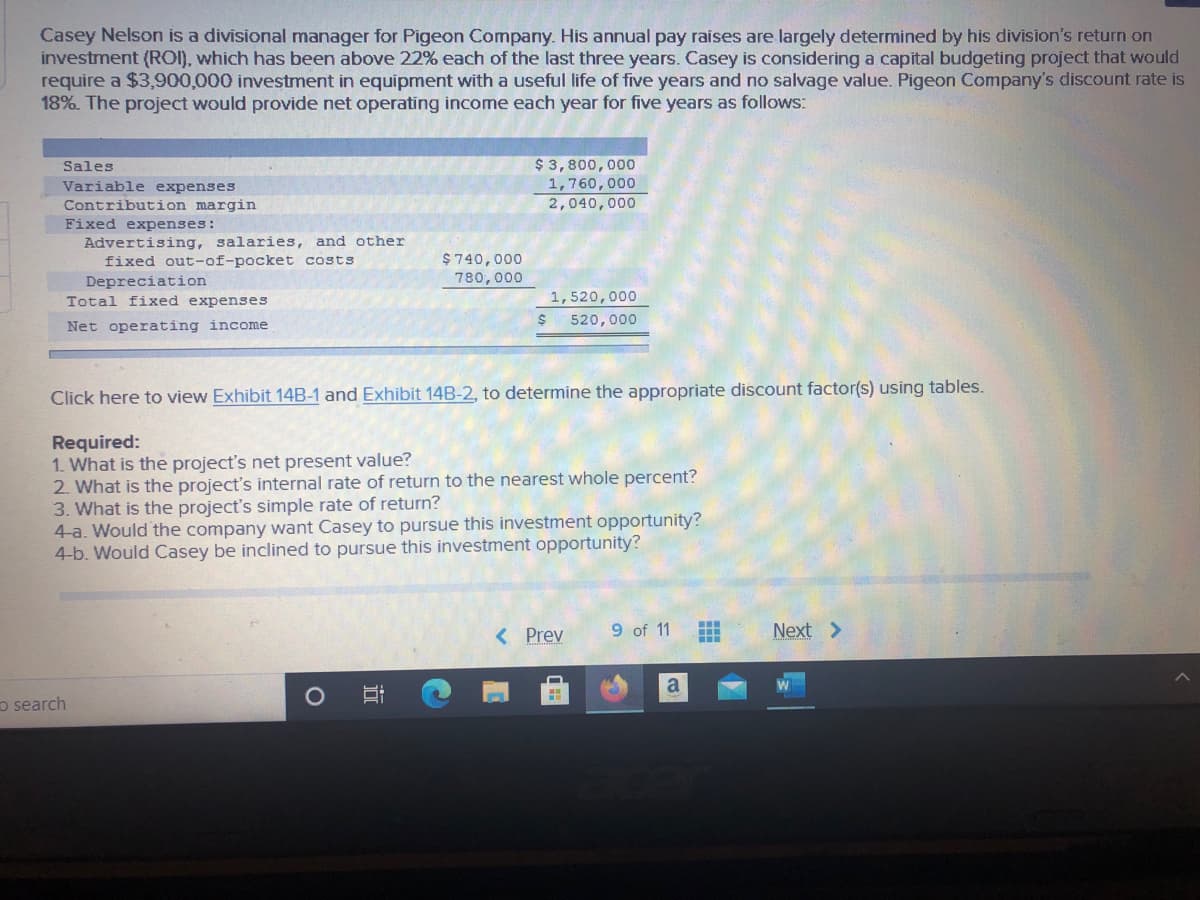

Casey Nelson is a divisional manager for Pigeon Company. His annual pay raises are largely determined by his division's return on investment (ROI), which has been above 22% each of the last three years. Casey is considering a capital budgeting project that would require a $3,900,000 investment in equipment with a useful life of five years and no salvage value. Pigeon Company's discout rate is 18%. The project would provide net operating income each year for five years as follows: $ 3,800,000 1,760,000 2,040,000 Sales Variable expenses Contribution margin Fixed expenses: Advertising, salaries, and other fixed out-of-pocket costs $740,000 780,000 Depreciation Total fixed expenses 1,520,000 %24 520,000 Net operating income Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using tables. Required: 1. What is the project's net present value? 2. What is the project's internal rate of return to the nearest whole percent? 3. What is the project's simple rate of return? 4-a. Would the company want Casey to pursue this investment opportunity? 4-b. Would Casey be inclined to pursue this investment opportunity?

Casey Nelson is a divisional manager for Pigeon Company. His annual pay raises are largely determined by his division's return on investment (ROI), which has been above 22% each of the last three years. Casey is considering a capital budgeting project that would require a $3,900,000 investment in equipment with a useful life of five years and no salvage value. Pigeon Company's discout rate is 18%. The project would provide net operating income each year for five years as follows: $ 3,800,000 1,760,000 2,040,000 Sales Variable expenses Contribution margin Fixed expenses: Advertising, salaries, and other fixed out-of-pocket costs $740,000 780,000 Depreciation Total fixed expenses 1,520,000 %24 520,000 Net operating income Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using tables. Required: 1. What is the project's net present value? 2. What is the project's internal rate of return to the nearest whole percent? 3. What is the project's simple rate of return? 4-a. Would the company want Casey to pursue this investment opportunity? 4-b. Would Casey be inclined to pursue this investment opportunity?

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter19: Capital Investment

Section: Chapter Questions

Problem 4CE: Manzer Enterprises is considering two independent investments: A new automated materials handling...

Related questions

Question

Please help with 4a and 4b

Transcribed Image Text:Casey Nelson is a divisional manager for Pigeon Company. His annual pay raises are largely determined by his division's return on

investment (ROI), which has been above 22% each of the last three years. Casey is considering a capital budgeting project that would

require a $3,900,000 investment in equipment with a useful life of five years and no salvage value. Pigeon Company's discount rate is

18%. The project would provide net operating income each year for five years as follows:

$ 3,800,000

1,760,000

Sales

Variable expenses

Contribution margin

2,040,000

Fixed expenses:

Advertising, salaries, and other

fixed out-of-pocket costs

$740,000

780, 000

Depreciation

Total fixed expenses

1,520,000

520,000

Net operating income

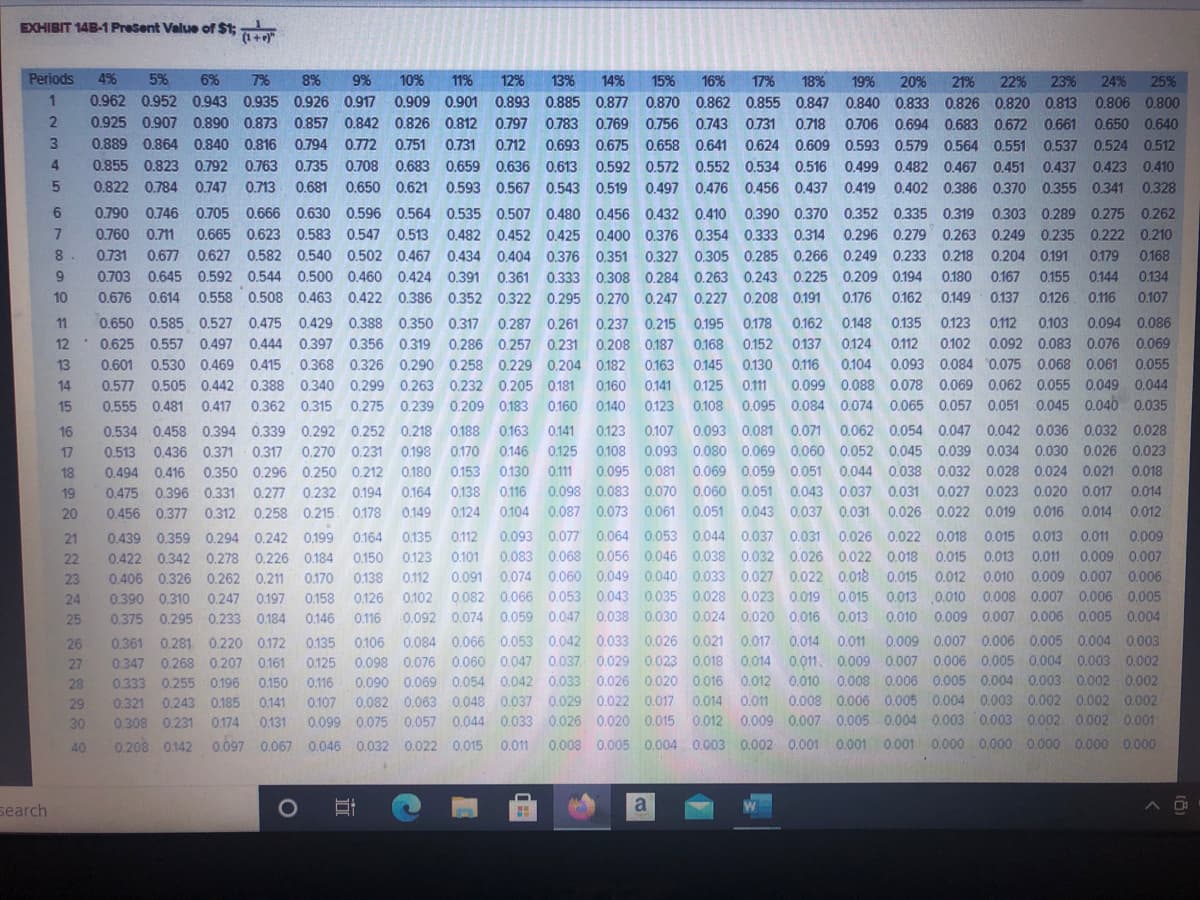

Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using tables.

Required:

1. What is the project's net present value?

2. What is the project's internal rate of return to the nearest whole percent?

3. What is the project's simple rate of return?

4-a. Would the company want Casey to pursue this investment opportunity?

4-b. Would Casey be inclined to pursue this investment opportunity?

9 of 11

...

< Prev

Next >

o search

近

Transcribed Image Text:EXHIBIT 14B-1 PreSent Value of $t; a

Periods

4%

5%

23%

0.855 0.847 0.840 0.833 0.826 0.820 0.813

0.706 0.694 0.683 0.672

6%

7%

8%

9%

10%

11%

12%

13%

14%

15%

16%

17%

18%

19%

20%

21%

22%

24%

25%

0.962 0.952 0.943 0.935 0.926 0.917

0.909 0.901 0.893 0.885 0.877 0.870 0.862

0.806 0.800

0.925

0.907 0.890 0.873

0.857 0.842

0.826

0.812

0.797

0.783

0.769 0.756 0.743

0.731

0,718

0.661

0,650 0,640

3

0.889 0.864 0.840 0.816

0.794 0.772 0.751

0.731

0,712

0.693 0.675 0.658 0.641

0.624 0.609 0.593 0.579 0.564

0.551

0.537

0.524 0,512

0.855 0.823 0,792

0.763 0.735 0.708 0.683 0,659 0,636

0.613

0.592 0.572 0.552

0.534 0,516

0.499 0.482 0.467 0.451

0.437

0.423

0.410

0.822 0.784

0.747

0.713

0.681

0.650

0.621

0.593 0.567 0.543 0.519

0.497 0.476 0.456

0.437 0.419

0.402 0.386 0.370 0.355 0.341

0.328

6

0.790 0.746

0.705 0.666 0.630 0.596 0.564 0.535 0.507 0.480 0.456 0.432 0.410

0.390 0.370 0.352 0.335

0.319

0.303 0.289

0.275

0.262

7

0.760 0.711

0.665 0.623 0.583 0.547

0.513

0.482 0.452 0.425 0.400 0.376 0.354 0.333

0.314

0.296 0.279

0.263 0.249 0.235 0.222

0.210

8

0.731 0.677

0,627 0.582 0.540 0.502 0.467

0.434 0.404 0.376 0.351 0.327 0.305 0.285 0.266 0.249 0.233 0.218 0.204 0.191

0.179

0.168

0.703 0.645 0.592 0.544 0.500 0.460 0.424 0.391

0.333 0.308 0.284 0.263 0.243 0.225 0.209 0.194

0.162

0.361

0.180

0.167

0.155

0.144

0.134

10

0,676

0.614

0,558 0,508

0.463

0.422

0.386 0.352 0.322 0.295 0.270 0.247 0.227 0.208

0.191

0.176

0.149

0.137

0.126

0.116

0.107

11

0.650 0.585 0.527 0.475

0.429 0.388

0.350 0.317

0.287

0.261 0.237 0.215 0.195

0.178

0.162

0.148

0.135

0.123

0.112

0.103

0.094 0.086

12 0.625 0.557

0.497

0,444

0.397 0.356 0.319 0.286 0.257 0.231 0.208 0.187

0.168 0.152

0.137

0.124

0.112

0.102

0.092 0.083 0.076

0.069

13

0.601

0.530 0.469

0.415

0.368

0.326 0.290 0.258 0.229 0.204 0.182

0.163

0.145

0.130

0.116

0.104

0.093 0.084 0.075 0.068 0.061

0.055

14

0.577 0.505 0.442 0.388 0.340

0.299 0.263 0.232 0.205 0.181

0.160

0.141

0.125 0.111

0.099 0.088 0.078 0.069 0.062 0.055 0.049 0.044

15

0.555 0.481

0.417

0.362 0.315

0.275

0.239 0.209 0.183

0.160

0.140

0.123

0.108 0.095 0.084 0.074 0.065 0.057 0.051

0.045 0.040 0.035

0.534 0.458 0.394 0.339 0.292 0.252 0.218 0.188

0.042 0.036 0.032 0.028

0.093 0.080 0.069 0.060 0.052 0.045 0.039 0.034 0.030 0.026 0.023

0.095 0.081 0.069 0.059 0.051 0.044 0.038 0.032 0.028 0.024 0.021 0.018

0.098 0.083 0.070 0.060 0.051 0.043 0.037 0.031 0.027 0.023 0,020 0.017 0.014

0.087 0.073 0.061 0.051 0.043 0.037 0.031 0.026 0.022 0.019 0.016 0.014 0.012

16

0.163

0.141

0.123

0.107

0.093 0.081 0.071 0.062 0.054 0.047

17

0.513 0.436 0.371

0.317

0.270 0.231

0.198

0.170

0.146

0.125

0.108

18

0.494 0.416

0.350

0.296

0.250 0.212

0.180 0.153

0.130

0.111

19

0.475 0.396 0.331

0.277

0.232 0.194

0.164

0.138

0.116

20

0.456 0.377

0.312

0.258 0.215. 0.178

0.149

0.124

0.104

0.093 0.077 0.064 0.053 0.044 0.037 0.031 0.026 0.022 0.018

0.083 0.068 0.056 0.046 0.038 0.032 0.026 0.022 0.018

0.091 0.074 0.060 0.049 0.040 0.033 0.027 0.022 0.01 0.015

0.082 0.066 0.053 0.043 0.035 0.028 0.023 0.019 0.015 0.013

21

0.439

0.359 0.294 0.242 0.199

0.164

0.135

0.112

0.015

0.013

0,011

0.009

0.011

0.278

0.326 0.262 0.211

22

0.422 0.342

0.226 0.184

0.150

0.123

0.101

0.015

0.013

0.009 0.007

23

0.406

0.170

0.138

0.112

0.012

0.010

0.009 0.007 0.006

24

0.390 0.310

0.247 0.197

0.158

0.126

0.102

,0.010

0.008 0.007 0.006 0.005

25

0.375

0.295 0.233 0.184

0.146

0.116

0.092 0.074 0.059 0.047 0.038 0.030 0.024 0.020 0.016 0.013

0.010

0.009

0.007

0.006 0.005

0.004

0.361 0.281 0.220 0.172

0.268 0.207 0.161

0.333 0.255 0196

0,009 0.007 0,006 0.005 0.004 0.003

0.098 0.076 0.060 0.047 0.037 0.029 0.023 0.018 0.014 0.011. 0.009 0.007 0.006 0.005 0.004 0.003 0.002

0.004 0.003 0.002 0.002

0.008 0.006 0.005 0.004 0.003 0.002 0.002 0.002

0,012 0.009 0,007 0.005 0.004 0.003 0.003 0.002 0.002 0.001

26

0.135

0.106

0.084 0.066 0.053 0.042 0.033 0.026 0.021

0.017

0.014 0.011

27

0.347

0.125

28

0.150

0.116

0.090 0.069 0.054 0.042 0.033 0.026 0.020 0.016 0.012 0.010 0.008 0.006 0.005

29

0.321 0.243

0.185

0.141

0.107

0.082 0.063 0,048 0.037 0.029 0.022 0.017

0.014

0.011

30

0.308 0.231

0.174

0.131

0.099 0.075 0,057 0.044 0.033 0.026 0.020 0.015

40

0.208 0.142 0.097 0.067 0.046 0.032 0.022 0.015 0.011

0.008 0.005 0.004 0.003 0.002 0.001

0.001 0.001 0.000 0.000

0.000 0.000 0.000

search

a

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning