Cash 45,100 15,000 6,800 (2,000) 21,000 27,500 72,600 Accounts Receivable Inventory prepaid expenses Equipment 32,600 47,600 48,000 54,800 7,200 5,200 56,000 77,000 Accum. Depr- Equipment (6,000) (32,500) 224,700 (26,500) total assets 144,800 Liabilities: Accounts Payable accrued Liabilities Bonds Payable 13,000 1,200 (32,000) 12,700 25,700 3,800 5,000 40,000 70,700 72,000 total liabilities 88,500 shareholders Equity: Common Stock Retained Earnings 20,000 20,000 36,300 134,000 97,700 total equity 56,300 154,000 total liabilities and shareholder equity 144,800 224,700 other info: new equipment purchase of 46,000

Cash 45,100 15,000 6,800 (2,000) 21,000 27,500 72,600 Accounts Receivable Inventory prepaid expenses Equipment 32,600 47,600 48,000 54,800 7,200 5,200 56,000 77,000 Accum. Depr- Equipment (6,000) (32,500) 224,700 (26,500) total assets 144,800 Liabilities: Accounts Payable accrued Liabilities Bonds Payable 13,000 1,200 (32,000) 12,700 25,700 3,800 5,000 40,000 70,700 72,000 total liabilities 88,500 shareholders Equity: Common Stock Retained Earnings 20,000 20,000 36,300 134,000 97,700 total equity 56,300 154,000 total liabilities and shareholder equity 144,800 224,700 other info: new equipment purchase of 46,000

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter11: The Statement Of Cash Flows

Section: Chapter Questions

Problem 33BE

Related questions

Question

Help me please

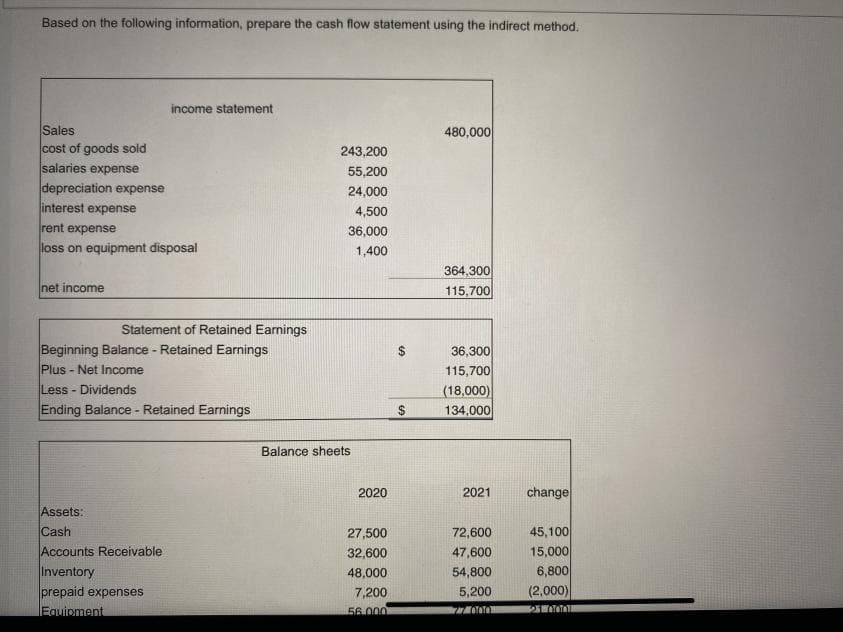

Transcribed Image Text:Based on the following information, prepare the cash flow statement using the indirect method.

income statement

Sales

cost of goods sold

480,000

243,200

salaries expense

55,200

depreciation expense

interest expense

rent expense

24,000

4,500

36,000

loss on equipment disposal

1,400

364,300

115,700

net income

Statement of Retained Earnings

Beginning Balance - Retained Earnings

Plus - Net Income

36,300

115,700

(18,000)

134,000

Less - Dividends

Ending Balance - Retained Earnings

24

Balance sheets

2020

2021

change

Assets:

Cash

45,100

15,000

6,800

(2,000)

27,500

72,600

Accounts Receivable

32,600

47,600

Inventory

prepaid expenses

Equioment

48,000

54,800

7,200

5,200

56 000

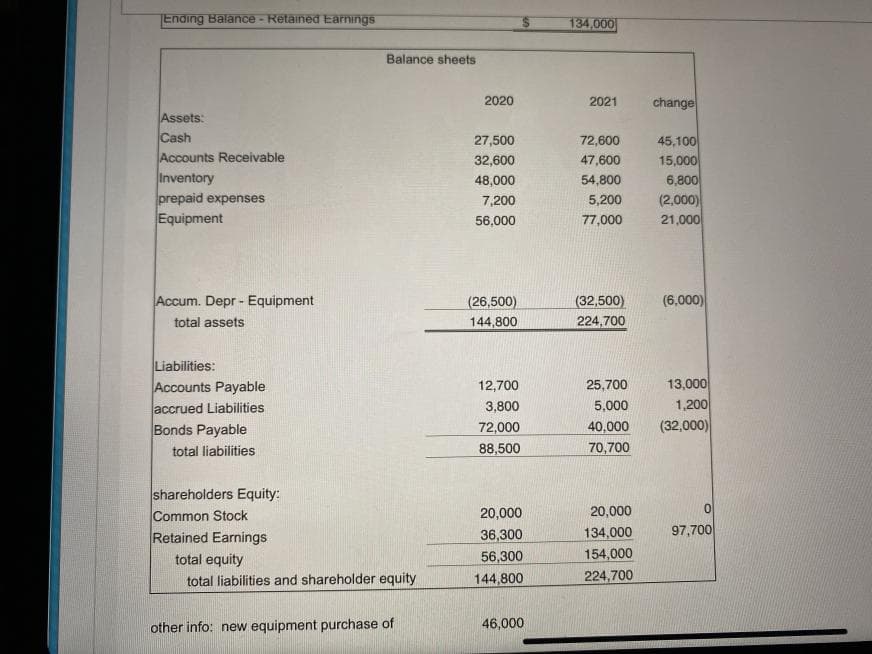

Transcribed Image Text:TEnding Balance - Retained Earnings

134,000

Balance sheets

2020

2021

change

Assets:

Cash

45,100

15,000

6,800

(2,000)

21,000

27,500

72,600

Accounts Receivable

32,600

47,600

Inventory

prepaid expenses

Equipment

48,000

54,800

7,200

5,200

56,000

77,000

Accum. Depr - Equipment

(32,500)

(6,000)

(26,500)

144,800

total assets

224,700

Liabilities:

Accounts Payable

accrued Liabilities

Bonds Payable

13,000

1,200

(32,000)

12,700

25,700

3,800

5,000

72,000

88,500

40,000

70,700

total liabilities

shareholders Equity:

Common Stock

Retained Earnings

total equity

20,000

20,000

36,300

134,000

97,700

56,300

154,000

total liabilities and shareholder equity

144,800

224,700

other info: new equipment purchase of

46,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning