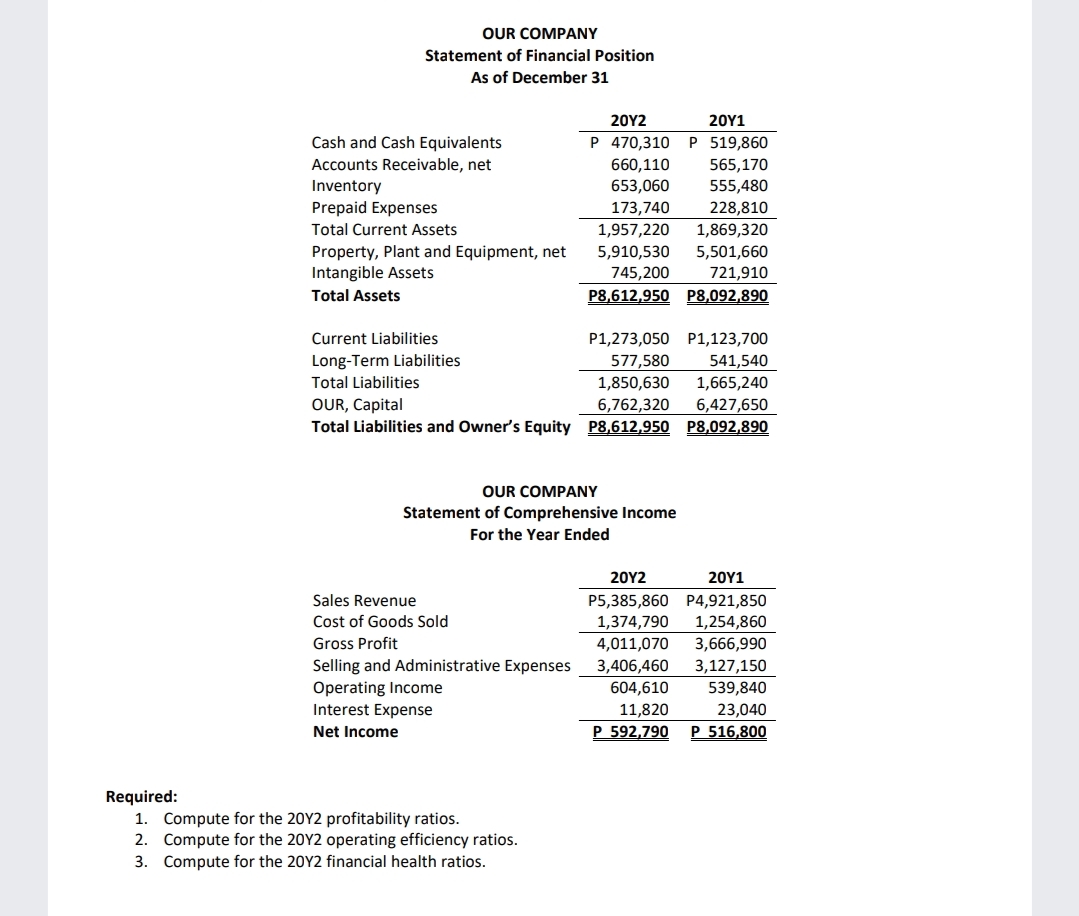

OUR COMPANY Statement of Financial Position As of December 31 20Y2 20Y1 P 470,310 P 519,860 Cash and Cash Equivalents Accounts Receivable, net 660,110 653,060 565,170 Inventory 555,480 Prepaid Expenses 173,740 1,957,220 228,810 1,869,320 Total Current Assets Property, Plant and Equipment, net Intangible Assets 5,910,530 745,200 5,501,660 721,910 Total Assets P8,612,950 P8,092,890 Current Liabilities P1,273,050 P1,123,700 Long-Term Liabilities 577,580 1,850,630 541,540 Total Liabilities 1,665,240 OUR, Capital Total Liabilities and Owner's Equity P8,612,950 P8,092,890 6,762,320 6,427,650

OUR COMPANY Statement of Financial Position As of December 31 20Y2 20Y1 P 470,310 P 519,860 Cash and Cash Equivalents Accounts Receivable, net 660,110 653,060 565,170 Inventory 555,480 Prepaid Expenses 173,740 1,957,220 228,810 1,869,320 Total Current Assets Property, Plant and Equipment, net Intangible Assets 5,910,530 745,200 5,501,660 721,910 Total Assets P8,612,950 P8,092,890 Current Liabilities P1,273,050 P1,123,700 Long-Term Liabilities 577,580 1,850,630 541,540 Total Liabilities 1,665,240 OUR, Capital Total Liabilities and Owner's Equity P8,612,950 P8,092,890 6,762,320 6,427,650

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter11: The Statement Of Cash Flows

Section: Chapter Questions

Problem 13MCQ

Related questions

Question

Transcribed Image Text:OUR COMPANY

Statement of Financial Position

As of December 31

2ΟΥ2

20Υ1

Cash and Cash Equivalents

P 470,310

P 519,860

Accounts Receivable, net

660,110

565,170

Inventory

653,060

555,480

228,810

Prepaid Expenses

173,740

Total Current Assets

1,957,220

1,869,320

Property, Plant and Equipment, net

Intangible Assets

5,910,530

745,200

5,501,660

721,910

Total Assets

P8,612,950 P8,092,890

Current Liabilities

P1,273,050 P1,123,700

Long-Term Liabilities

577,580

541,540

Total Liabilities

1,850,630

1,665,240

OUR, Capital

6,762,320

6,427,650

Total Liabilities and Owner's Equity P8,612,950 P8,092,890

OUR COMPANY

Statement of Comprehensive Income

For the Year Ended

20Υ2

20Υ1

Sales Revenue

P5,385,860 P4,921,850

1,374,790

Cost of Goods Sold

1,254,860

Gross Profit

4,011,070

3,666,990

3,127,150

3,406,460

604,610

Selling and Administrative Expenses

Operating Income

Interest Expense

539,840

23,040

11,820

Net Income

P 592,790

P 516,800

Required:

1. Compute for the 20Y2 profitability ratios.

2. Compute for the 20Y2 operating efficiency ratios.

3. Compute for the 20Y2 financial health ratios.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 6 images

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning