Cash $240 Accounts receivable (net of allowance of $80) 400 Inventory 300 Other current assets 160 Accounts payable 218 Other current liabilities 340 The president of the company is concerned that the company is in violation of a debt covenant that requires the company to maintain a minimum current ratio of 2.0. He believes the best way to rectify this is to reverse a bad debt write-off in the amount of $20 that the company just recorded. He argues that the write-off was done too. early and that the collections department should be given more time to collect the outstanding receivables. The CFO argues that this will have no effect on the current ratio, so a better idea is to use $20 of cash to pay accounts payable early. Florence Company uses the allowance method to account for bad debts. a. Calculate the current ratio under the following scenarios: Round answers to two decimal places. Current ratio (with no action) Current ratio (after reversal of bad debt) Current ratio (after paydown of accounts payable) Which action, if any, should Florence Company take to maintain a minimum 2.0 current ratio? 0 0 0

Cash $240 Accounts receivable (net of allowance of $80) 400 Inventory 300 Other current assets 160 Accounts payable 218 Other current liabilities 340 The president of the company is concerned that the company is in violation of a debt covenant that requires the company to maintain a minimum current ratio of 2.0. He believes the best way to rectify this is to reverse a bad debt write-off in the amount of $20 that the company just recorded. He argues that the write-off was done too. early and that the collections department should be given more time to collect the outstanding receivables. The CFO argues that this will have no effect on the current ratio, so a better idea is to use $20 of cash to pay accounts payable early. Florence Company uses the allowance method to account for bad debts. a. Calculate the current ratio under the following scenarios: Round answers to two decimal places. Current ratio (with no action) Current ratio (after reversal of bad debt) Current ratio (after paydown of accounts payable) Which action, if any, should Florence Company take to maintain a minimum 2.0 current ratio? 0 0 0

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter7: Receivables And Investments

Section: Chapter Questions

Problem 7.1DC: Reading 3M Companys Balance Sheet: Accounts Receivable The following current asset appears on the...

Related questions

Question

Please don't provide answer in image format thank you

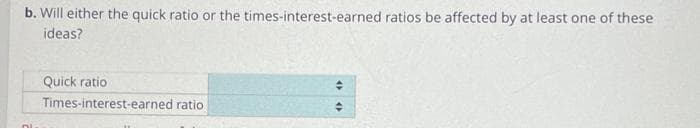

Transcribed Image Text:b. Will either the quick ratio or the times-interest-earned ratios be affected by at least one of these

ideas?

Quick ratio

Times-interest-earned ratio

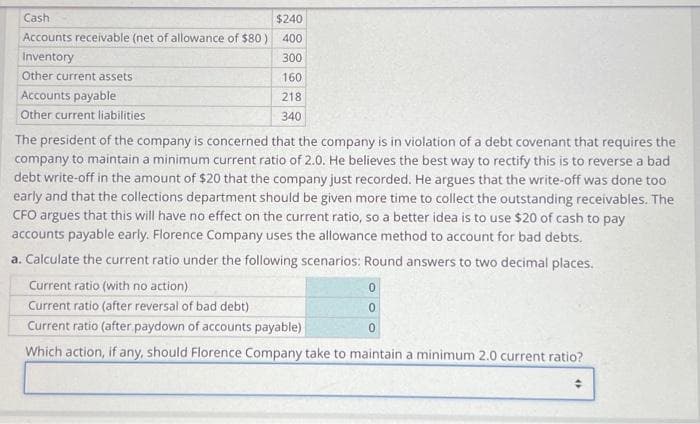

Transcribed Image Text:Cash

$240

Accounts receivable (net of allowance of $80) 400

Inventory

300

Other current assets.

160

Accounts payable

218

Other current liabilities

340

The president of the company is concerned that the company is in violation of a debt covenant that requires the

company to maintain a minimum current ratio of 2.0. He believes the best way to rectify this is to reverse a bad

debt write-off in the amount of $20 that the company just recorded. He argues that the write-off was done too

early and that the collections department should be given more time to collect the outstanding receivables. The

CFO argues that this will have no effect on the current ratio, so a better idea is to use $20 of cash to pay

accounts payable early. Florence Company uses the allowance method to account for bad debts.

a. Calculate the current ratio under the following scenarios: Round answers to two decimal places.

Current ratio (with no action)

Current ratio (after reversal of bad debt)

Current ratio (after paydown of accounts payable)

Which action, if any, should Florence Company take to maintain a minimum 2.0 current ratio?

0

0

0

+

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning