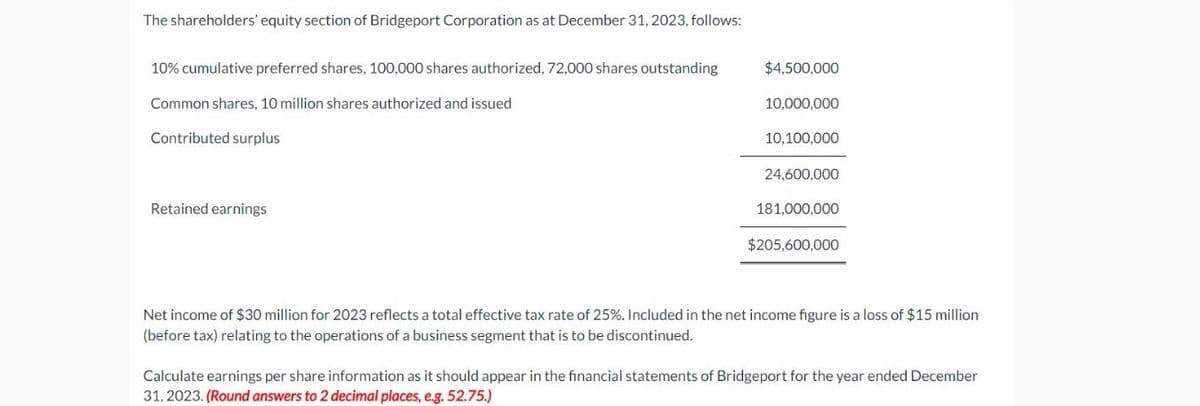

The shareholders' equity section of Bridgeport Corporation as at December 31, 2023, follows: 10% cumulative preferred shares, 100,000 shares authorized, 72,000 shares outstanding Common shares, 10 million shares authorized and issued Contributed surplus Retained earnings $4,500,000 10,000,000 10,100,000 24,600,000 181,000,000

Q: On January 1, 2020 ABC Company leased a building to XYZ Company for a 10-year term at an annual…

A: Liabilities are the obligations of the company that are being owed to someone else such as current…

Q: Ardmark Corporation was incorporated on January 1, 2003. It is authorized to issue an unlimited…

A: A company may issue common stock or preferred stock to raise capital for business. Common stock may…

Q: Aggregate Mining Corporation was incorporated five years ago. It is authorized to issue 500,000…

A: The journal entries are prepared to record the transactions on regular basis. The dividend is…

Q: The following information is available for the preparation of the government-wide financial…

A: The net position statement summarizes the financial condition of the governmental entity as well as…

Q: ABC Company was organized on January 1, 2019 at which date it issued 100,000 ordinary shares of P10…

A: The treasury stock has debit balance. The treasury stock shares decreases the number of shares…

Q: P7.1 Assume you are given the following abbreviated financial statement. چیزا مرگ دخل Current assets…

A: There are different types of ratio like liquidity,Activity ,leverage and profitability ratio…

Q: Exercise 1-11 (Algo) Cost Behavior; Contribution Format Income Statement [LO1-4, LO1-6] Harris…

A: Income Statement :— It is one of the financial statement that shows profitability, total revenue and…

Q: Schedule of Cash Receipts Rosita Flores owns Rosita's Mexican Restaurant in Tempe, Arizona.…

A: By crediting sales and debiting cash and transactions linked to receipts, a cash receipts…

Q: Sunland Company purchases a patent for $146.800 cash on January 2, 2024. Its legal life is 20 years…

A: JOURNAL ENTRIESJournal Entry is the First stage of Accounting Process. Journal Entry is the Process…

Q: What is the difference

A: The amount of security or collateral that each type of creditor has in relation to the debts owed to…

Q: Ms Munoz bought 2,500 shares of Google Corporation stock for $15,000 on March 21, 2017. On December…

A: Recognized loss refers to the loss on the sale or disposition of an investment or asset that is…

Q: c. Prepare the consolidated balance sheet at the date of acquisition. • Do not use negative signs…

A: Acquisition cost, occasionally appertained to as book value or asset book value, is a cost…

Q: [The following information applies to the questions displayed below.] The Field, Brown & Snow are…

A: A partnership is one type of business where two or more persons jointly own for the purpose of…

Q: Prepare a direct materials budget for the first quarter of the financial year ending 30 September…

A: Prior to beginning an operation, a budget is used to estimate revenue and expenses. Setting a…

Q: a. Prepare a schedule calculating the goodwill to be recognized for this acquisition. Acquisition…

A: Goodwill is the excess amount paid over the fair value (FV) of the net assets of the entity. It is…

Q: Prepare a cost of goods manufactured schedule. (Assume all raw materials used were direct materials…

A: SCHEDULE OF COST OF GOODS MANUFACTUREDSchedule Of Cost Of Goods Manufactured are those Cost Which is…

Q: Present Value of Amounts Due Assume that you are going to receive $380,000 in 10 years. The current…

A: PRESENT VALUEPresent Value is the Current Value of Future Cash Flows at a Discounting Rate.Present…

Q: Find the EPS, P/E ratio, and dividend yield of a company that has six million shares of common stock…

A: As per our policy,in case of multiple questions,we are allowed to answer the first one.Hence…

Q: Merrill Company makes a household appliance with model number X800. The goal for 2020 is to reduce…

A: Revenue is defined as any monetary payment received from a customer when an entity carries out its…

Q: 5-6A - Recording receivables transactions On November 1, 2024, Recchi Company showed the following…

A: Journal Entry is the primary step to record the transaction in the books of accounts.The increase in…

Q: Three independent situations follow. Situation 1: During 2020, Sugarpost Inc. became involved in a…

A: Costs that a company would be liable for in the event that a specific occurrence happened in the…

Q: January 1 January 5 Sheridan Inc. is a retailer operating in British Columbia. Sheridan uses the…

A: Inventory Valuation Methods are methods of valuation of inventory.There are three methods of…

Q: public company to a registered charity. At the time of the gift, the shares had a value of $80,000…

A: Capital gain refers to increase in the value of a capital asset when the asset is sold.

Q: James invested additional $7,800 cash and car valued at $10,600 into the firm. What accounts…

A: JOURNAL ENTRIES Journal Entry is the First stage of Accounting Process. Journal…

Q: Exercise 4-12 (Static) Recording purchases, sales, returns, and shipping LO P1, P2 Following are the…

A: Journal Entries -Journal Entries are the records of the transactions that take place in the ordinary…

Q: General Journal Effect How should the decline affect net income and comprehensive income? (Negative…

A: Available for sale securities: These are the securities which are not intended to be sold in the…

Q: a. Juan, age 41, earns a salary of $28,000 and is not an active participant in any other qualified…

A: Explanation:No Income limit will apply as they are not active participant in any other qualified…

Q: ABC Company had 600,000 ordinary shares issued and outstanding at December 31, 2019. During 2020, no…

A: Basic earnings per share is the per share amount that is available for the ordinary shareholders…

Q: The following information was available for Bramble Company at December 31, 2020: beginning…

A: Average inventory :— It is calculated by dividing sum of beginning inventory and ending inventory by…

Q: Determining Cost of Land On-Time Delivery Company acquired an adjacent lot to construct a new…

A: The cost of an assets includes the costs incurred to make assets ready for use. The cost of land…

Q: Berry's Boxes manufactures boxes. It expects to sell 20,000 bo of direct materials to produce 24,000…

A: To calculate Berry's Boxes production costs for direct materials, direct manufacturing labor, and…

Q: For each item, determine the accounts to be adjusted on December 31, 2024, the amount of the…

A: Unearned Revenue -Unearned Revenue is the amount received by the organization from the customer. The…

Q: Prepare a production report for the Mixing Department for the current year. If an amount is zero,…

A: The production report provides a detailed summary of the production cost reports in the department…

Q: Ivanhoe Corporation had the following transactions pertaining to debt investments. Purchased 70…

A: Bonds are security that is issued by entities in order to raise capital. They are similar to the…

Q: Milo Manufacturing produces products Kappa and Lambda from a joint process. Total joint costs are…

A: The joint costs can be allocated to products on the basis of split off values and physical units…

Q: Disbursements) as well as a General Journal. For this question, you will only be recording the…

A: sales journaldatecustomerinvoice no.amountMay 4Lenten Inc543$6,750total$6,750

Q: Explain the nature of the liability, if any, by Mr. Daniel in each of the following situations. a.…

A: Mr Daniel's liability for unpaid debts would be unlimited and he may need to pay out of his private…

Q: [The following information applies to the questions displayed below.] Roth Incorporated…

A: Financial Statements -Financial Statements include Income Statements, Statements of Changes in…

Q: Sandhill Company allocates manufacturing overhead at $23 per direct labor hour. Job A890 required 4…

A: Total cost is the amount of cost incurred on the making of the goods. It includes the cost of direct…

Q: At December 31, 2023, Novak Corporation had the following shares outstanding: 6% cumulative…

A: Earnings per share is the per share amount of earnings available to the common shareholders. It is…

Q: Sold a two-story house and lot amountinf to $106,000. The 7% commission will be collected next…

A: Journal entries are the entries passed in the books of accounts to record the business transactions…

Q: Required: 1. Prepare a single-step income statement (Round "Earnings per share" answers to 2 decimal…

A: "Since you have asked multiple questions, we shall solve the first one for you. please post the…

Q: 1. 2. 3. le Corporation had the following activities in 2020. Sale of land $163,000 Purchase of…

A: The cash flow statement is one of the financial statement that is prepared to record the cash flow…

Q: Mainline Produce Corporation acquired all the outstanding common stock of Iceberg Lettuce…

A: Investment in Associates and Joint venture and SubsidiaryEquity Accounting method - This method is…

Q: how about these 3 requirments Prepare a direct materials budget for the first quarter of the…

A: Prior to beginning an operation, a budget is used to estimate revenue and expenses. Setting a…

Q: had the following receipts during the month: Interest income from members P 210,000.00 Rent…

A: Interest income from members is not subject to buisness tax

Q: a. What are the tax liability the marginal tax rate, and the average tax rate for a married couple…

A: Tax Liability is calculated by multiplying the taxable income with applicable income tax rates.…

Q: S On January 1, Marcum's Landscape purchased 10,000 shares (35%) of the common stock of Atlantic…

A: Journal is the method of recording financial transactions in the book of original entry by debiting…

Q: Starling Co. is considering disposing of a machine with a book value of $21,600 and estimated…

A: The differential analysis is performed to compare the different alternatives available for the…

Q: During 2020, ABC Company had the following two classes of share capital issued and outstanding for…

A: Earnings per share is often abbreviated as EPS which determines the earnings or net profit…

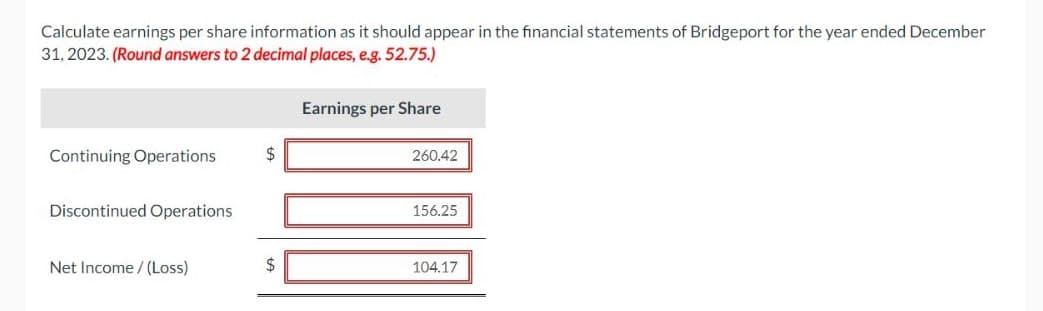

Need help with correct answers and explanation.

Step by step

Solved in 3 steps with 5 images

- Cash Dividends on Common and Preferred Stock Lemon Inc. has the following information regarding its preferred and common stock: Preferred stock, S30 par, 12% cumulative; 300,000 shares authorized; 150,000 shares issued and outstanding Common stock, $2 par; 2,500,000 shares authorized; 1,200,000 shares issued; 1,000,000 outstanding As of December 31, 2019, Lemon was 3 years in arrears on its dividends. During 2020, Lemon declared and paid dividends. As a result, the common stockholders received dividends of $0.45 per share. Required: What was the total amount of dividends declared and paid? What journal entry was made at the date of declaration?Cary Corporation has 50,000 shares of 10 par common stock authorized. The following transactions took place during 2019, the first year of the corporations existence: Sold 5,000 shares of common stock for 18 per share. Issued 5,000 shares of common stock in exchange for a patent valued at 100,000. At the end of Carys first year, total contributed capital amounted to: a. 40,000 b. 90,000 c. 100,000 d. 190,000Statement of Stockholders' Equity At the end of 2019, Stanley Utilities Inc. had the following equity accounts and balances: During 2020, Stanley Utilities engaged in the following transactions involving its equity accounts: Sold 3,300 shares of common stock for $15 per share. Sold 1,000 shares of 12%, $100 par preferred stock at $105 per share. Declared and paid cash dividends of $8,000. Repurchased 1,000 shares of treasury stock (common) for $38 per share. Sold 400 of the treasury shares for $42 per share. Required: Prepare the journal entries for Transactions a through e. Assume that 2020 net income was $87,000. Prepare a statement of stockholders equity at December 31, 2020.

- Raun Company had the following equity items as of December 31, 2019: Preferred stock, 9% cumulative, 100 par, convertible Paid-in capital in excess of par value on preferred stock Common stock, 1 stated value Paid-in capital in excess of stated value on common stock| Retained earnings The following additional information about Raun was available for the year ended December 31, 2019: 1. There were 2 million shares of preferred stock authorized, of which 1 million were outstanding. All 1 million shares outstanding were issued on January 2, 2016, for 120 a share. The preferred stock is convertible into common stock on a 1-for-1 basis until December 31, 2025; thereafter, the preferred stock ceases to be convertible and is callable at par value by the company. No preferred stock has been converted into common stock, and there were no dividends in arrears at December 31, 2019. 2. The common stock has been issued at amounts above stated value per share since incorporation in 2002. Of the 5 million shares authorized, 3,580,000 were outstanding at January 1, 2019. The market price of the outstanding common stock has increased slowly but consistently for the last 5 years. 3. Raun has an employee share option plan where certain key employees and officers may purchase shares of common stock at 100% of the marker price at the date of the option grant. All options are exercisable in installments of one-third each year, commencing 1 year after the date of the grant, and expire if not exercised within 4 years of the grant date. On January 1, 2019, options for 70,000 shares were outstanding at prices ranging from 47 to 83 a share. Options for 20,000 shares were exercised at 47 to 79 a share during 2019. During 2019, no options expired and additional options for 15,000 shares were granted at 86 a share. The 65,000 options outstanding at December 31, 2019, were exercisable at 54 to 86 a share; of these, 30,000 were exercisable at that date at prices ranging from 54 to 79 a share. 4. Raun also has an employee share purchase plan whereby the company pays one-half and the employee pays one-half of the market price of the stock at the date of the subscription. During 2019, employees subscribed to 60,000 shares at an average price of 87 a share. All 60,000 shares were paid for and issued late in September 2019. 5. On December 31, 2019, there was a total of 355,000 shares of common stock set aside for the granting of future share options and for future purchases under the employee share purchase plan. The only changes in the shareholders equity for 2019 were those described previously, the 2019 net income, and the cash dividends paid. Required: Prepare the shareholders equity section of Rauns balance sheet at December 31, 2019. Substitute, where appropriate, Xs for unknown dollar amounts. Use good form and provide full disclosure. Write appropriate notes as they should appear in the publisher financial statements.Kent Corporation was organized on January 1, 2014. On that date, it issued 200,000 shares of 10 par value common stock at 15 per share (400,000 shares were authorized). During the period January 1, 2014, through December 31, 2019, Kent reported net income of 750,000 and paid cash dividends of 380,000. On January 5, 2019, Kent purchased 12,000 shares of its common stock at 12 per share. On December 28, 2019, 8,000 treasury shares were sold at 8 per share. Kent used the cost method of accounting for treasury shares. What is Kents total shareholders equity as of December 31, 2019? a. 3,290,000 b. 3,306,000 c. 3,338,000 d. 3,370,000Outstanding Stock Lars Corporation shows the following information in the stockholders equity section of its balance sheet: The par value of common stock is S5, and the total balance in the Common Stock account is $225,000. There are 13,000 shares of treasury stock. Required: What is the number of shares outstanding? Use the following information for Exercises 10-58 and 10-59: Stahl Company was incorporated as a new business on January 1, 2019. The company is authorized to issue 600,000 shares of $2 par value common stock and 80,000 shares of 6%, S20 par value, cumulative preferred stock. On January 1, 2019, the company issued 75,000 shares of common stock for $15 per share and 5,000 shares of preferred stock for $25 per share. Net income for the year ended December 31, 2019, was $500,000.

- Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 2016, were as follows: a. Issued 15,000 shares of 20 par common stock at 30, receiving cash. b. Issued 4, 000 shares of 80 par preferred 5% stock at 100, receiving cash. c. Issued 500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. d. Declared a quarterly dividend of 0.50 per share on common stock and 1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. e. Paid the cash dividends declared in (d). f. Purchased 7,500 shares of Solstice Corp. at 40 per share, plus a 150 brokerage commission. The investment is classified as an available-for-sale investment. g. Purchased 8,000 shares of treasury common stock at 33 per share. h. Purchased 40,000 shares of Pinkberry Co. stock directly from the founders for 24 per share. Pinkberry has 125,000 shares issued and outstanding. Equinox Products Inc. treated the investment as an equity method investment. i. Declared a 1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. j. Paid the cash dividends to the preferred stockholders. k. Received 27,500 dividend from Pinkberry Co. investment in (h). l. Purchased 90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of 37 5. The bonds are classified as a held-to-maturity long -term investment. m. Sold, at 38 per share, 2,600 shares of treasury common stock purchased in (g). n. Received a dividend of 0 .60 per share from the Solstice Corp. investment in (f). o. Sold 1,000 shares of Solstice Corp. at 45, including commission. p. Recorded the payment of semiannual interest on the bonds issue d in (c) and the amortization of the premium for six months. The amortization is determined using the straight-line method . q. Accrued interest for three months on the Dream Inc. bonds purchased in (I). r. Pinkberry Co. recorded total earnings of 240 ,000. Equinox Products recorded equity earnings for its share of Pinkberry Co. net income. s. The fair value for Solstice Corp. stock was 39. 02 per share on December 31, 2016. The investment is adjusted to fair value , using a valuation allowance account. Assume Valuation Allowance for Available-for-Sale Investments h ad a beginning balance of zero. Instructions 1. Journalize the selected transactions. 2. After all of the transaction s for the year ended December 31, 201 6, had been poste d [including the transactions recorded in part (1) and all adjusting entries), the data that follows were taken from the records of Equinox Products Inc. a. Prepare a multiple-step in come statement for the year ended December 31, 201 6, concluding with earnings per share . In computing earnings per share, assume that the average number of common shares outstanding was 100,000 and preferred dividends were 100,000. ( Round earnings per share to the nearest cent.) b. Prepare a retained earnings statement for the year ended December 31, 20 6. c. Prepare a balance sheet in report form as of December 31, 2016.Given the following year-end information, compute Greenwood Corporations basic and diluted earnings per share. Net income, 15,000 The income tax rate, 30% 4,000 shares of common stock were outstanding the entire year. shares of 10%, 50 par (and issuance price) convertible preferred stock were outstanding the entire year. Dividends of 2,500 were declared on this stock during the year. Each share of preferred stock is convertible into 5 shares of common stock.Statement of Stockholders' Equity At the end of 2019, Stanley Utilities Inc. had the following equity accounts and balances: During 2020, Haley engaged in the following transactions involving its equity accounts: Sold 5,000 shares of common stock for $19 per share. Sold 1.200 shares of 12%, $50 par preferred stock at $75 per share. Declared and paid cash dividends of $22,000. Repurchased 1,000 shares of treasury stock (common) for $24 per share. Sold 300 of the treasury shares for $26 per share. Required: Prepare the journal entries for Transactions a through e. Assume that 2020 net income was $123,700. Prepare a statement of stockholders equity at December 31, 2020.

- Stockholders equity accounts and other related accounts of Gonzales Company as of January 1, 20--, the beginning of its fiscal year, are shown below. Preferred stock subscriptions receivable 50,000 Preferred stock, 10 par, 9% (200,000 shares authorized; 20,000 shares issued)200,000 Preferred stock subscribed (10,000 shares)100,000 Paid-in capital in excess of parpreferred stock40,000 Common stock, 10 par (100,000 shares authorized; 60,000 shares issued)600,000 Paid-in capital in excess of parcommon stock250,000 Retained earnings750,000 During 20--, Gonzales Company completed the following transactions affecting stockholders equity: (a) Received 20,000 for the balance due on subscriptions for 4,000 shares of preferred stock with a par value of 40,000 and issued the stock. (b) Purchased 10,000 shares of common treasury stock for 18 per share. (c) Received subscriptions for 10,000 shares of common stock at 19 per share, collecting down payments of 45,000. (d) Issued 15,000 shares of common stock in exchange for land with a fair market value of 290,000. (e) Sold 5,000 shares of common treasury stock for 100,000. (f) Issued 10,000 shares of preferred stock at 11.50 per share, receiving cash. (g) Sold 3,000 shares of common treasury stock for 17 per share. REQUIRED 1. Prepare general journal entries for the transactions, identifying each transaction by letter. 2. Post the journal entries to appropriate T accounts. The cash account has a beginning balance of 300,000. 3. Prepare the stockholders equity section of the balance sheet as of December 31, 20--. Net income for the year was 825,000 and dividends of 400,000 were paid.Treasury Stock, Cost Method Bush-Caine Company reported the following data on its December 31, 2018, balance sheet: The following transactions were reported by the company during 2019: 1. Reacquired 200 shares of its preferred stock at 57 per share. 2. Reacquired 500 shares of its common stock at 16 per share. 3. Sold 100 shares of preferred treasury stock at 58 per share. 4. Sold 200 shares of common treasury stock at 17 per share. 5. Sold 100 shares of common treasury stock at 9 per share. 6. Retired the shares of common stock remaining in the treasury. The company maintains separate treasury stock accounts and related additional paid-in capital accounts for each class of stock. Required: 1. Prepare the journal entries required to record the treasury stock transactions using the cost method. 2. Assuming the company earned a net income in 2019 of 30.000 and declared and paid dividends of 10,000, prepare the shareholders equity section of its balance sheet at December 31, 2019.Hyde Corporations capital structure at December 31, 2018, was as follows: On July 2, 2019, Hyde issued a 10% stock dividend on its common stock and paid a cash dividend of 2.00 per share on its preferred stock. Net income for the year ended December 31, 2019, was 780,000. What should be Hydes 2019 basic earnings per share? a. 7.80 b. 7.09 c. 7.68 d. 6.73