cat ine. Has been manufacturing its own Camera for its Mobile Phone. The company is currently operating at 100% of capacity. Variable manufacturing overhead cost is OMR 3 per unit. The direct materials and direct labor cost per unit to maket camera are OMR 4 and OMR 6, respectively, fixed cost is OMR 50,000. Normal production is 50,000 Mobile Phone per year. A supplier offers to make the Cameras at a price of OMR 13.50 per unit. If Muscat accepts the supplier's offer; all variable manufacturing costs will be eliminated, but the OMR 50,000 of fixed manufacturing overhead currently being charged to the Cameras will have to be absorbed by other products. what will be the effect on net income? if the productive capacity release by not making the Cameras could be used to produce income of R.O. 40,000 elect one: D a. OMR 15,000 decrease O b. OMR 25,000 decrease O c. OMR 725,000 increase Od. None of the answers are correct e. OMR 15,000 increase

cat ine. Has been manufacturing its own Camera for its Mobile Phone. The company is currently operating at 100% of capacity. Variable manufacturing overhead cost is OMR 3 per unit. The direct materials and direct labor cost per unit to maket camera are OMR 4 and OMR 6, respectively, fixed cost is OMR 50,000. Normal production is 50,000 Mobile Phone per year. A supplier offers to make the Cameras at a price of OMR 13.50 per unit. If Muscat accepts the supplier's offer; all variable manufacturing costs will be eliminated, but the OMR 50,000 of fixed manufacturing overhead currently being charged to the Cameras will have to be absorbed by other products. what will be the effect on net income? if the productive capacity release by not making the Cameras could be used to produce income of R.O. 40,000 elect one: D a. OMR 15,000 decrease O b. OMR 25,000 decrease O c. OMR 725,000 increase Od. None of the answers are correct e. OMR 15,000 increase

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter8: Tactical Decision-making And Relevant Analysis

Section: Chapter Questions

Problem 40E

Related questions

Question

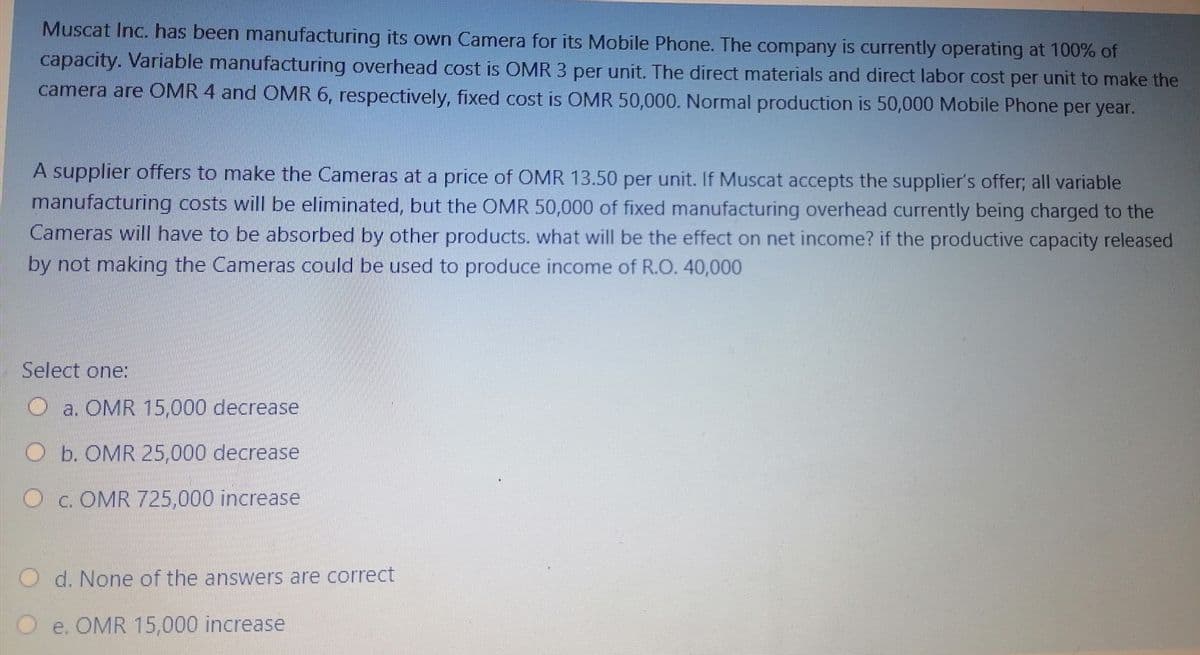

Transcribed Image Text:Muscat Inc. has been manufacturing its own Camera for its Mobile Phone. The company is currently operating at 100% of

capacity. Variable manufacturing overhead cost is OMR 3 per unit. The direct materials and direct labor cost per unit to make the

camera are OMR 4 and OMR 6, respectively, fixed cost is OMR 50,000. Normal production is 50,000 Mobile Phone per year.

A supplier offers to make the Cameras at a price of OMR 13.50 per unit. If Muscat accepts the supplier's offer; all variable

manufacturing costs will be eliminated, but the OMR 50,000 of fixed manufacturing overhead currently being charged to the

Cameras will have to be absorbed by other products. what will be the effect on net income? if the productive capacity released

by not making the Cameras could be used to produce income of R.O. 40,000

Select one:

a. OMR 15,000 decrease

Ob. OMR 25,000 decrease

O c. OMR 725,000 increase

O d. None of the answers are correct

O e. OMR 15,000 increase

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning