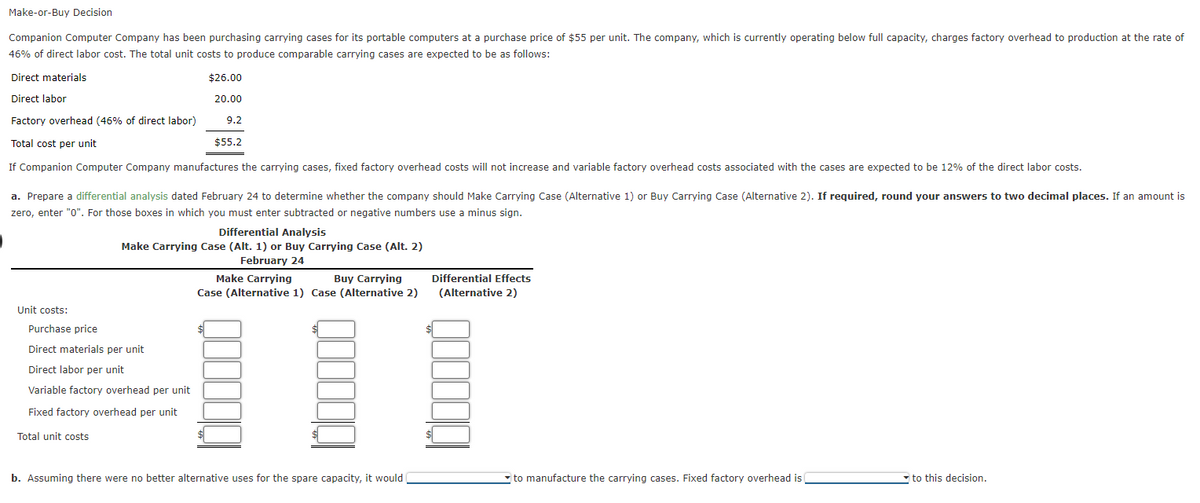

Companion Computer Company has been purchasing carrying cases for its portable computers at a purchase price of $55 per unit. The company, which is currently operating below full capacity, charges factory overhead to production at the rate 46% of direct labor cost. The total unit costs to produce comparable carrying cases are expected to be as follows: Direct materials $26.00 Direct labor 20.00 Factory overhead (46% of direct labor) 9.2 Total cost per unit $55.2 If Companion Computer Company manufactures the carrying cases, fixed factory overhead costs will not increase and variable factory overhead costs associated with the cases are expected to be 12% of the direct labor costs. a. Prepare a differential analysis dated February 24 to determine whether the company should Make Carrying Case (Alternative 1) or Buy Carrying Case (Alternative 2). If required, round your answers to two decimal places. If an amount zero, enter "0". For those boxes in which you must enter subtracted or negative numbers use a minus sign. Differential Analysis Make Carrying Case (Alt. 1) or Buy Carrying Case (Alt. 2) February 24 Differential Effects (Alternative 2) Make Carrying Buy Carrying Case (Alternative 1) Case (Alternative 2) Unit costs: Purchase price Direct materials per unit

Companion Computer Company has been purchasing carrying cases for its portable computers at a purchase price of $55 per unit. The company, which is currently operating below full capacity, charges factory overhead to production at the rate 46% of direct labor cost. The total unit costs to produce comparable carrying cases are expected to be as follows: Direct materials $26.00 Direct labor 20.00 Factory overhead (46% of direct labor) 9.2 Total cost per unit $55.2 If Companion Computer Company manufactures the carrying cases, fixed factory overhead costs will not increase and variable factory overhead costs associated with the cases are expected to be 12% of the direct labor costs. a. Prepare a differential analysis dated February 24 to determine whether the company should Make Carrying Case (Alternative 1) or Buy Carrying Case (Alternative 2). If required, round your answers to two decimal places. If an amount zero, enter "0". For those boxes in which you must enter subtracted or negative numbers use a minus sign. Differential Analysis Make Carrying Case (Alt. 1) or Buy Carrying Case (Alt. 2) February 24 Differential Effects (Alternative 2) Make Carrying Buy Carrying Case (Alternative 1) Case (Alternative 2) Unit costs: Purchase price Direct materials per unit

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter11: Differential Analysis And Product Pricing

Section: Chapter Questions

Problem 7E: Make-or-buy decision Somerset Computer Company has been purchasing carrying cases for its portable...

Related questions

Question

Could someone show all the steps and help me fill it in

Transcribed Image Text:Make-or-Buy Decision

Companion Computer Company has been purchasing carrying cases for its portable computers at a purchase price of $55 per unit. The company, which is currently operating below full capacity, charges factory overhead to production at the rate of

46% of direct labor cost. The total unit costs to produce comparable carrying cases are expected to be as follows:

Direct materials

$26.00

Direct labor

20.00

Factory overhead (46% of direct labor)

9.2

Total cost per unit

$55,2

If Companion Computer Company manufactures the carrying cases, fixed factory overhead costs will not increase and variable factory overhead costs associated with the cases are expected to be 12% of the direct labor costs.

a. Prepare a differential analysis dated February 24 to determine whether the company should Make Carrying Case (Alternative 1) or Buy Carrying Case (Alternative 2). If required, round your answers to two decimal places. If an amount is

zero, enter "0". For those boxes in which you must enter subtracted or negative numbers use a minus sign.

Differential Analysis

Make Carrying Case (Alt. 1) or Buy Carrying Case (Alt. 2)

February 24

Make Carrying

Case (Alternative 1) Case (Alternative 2)

Buy Carrying

Differential Effects

(Alternative 2)

Unit costs:

Purchase price

Direct materials per unit

Direct labor per unit

Variable factory overhead per unit

Fixed factory overhead per unit

Total unit costs

b. Assuming there were no better alternative uses for the spare capacity, it would

- to manufacture the carrying cases. Fixed factory overhead is

to this decision.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning