ces Required: 1. Do you agree with the intern's decision to use an absorption format for her segmented income statement? 2. Based on a review of the intern's segmented income statement. a. How much of the company's common fixed expenses did she allocate to the Commercial and Residential segments? b. Which of the following three allocation bases did she most likely used to allocate common fixed expenses to the Commercial ar Residential segments: (a) sales, (b) cost of goods sold, or (c) gross margin? 3. Do you agree with the intern's decision to allocate the common fixed expenses to the Commercial and Residential segments? 4. Redo the intern's segmented income statement using the contribution format. 5. Compute the companywide break-even point in dollar sales. 6. Compute the break-even point in dollar sales for the Commercial Division and for the Residential Division. 7. Assume the company decided to pay its sales representatives in the Commercial and Residential Divisions a total monthly salar $16,000 and $32,000, respectively, and to lower its companywide sales commission percentage from 10% to 5%. Calculate the ne break-even point in dollar sales for the Commercial Division and the Residential Division. Complete this question by entering your answers in the tabs below. Req 1 Req 2A Req 2B Req 3 < Req 4 Req 1 Req 5 Do you agree with the intern's decision to use an absorption format for her segmented income statement? Yes No Req 6 Req 2A > Req 7

ces Required: 1. Do you agree with the intern's decision to use an absorption format for her segmented income statement? 2. Based on a review of the intern's segmented income statement. a. How much of the company's common fixed expenses did she allocate to the Commercial and Residential segments? b. Which of the following three allocation bases did she most likely used to allocate common fixed expenses to the Commercial ar Residential segments: (a) sales, (b) cost of goods sold, or (c) gross margin? 3. Do you agree with the intern's decision to allocate the common fixed expenses to the Commercial and Residential segments? 4. Redo the intern's segmented income statement using the contribution format. 5. Compute the companywide break-even point in dollar sales. 6. Compute the break-even point in dollar sales for the Commercial Division and for the Residential Division. 7. Assume the company decided to pay its sales representatives in the Commercial and Residential Divisions a total monthly salar $16,000 and $32,000, respectively, and to lower its companywide sales commission percentage from 10% to 5%. Calculate the ne break-even point in dollar sales for the Commercial Division and the Residential Division. Complete this question by entering your answers in the tabs below. Req 1 Req 2A Req 2B Req 3 < Req 4 Req 1 Req 5 Do you agree with the intern's decision to use an absorption format for her segmented income statement? Yes No Req 6 Req 2A > Req 7

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter4: Activity-based Costing

Section: Chapter Questions

Problem 18E

Related questions

Question

Transcribed Image Text:ces

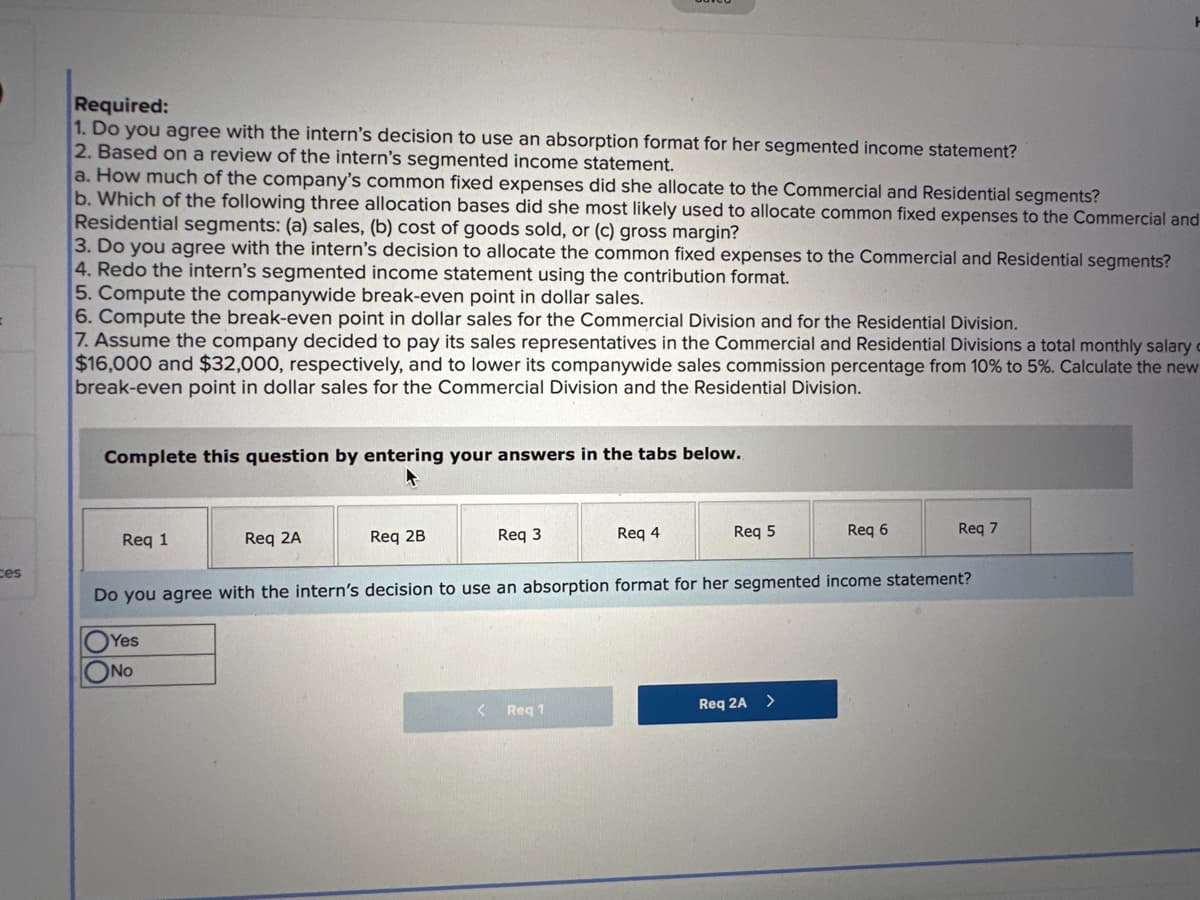

Required:

1. Do you agree with the intern's decision to use an absorption format for her segmented income statement?

2. Based on a review of the intern's segmented income statement.

a. How much of the company's common fixed expenses did she allocate to the Commercial and Residential segments?

b. Which of the following three allocation bases did she most likely used to allocate common fixed expenses to the Commercial and

Residential segments: (a) sales, (b) cost of goods sold, or (c) gross margin?

3. Do you agree with the intern's decision to allocate the common fixed expenses to the Commercial and Residential segments?

4. Redo the intern's segmented income statement using the contribution format.

5. Compute the companywide break-even point in dollar sales.

6. Compute the break-even point in dollar sales for the Commercial Division and for the Residential Division.

7. Assume the company decided to pay its sales representatives in the Commercial and Residential Divisions a total monthly salary c

$16,000 and $32,000, respectively, and to lower its companywide sales commission percentage from 10% to 5%. Calculate the new

break-even point in dollar sales for the Commercial Division and the Residential Division.

Complete this question by entering your answers in the tabs below.

Req 1

Req 2A

Req 2B

Req 3

<

Req 4

Req 1

Req 5

Do you agree with the intern's decision to use an absorption format for her segmented income statement?

Yes

No

Req 2A

Req 6

>

Req 7

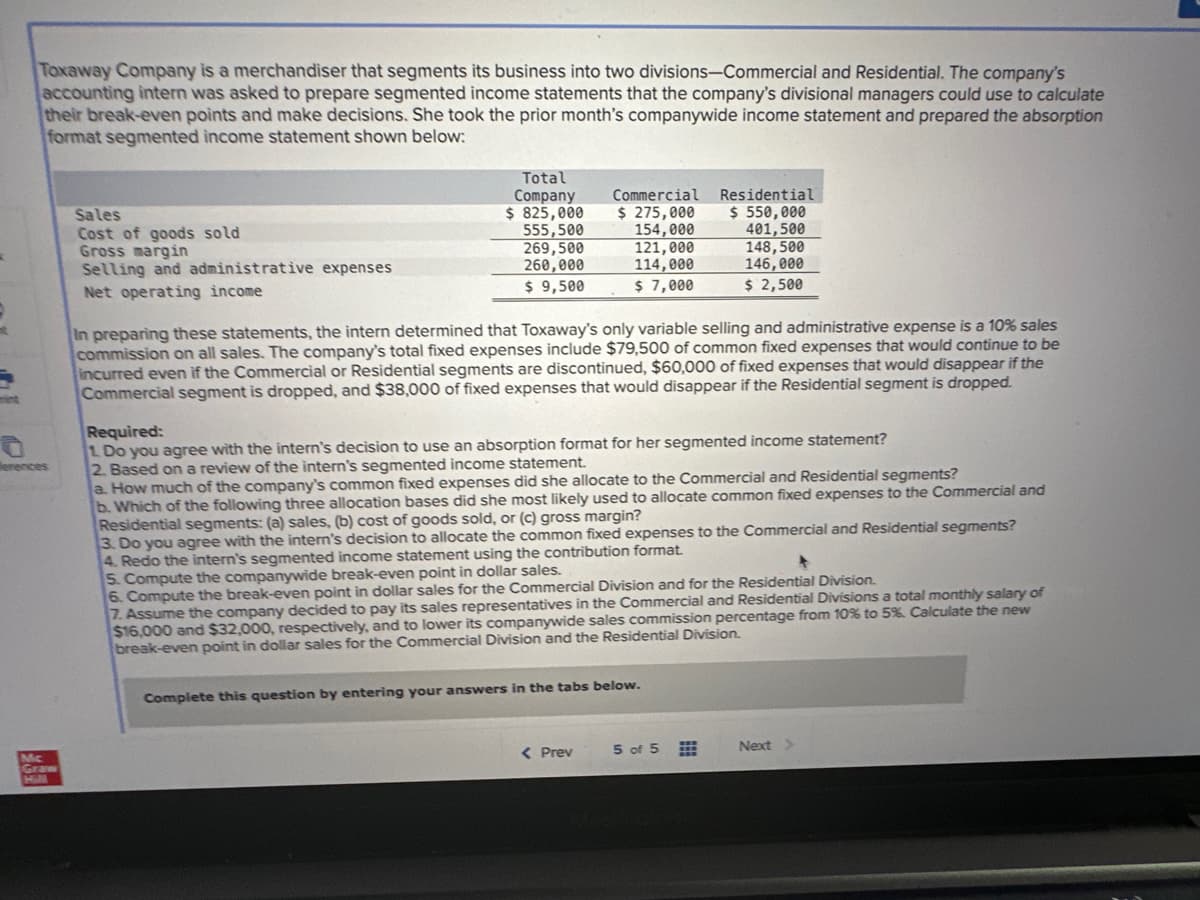

Transcribed Image Text:Toxaway Company is a merchandiser that segments its business into two divisions-Commercial and Residential. The company's

accounting intern was asked to prepare segmented income statements that the company's divisional managers could use to calculate

their break-even points and make decisions. She took the prior month's companywide income statement and prepared the absorption

format segmented income statement shown below:

erences

Mc.

Graw

H&M

Sales

Cost of goods sold

Gross margin

Selling and administrative expenses

Net operating income

Total

Company

$ 825,000

555,500

269,500

260,000

$9,500

Commercial Residential

$ 275,000

$ 550,000

154,000

401,500

121,000

148,500

114,000

146,000

$ 7,000

$ 2,500

In preparing these statements, the intern determined that Toxaway's only variable selling and administrative expense is a 10% sales

commission on all sales. The company's total fixed expenses include $79,500 of common fixed expenses that would continue to be

incurred even if the Commercial or Residential segments are discontinued, $60,000 of fixed expenses that would disappear if the

Commercial segment is dropped, and $38,000 of fixed expenses that would disappear if the Residential segment is dropped.

Required:

1. Do you agree with the intern's decision to use an absorption format for her segmented income statement?

2. Based on a review of the intern's segmented income statement.

a. How much of the company's common fixed expenses did she allocate to the Commercial and Residential segments?

b. Which of the following three allocation bases did she most likely used to allocate common fixed expenses to the Commercial and

Residential segments: (a) sales, (b) cost of goods sold, or (c) gross margin?

3. Do you agree with the intern's decision to allocate the common fixed expenses to the Commercial and Residential segments?

4. Redo the intern's segmented income statement using the contribution format.

5. Compute the companywide break-even point in dollar sales.

6. Compute the break-even point in dollar sales for the Commercial Division and for the Residential Division.

7. Assume the company decided to pay its sales representatives in the Commercial and Residential Divisions a total monthly salary of

$16,000 and $32,000, respectively, and to lower its companywide sales commission percentage from 10% to 5% Calculate the new

break-even point in dollar sales for the Commercial Division and the Residential Division.

Complete this question by entering your answers in the tabs below.

< Prev

5 of 5

Next

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning