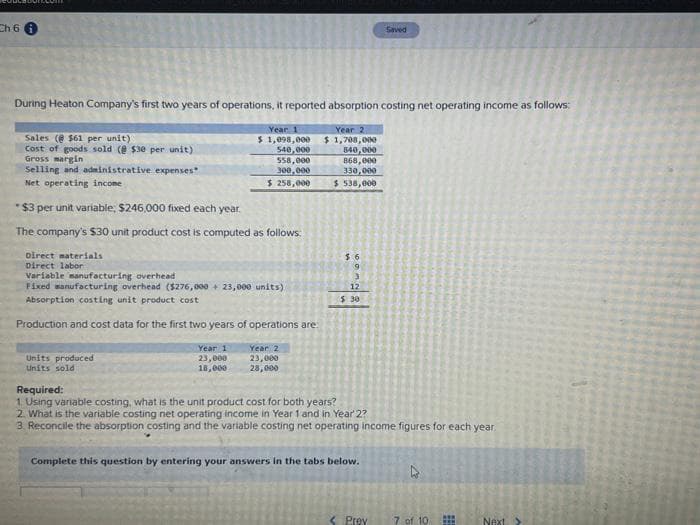

Ch 6 During Heaton Company's first two years of operations, it reported absorption costing net operating income as follows: Year 1 Year 2 $1,708,000 $ 1,098,000 540,000 558,000 300,000 $ 258,000 Sales ($61 per unit) Cost of goods sold (@ $30 per unit) Gross margin Selling and administrative expenses Net operating income *$3 per unit variable, $246,000 fixed each year. The company's $30 unit product cost is computed as follows: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead ($276,000+ 23,000 units) Absorption costing unit product cost Production and cost data for the first two years of operations are: Year 1 23,000 18,000 Units produced Units sold Year 2 23,000 28,000 840,000 868,000 330,000 $538,000 5.6 3 12 $:30 Saved Required: 1. Using variable costing, what is the unit product cost for both years? 2. What is the variable costing net operating income in Year 1 and in Year 2? 3. Reconcile the absorption costing and the variable costing net operating income figures for each year. Complete this question by entering your answers in the tabs below. < Prey www 7 of 10 $19 Next >

Ch 6 During Heaton Company's first two years of operations, it reported absorption costing net operating income as follows: Year 1 Year 2 $1,708,000 $ 1,098,000 540,000 558,000 300,000 $ 258,000 Sales ($61 per unit) Cost of goods sold (@ $30 per unit) Gross margin Selling and administrative expenses Net operating income *$3 per unit variable, $246,000 fixed each year. The company's $30 unit product cost is computed as follows: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead ($276,000+ 23,000 units) Absorption costing unit product cost Production and cost data for the first two years of operations are: Year 1 23,000 18,000 Units produced Units sold Year 2 23,000 28,000 840,000 868,000 330,000 $538,000 5.6 3 12 $:30 Saved Required: 1. Using variable costing, what is the unit product cost for both years? 2. What is the variable costing net operating income in Year 1 and in Year 2? 3. Reconcile the absorption costing and the variable costing net operating income figures for each year. Complete this question by entering your answers in the tabs below. < Prey www 7 of 10 $19 Next >

Financial & Managerial Accounting

14th Edition

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter20: Variable Costing For Management Analysis

Section: Chapter Questions

Problem 20.4BPR: Salespersons' report and analysis Pachec Inc. employs seven salespersons to sell and distribute its...

Related questions

Question

Please help me with all answers thanku

Transcribed Image Text:Ch 6

During Heaton Company's first two years of operations, it reported absorption costing net operating income as follows:

Year 1

Year 2

$1,708,000

$ 1,098,000

540,000

558,000

300,000

$ 258,000

Sales ($61 per unit)

Cost of goods sold (@ $30 per unit)

Gross margin

Selling and administrative expenses

Net operating income

*$3 per unit variable, $246,000 fixed each year.

The company's $30 unit product cost is computed as follows:

Direct materials

Direct labor

Variable manufacturing overhead

Fixed manufacturing overhead ($276,000+ 23,000 units)

Absorption costing unit product cost

Production and cost data for the first two years of operations are:

Year 1

23,000

18,000

Units produced

Units sold

Year 2

23,000

28,000

840,000

868,000

330,000

$538,000

5.6

3

12

$:30

Saved

Required:

1. Using variable costing, what is the unit product cost for both years?

2. What is the variable costing net operating income in Year 1 and in Year 2?

3. Reconcile the absorption costing and the variable costing net operating income figures for each year.

Complete this question by entering your answers in the tabs below.

Prey

20

7 of 10

www

III

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning