Igeland Company completed the "anuary 15 Purchased and paid for merchandise. The invoice amount was $15,000; assume a perpetual inventory system. pril 1 Borrowed $734,000 from Summit Bank for general use; signed a 10-month, 7 annual interest-bearing note for the money. "une 14 Received a $35,000 customer deposit for services to be performed in the future. Performed $4,050 of the services paid for on June 14. July 15 December 12 Received electric bill for $26,260. Vigeland plans to pay the bill in early January. December 31 Determined wages of $26,000 were earned but not yet paid on December 31 (disregard payroll taxes). equired: Prepare journal entries for each of these transactions. Prepare the adjusting entries required on December 31. ng transactions ing year 1. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare journal entries for each of these transactions. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Adjusting entries will be recorded in Part 2. View transaction list Journal entry worksheet < 1 2 3 4 5 Note: Enter debits before credits. Record the $15,000 purchase of merchandise assuming a perpetual inventory system. Date January 15 ind's fiscal year ends on December 31. General Journal Debit Credit

Igeland Company completed the "anuary 15 Purchased and paid for merchandise. The invoice amount was $15,000; assume a perpetual inventory system. pril 1 Borrowed $734,000 from Summit Bank for general use; signed a 10-month, 7 annual interest-bearing note for the money. "une 14 Received a $35,000 customer deposit for services to be performed in the future. Performed $4,050 of the services paid for on June 14. July 15 December 12 Received electric bill for $26,260. Vigeland plans to pay the bill in early January. December 31 Determined wages of $26,000 were earned but not yet paid on December 31 (disregard payroll taxes). equired: Prepare journal entries for each of these transactions. Prepare the adjusting entries required on December 31. ng transactions ing year 1. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare journal entries for each of these transactions. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Adjusting entries will be recorded in Part 2. View transaction list Journal entry worksheet < 1 2 3 4 5 Note: Enter debits before credits. Record the $15,000 purchase of merchandise assuming a perpetual inventory system. Date January 15 ind's fiscal year ends on December 31. General Journal Debit Credit

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 24E: Spath Company borrows 75,000 by issuing a 4-year, noninterest-bearing note to a customer on January...

Related questions

Question

Qw.120.

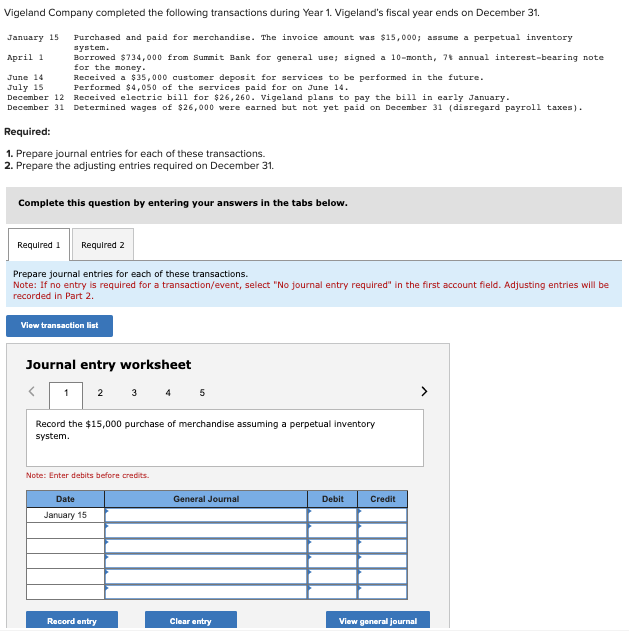

Transcribed Image Text:Vigeland Company completed the following transactions during Year 1. Vigeland's fiscal year ends on December 31.

January 15

Purchased and paid for merchandise. The invoice amount was $15,000; assume a perpetual inventory

system.

April 1

Borrowed $734,000 from Summit Bank for general use; signed a 10-month, 7 annual interest-bearing note

for the money.

June 14

July 15

Received a $35,000 customer deposit for services to be performed in the future.

Performed $4,050 of the services paid for on June 14.

December 12

Received electric bill for $26,260. Vigeland plans to pay the bill in early January.

December 31 Determined wages of $26,000 were earned but not yet paid on December 31 (disregard payroll taxes).

Required:

1. Prepare journal entries for each of these transactions.

2. Prepare the adjusting entries required on December 31.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Prepare journal entries for each of these transactions.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Adjusting entries will be

recorded in Part 2.

View transaction list

Journal entry worksheet

1 2

3 4 5

Record the $15,000 purchase of merchandise assuming a perpetual inventory

system.

Note: Enter debits before credits.

Date

January 15

Record entry

General Journal

Clear entry

Debit

Credit

View general journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage