Charleston Company produces a headset for kids. The following unit cost information is available: Selling price per game Variable costs per game $ 30.00 $ 18.00 90,000 units $360,000 Current annual sales Current fixed costs The sales manager proposes that for next year, Charleston should reduce the selling price by 5%, increase the quality of direct materials, and increase advertising spending to drastically increase unit sales. The manager expects the following : Proposed new price $28.50 Required increase in advertising spending New Variable costs per game 24 20,000 2$ 20.00 Increase in unit sales 40% 12 How will net income be impacted? A. Net income will increase by 2$ $ 20,000 2$ $ 29,000 9,000 B. Net income will decrease by C. Net income will increase by 11,000 D. Net income will decrease by E. None of the Above LO26 13

Charleston Company produces a headset for kids. The following unit cost information is available: Selling price per game Variable costs per game $ 30.00 $ 18.00 90,000 units $360,000 Current annual sales Current fixed costs The sales manager proposes that for next year, Charleston should reduce the selling price by 5%, increase the quality of direct materials, and increase advertising spending to drastically increase unit sales. The manager expects the following : Proposed new price $28.50 Required increase in advertising spending New Variable costs per game 24 20,000 2$ 20.00 Increase in unit sales 40% 12 How will net income be impacted? A. Net income will increase by 2$ $ 20,000 2$ $ 29,000 9,000 B. Net income will decrease by C. Net income will increase by 11,000 D. Net income will decrease by E. None of the Above LO26 13

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter11: Differential Analysis And Product Pricing

Section: Chapter Questions

Problem 2CMA

Related questions

Question

Please I want to learn how to make these problems with a good explanation. One of those there is the possible answer.

I need only question 12

Thank you

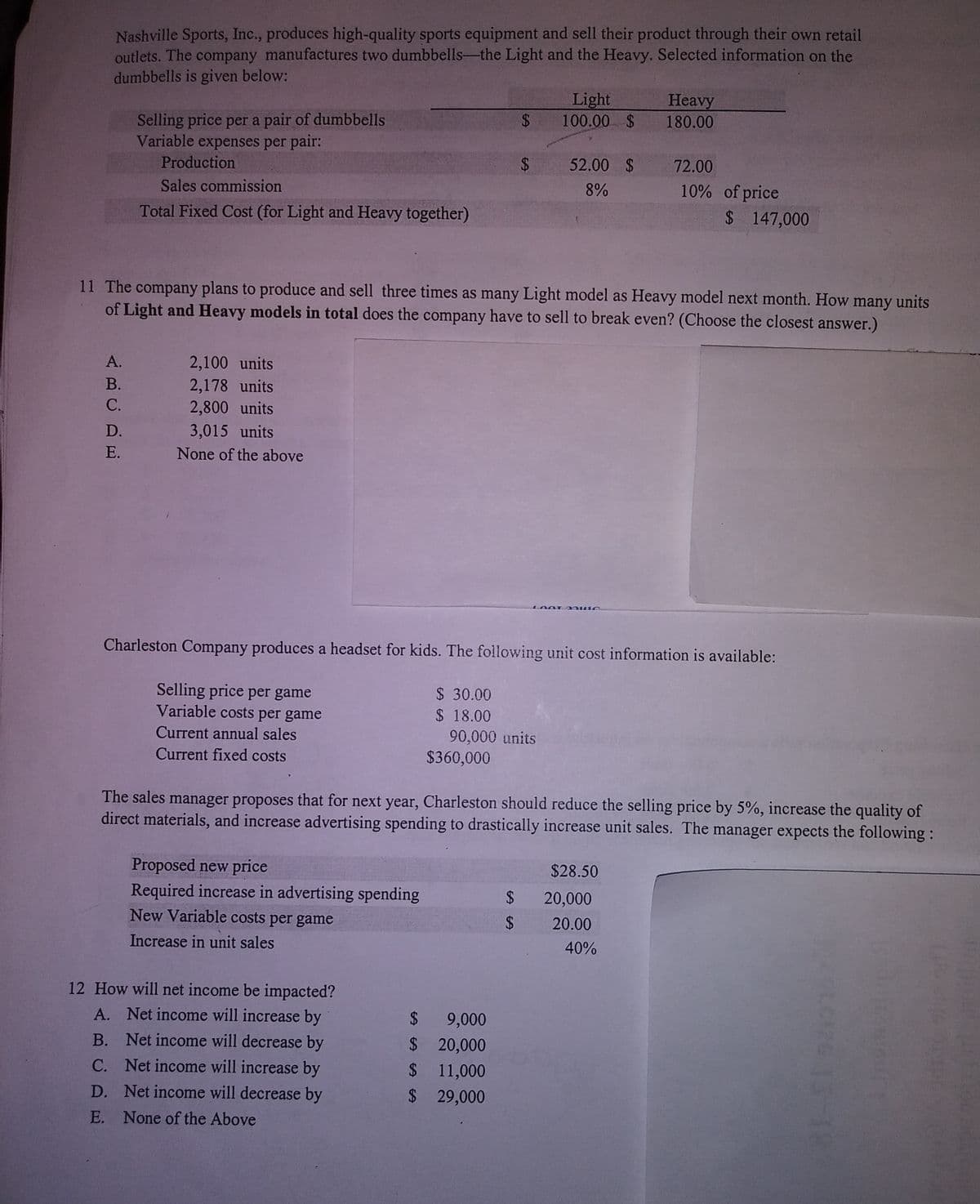

Transcribed Image Text:Nashville Sports, Inc., produces high-quality sports equipment and sell their product through their own retail

outlets. The company manufactures two dumbbells-the Light and the Heavy. Selected information on the

dumbbells is given below:

Light

Heavy

180.00

Selling price per a pair of dumbbells

Variable expenses per pair:

%24

100.00 $

Production

52.00 $

72.00

Sales commission

8%

10% of price

Total Fixed Cost (for Light and Heavy together)

$ 147,000

11 The company plans to produce and sell three times as many Light model as Heavy model next month. How

units

many

of Light and Heavy models in total does the company have to sell to break even? (Choose the closest answer.)

А.

2,100 units

2,178 units

2,800 units

В.

С.

D.

3,015 units

E.

None of the above

Charleston Company produces a headset for kids. The following unit cost information is available:

Selling price per game

Variable costs per game

$ 30.00

$ 18.00

90,000 units

$360,000

Current annual sales

Current fixed costs

The sales manager proposes that for next year, Charleston should reduce the selling price by 5%, increase the quality of

direct materials, and increase advertising spending to drastically increase unit sales. The manager expects the following:

Proposed new price

$28.50

Required increase in advertising spending

New Variable costs per game

2$

20,000

2$

20.00

Increase in unit sales

40%

12 How will net income be impacted?

A. Net income will increase by

%24

9,000

$ 20,000

B. Net income will decrease by

C. Net income will increase by

$ 11,000

$ 29,000

D. Net income will decrease by

E. None of the Above

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub