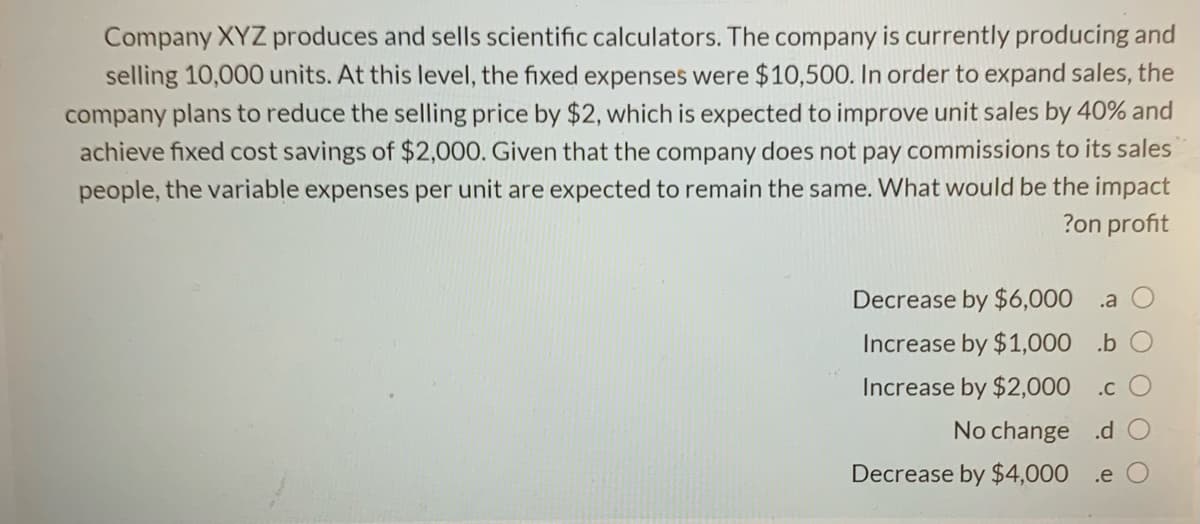

Company XYZ produces and sells scientific calculators. The company is currently producing and selling 10,000 units. At this level, the fixed expenses were $10,500. In order to expand sales, the company plans to reduce the selling price by $2, which is expected to improve unit sales by 40% and achieve fixed cost savings of $2,000. Given that the company does not pay commissions to its sales people, the variable expenses per unit are expected to remain the same. What would be the impact ?on profit Decrease by $6,000 .a Increase by $1,000 .b Increase by $2,000 .C No change .d Decrease by $4,000 .e

Company XYZ produces and sells scientific calculators. The company is currently producing and selling 10,000 units. At this level, the fixed expenses were $10,500. In order to expand sales, the company plans to reduce the selling price by $2, which is expected to improve unit sales by 40% and achieve fixed cost savings of $2,000. Given that the company does not pay commissions to its sales people, the variable expenses per unit are expected to remain the same. What would be the impact ?on profit Decrease by $6,000 .a Increase by $1,000 .b Increase by $2,000 .C No change .d Decrease by $4,000 .e

Chapter10: Short-term Decision Making

Section: Chapter Questions

Problem 6MC: Jansen Crafters has the capacity to produce 50,000 oak shelves per year and is currently selling...

Related questions

Question

Answer this question???

Transcribed Image Text:Company XYZ produces and sells scientific calculators. The company is currently producing and

selling 10,000 units. At this level, the fixed expenses were $10,500. In order to expand sales, the

company plans to reduce the selling price by $2, which is expected to improve unit sales by 40% and

achieve fixed cost savings of $2,000. Given that the company does not pay commissions to its sales

people, the variable expenses per unit are expected to remain the same. What would be the impact

?on profit

Decrease by $6,000 .a

Increase by $1,000 .b O

Increase by $2,000 .c

No change .d

Decrease by $4,000 .e

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT