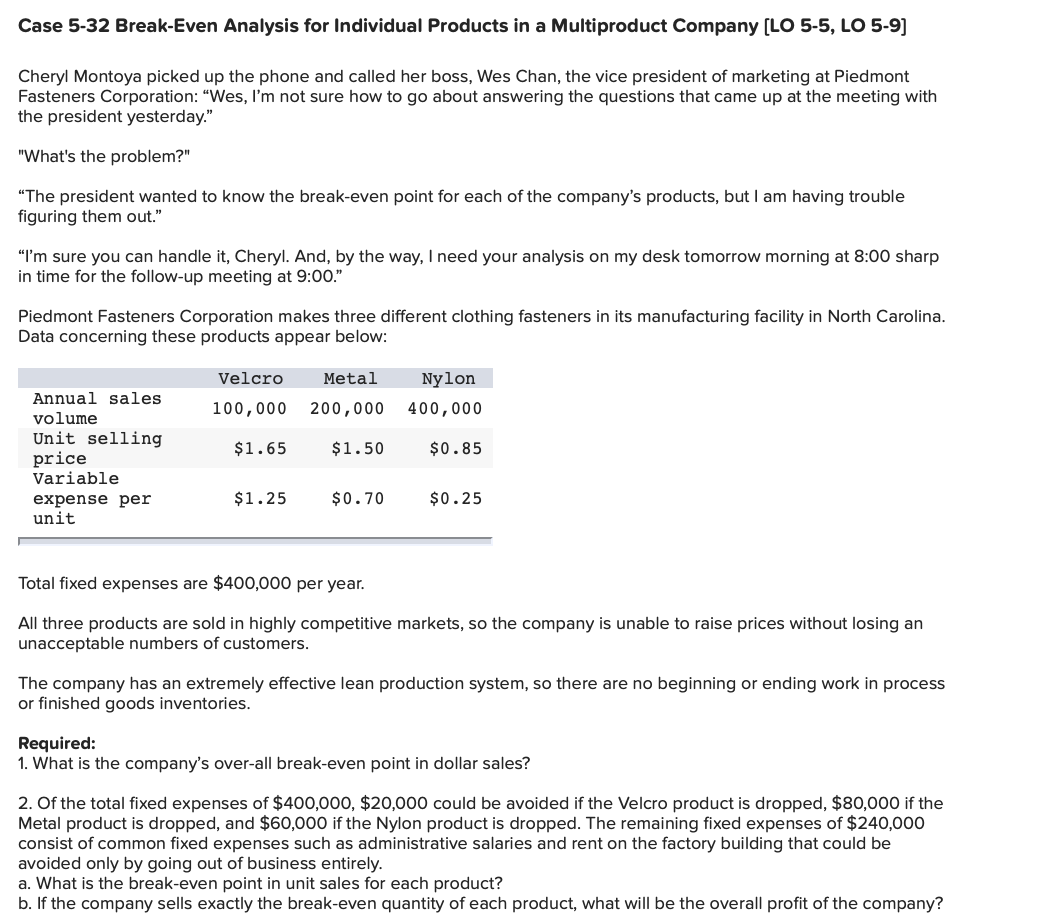

Cheryl Montoya picked up the phone and called her boss, Wes Chan, the vice president of marketing at Piedmont Fasteners Corporation: "Wes, l'm not sure how to go about answering the questions that came up at the meeting with the president yesterday." "What's the problem?" “The president wanted to know the break-even point for each of the company's products, but I am having trouble figuring them out." “I'm sure you can handle it, Cheryl. And, by the way, I need your analysis on my desk tomorrow morning at 8:00 sharp in time for the follow-up meeting at 9:00." Piedmont Fasteners Corporation makes three different clothing fasteners in its manufacturing facility in North Carolina. Data concerning these products appear below: Velcro Metal Nylon Annual sales 100,000 200,000 400,000 volume Unit selling price Variable $1.65 $1.50 $0.85 $1.25 $0.70 $0.25 expense per unit Total fixed expenses are $400,000 per year. All three products are sold in highly competitive markets, so the company is unable to raise prices without losing an unacceptable numbers of customers. The company has an extremely effective lean production system, so there are no beginning or ending work in process or finished goods inventories. Required: 1. What is the company's over-all break-even point in dollar sales? 2. Of the total fixed expenses of $400,000, $20,000 could be avoided if the Velcro product is dropped, $80,000 if the Metal product is dropped, and $60,000 if the Nylon product is dropped. The remaining fixed expenses of $240,000 consist of common fixed expenses such as administrative salaries and rent on the factory building that could be avoided only by going out of business entirely. a. What is the break-even point in unit sales for each product? b. If the company sells exactly the break-even quantity of each product, what will be the overall profit of the company?

Cheryl Montoya picked up the phone and called her boss, Wes Chan, the vice president of marketing at Piedmont Fasteners Corporation: "Wes, l'm not sure how to go about answering the questions that came up at the meeting with the president yesterday." "What's the problem?" “The president wanted to know the break-even point for each of the company's products, but I am having trouble figuring them out." “I'm sure you can handle it, Cheryl. And, by the way, I need your analysis on my desk tomorrow morning at 8:00 sharp in time for the follow-up meeting at 9:00." Piedmont Fasteners Corporation makes three different clothing fasteners in its manufacturing facility in North Carolina. Data concerning these products appear below: Velcro Metal Nylon Annual sales 100,000 200,000 400,000 volume Unit selling price Variable $1.65 $1.50 $0.85 $1.25 $0.70 $0.25 expense per unit Total fixed expenses are $400,000 per year. All three products are sold in highly competitive markets, so the company is unable to raise prices without losing an unacceptable numbers of customers. The company has an extremely effective lean production system, so there are no beginning or ending work in process or finished goods inventories. Required: 1. What is the company's over-all break-even point in dollar sales? 2. Of the total fixed expenses of $400,000, $20,000 could be avoided if the Velcro product is dropped, $80,000 if the Metal product is dropped, and $60,000 if the Nylon product is dropped. The remaining fixed expenses of $240,000 consist of common fixed expenses such as administrative salaries and rent on the factory building that could be avoided only by going out of business entirely. a. What is the break-even point in unit sales for each product? b. If the company sells exactly the break-even quantity of each product, what will be the overall profit of the company?

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter10: Standard Costing And Variance Analysis

Section: Chapter Questions

Problem 51E: Jackie Iverson was furious. She was about ready to fire Tom Rich, her purchasing agent. Just a month...

Related questions

Question

Transcribed Image Text:Cheryl Montoya picked up the phone and called her boss, Wes Chan, the vice president of marketing at Piedmont

Fasteners Corporation: "Wes, l'm not sure how to go about answering the questions that came up at the meeting with

the president yesterday."

"What's the problem?"

“The president wanted to know the break-even point for each of the company's products, but I am having trouble

figuring them out."

“I'm sure you can handle it, Cheryl. And, by the way, I need your analysis on my desk tomorrow morning at 8:00 sharp

in time for the follow-up meeting at 9:00."

Piedmont Fasteners Corporation makes three different clothing fasteners in its manufacturing facility in North Carolina.

Data concerning these products appear below:

Velcro

Metal

Nylon

Annual sales

100,000

200,000

400,000

volume

Unit selling

price

Variable

$1.65

$1.50

$0.85

$1.25

$0.70

$0.25

expense per

unit

Total fixed expenses are $400,000 per year.

All three products are sold in highly competitive markets, so the company is unable to raise prices without losing an

unacceptable numbers of customers.

The company has an extremely effective lean production system, so there are no beginning or ending work in process

or finished goods inventories.

Required:

1. What is the company's over-all break-even point in dollar sales?

2. Of the total fixed expenses of $400,000, $20,000 could be avoided if the Velcro product is dropped, $80,000 if the

Metal product is dropped, and $60,000 if the Nylon product is dropped. The remaining fixed expenses of $240,000

consist of common fixed expenses such as administrative salaries and rent on the factory building that could be

avoided only by going out of business entirely.

a. What is the break-even point in unit sales for each product?

b. If the company sells exactly the break-even quantity of each product, what will be the overall profit of the company?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Business Its Legal Ethical & Global Environment

Accounting

ISBN:

9781305224414

Author:

JENNINGS

Publisher:

Cengage

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Business Its Legal Ethical & Global Environment

Accounting

ISBN:

9781305224414

Author:

JENNINGS

Publisher:

Cengage

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning