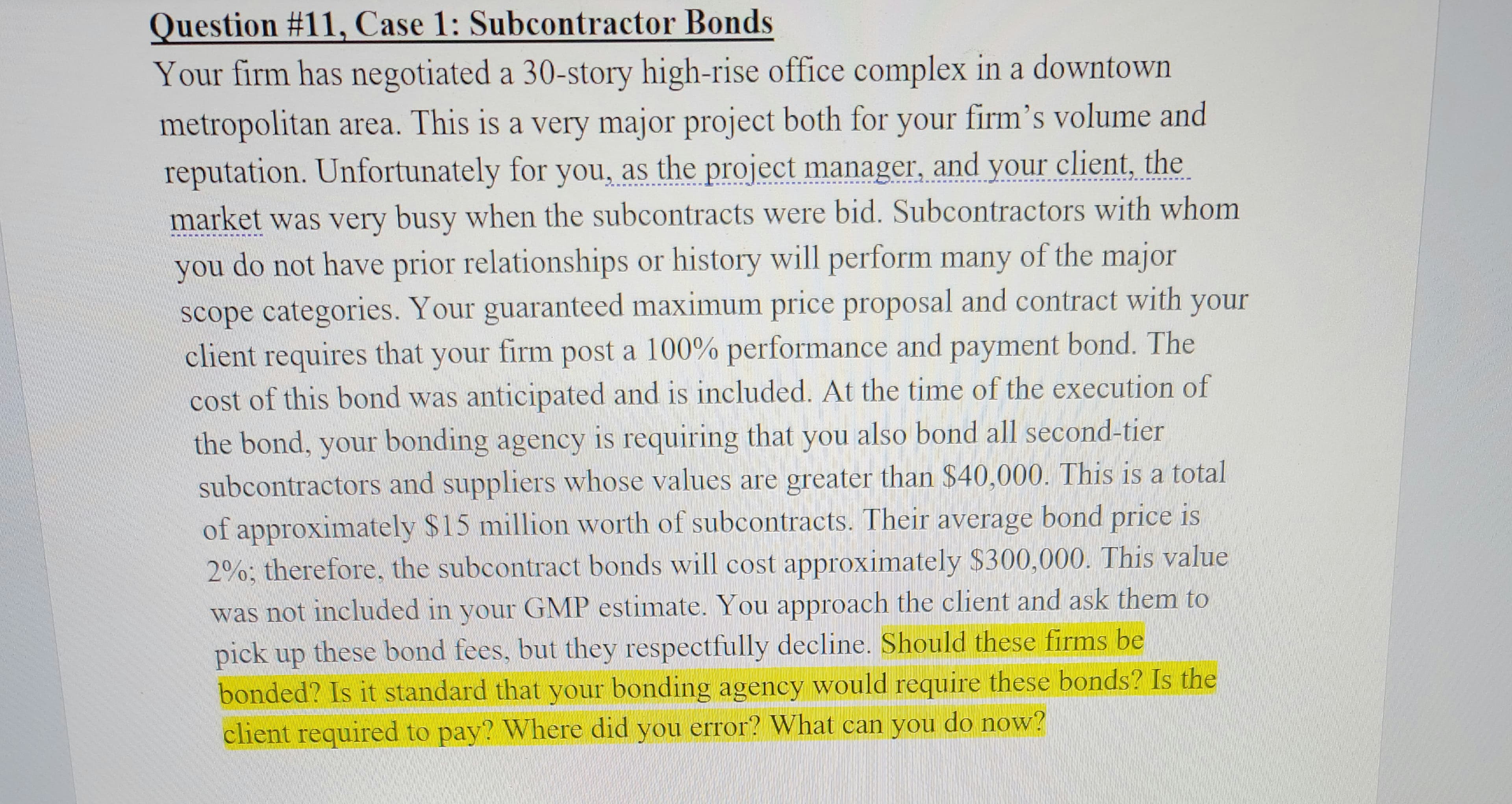

Question #11, Case 1: Subcontractor Bonds Your firm has negotiated a 30-story high-rise office complex in a downtown metropolitan area. This is a very major project both for your firm's volume and reputation. Unfortunately for you, as the project manager, and your client, the market was very busy when the subcontracts were bid. Subcontractors with whom you do not have prior relationships or history will perform many of the major scope categories. Your guaranteed maximum price proposal and contract with your client requires that your firm post a 100% performance and payment bond. The cost of this bond was anticipated and is included. At the time of the execution of the bond, your bonding agency is requiring that you also bond all second-tier subcontractors and suppliers whose values are greater than $40,000. This is a total of approximately $15 million worth of subcontracts. Their average bond price is 2%; therefore, the subcontract bonds will cost approximately $300,000. This value was not included in your GMP estimate. You approach the client and ask them to pick up these bond fees, but they respectfully decline. Should these firms be bonded? Is it standard that your bonding agency would require these bonds? Is the client required to pay? Where did you error? What can you do now?

Question #11, Case 1: Subcontractor Bonds Your firm has negotiated a 30-story high-rise office complex in a downtown metropolitan area. This is a very major project both for your firm's volume and reputation. Unfortunately for you, as the project manager, and your client, the market was very busy when the subcontracts were bid. Subcontractors with whom you do not have prior relationships or history will perform many of the major scope categories. Your guaranteed maximum price proposal and contract with your client requires that your firm post a 100% performance and payment bond. The cost of this bond was anticipated and is included. At the time of the execution of the bond, your bonding agency is requiring that you also bond all second-tier subcontractors and suppliers whose values are greater than $40,000. This is a total of approximately $15 million worth of subcontracts. Their average bond price is 2%; therefore, the subcontract bonds will cost approximately $300,000. This value was not included in your GMP estimate. You approach the client and ask them to pick up these bond fees, but they respectfully decline. Should these firms be bonded? Is it standard that your bonding agency would require these bonds? Is the client required to pay? Where did you error? What can you do now?

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter2: Introduction To Spreadsheet Modeling

Section: Chapter Questions

Problem 20P: Julie James is opening a lemonade stand. She believes the fixed cost per week of running the stand...

Related questions

Question

Transcribed Image Text:Question #11, Case 1: Subcontractor Bonds

Your firm has negotiated a 30-story high-rise office complex in a downtown

metropolitan area. This is a very major project both for your firm's volume and

reputation. Unfortunately for you, as the project manager, and your client, the

market was very busy when the subcontracts were bid. Subcontractors with whom

you do not have prior relationships or history will perform many of the major

scope categories. Your guaranteed maximum price proposal and contract with your

client requires that your firm post a 100% performance and payment bond. The

cost of this bond was anticipated and is included. At the time of the execution of

the bond, your bonding agency is requiring that you also bond all second-tier

subcontractors and suppliers whose values are greater than $40,000. This is a total

of approximately $15 million worth of subcontracts. Their average bond price is

2%; therefore, the subcontract bonds will cost approximately $300,000. This value

was not included in your GMP estimate. You approach the client and ask them to

pick up these bond fees, but they respectfully decline. Should these firms be

bonded? Is it standard that your bonding agency would require these bonds? Is the

client required to pay? Where did you error? What can you do now?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Operations Management

Operations Management

ISBN:

9781259667473

Author:

William J Stevenson

Publisher:

McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi…

Operations Management

ISBN:

9781259666100

Author:

F. Robert Jacobs, Richard B Chase

Publisher:

McGraw-Hill Education

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Operations Management

Operations Management

ISBN:

9781259667473

Author:

William J Stevenson

Publisher:

McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi…

Operations Management

ISBN:

9781259666100

Author:

F. Robert Jacobs, Richard B Chase

Publisher:

McGraw-Hill Education

Purchasing and Supply Chain Management

Operations Management

ISBN:

9781285869681

Author:

Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:

Cengage Learning

Production and Operations Analysis, Seventh Editi…

Operations Management

ISBN:

9781478623069

Author:

Steven Nahmias, Tava Lennon Olsen

Publisher:

Waveland Press, Inc.