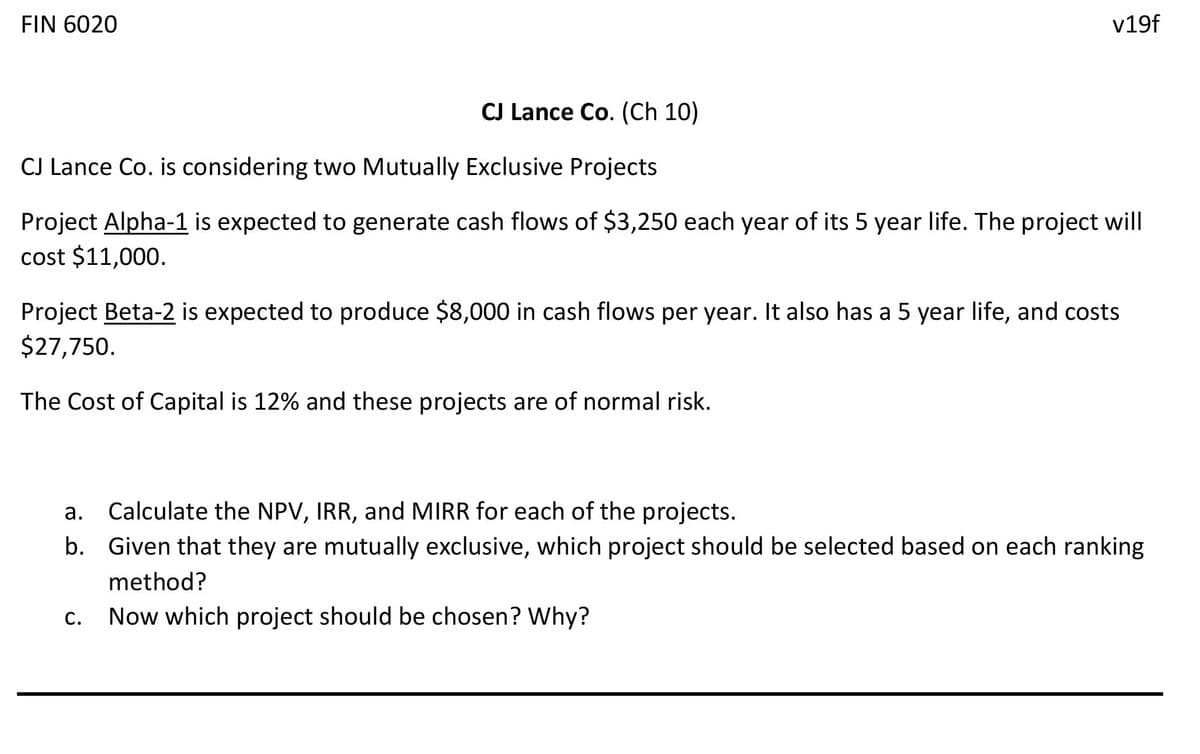

CJ Lance Co. is considering two Mutually Exclusive Projects Project Alpha-1 is expected to generate cash flows of $3,250 each year of its 5 year life. The project will cost $11,000. Project Beta-2 is expected to produce $8,000 in cash flows per year. It also has a 5 year life, and costs $27,750. The Cost of Capital is 12% and these projects are of normal risk. Calculate the NPV, IRR, and MIRR for each of the projects. b. Given that they are mutually exclusive, which project should be selected based on each ranking а. method? с. Now which project should be chosen? Why?

CJ Lance Co. is considering two Mutually Exclusive Projects Project Alpha-1 is expected to generate cash flows of $3,250 each year of its 5 year life. The project will cost $11,000. Project Beta-2 is expected to produce $8,000 in cash flows per year. It also has a 5 year life, and costs $27,750. The Cost of Capital is 12% and these projects are of normal risk. Calculate the NPV, IRR, and MIRR for each of the projects. b. Given that they are mutually exclusive, which project should be selected based on each ranking а. method? с. Now which project should be chosen? Why?

Chapter9: Capital Budgeting Techniques

Section: Chapter Questions

Problem 7PROB

Related questions

Question

Transcribed Image Text:FIN 6020

v19f

CJ Lance Co. (Ch 10)

CJ Lance Co. is considering two Mutually Exclusive Projects

Project Alpha-1 is expected to generate cash flows of $3,250 each year of its 5 year life. The project will

cost $11,000.

Project Beta-2 is expected to produce $8,000 in cash flows per year. It also has a 5 year life, and costs

$27,750.

The Cost of Capital is 12% and these projects are of normal risk.

a. Calculate the NPV, IRR, and MIRR for each of the projects.

а.

b. Given that they are mutually exclusive, which project should be selected based on each ranking

method?

С.

Now which project should be chosen? Why?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning