Phoenix Company is considering investments in projects C1 and C2. Both require an initial investment of $270,000 and would yield the following annual net cash flows. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) Net cash flows Project C1 Project C2 Year 1 $ 26,000 $ 110,000 Year 2 122,000 110,000 Year 3 182,000 110,000 Totals $ 330,000 $ 330,000 a. The company requires a 10% return from its investments. Compute net present values using factors from Table B.1 in Appendix B to determine which projects, if any, should be accepted. b. Using the answer from part a, is the internal rate of return higher or lower than 10% for (i) Project C1 and (ii) Project C2? Hint: It is not necessary to compute IRR to answer this question.

Phoenix Company is considering investments in projects C1 and C2. Both require an initial investment of $270,000 and would yield the following annual net cash flows. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) Net cash flows Project C1 Project C2 Year 1 $ 26,000 $ 110,000 Year 2 122,000 110,000 Year 3 182,000 110,000 Totals $ 330,000 $ 330,000 a. The company requires a 10% return from its investments. Compute net present values using factors from Table B.1 in Appendix B to determine which projects, if any, should be accepted. b. Using the answer from part a, is the internal rate of return higher or lower than 10% for (i) Project C1 and (ii) Project C2? Hint: It is not necessary to compute IRR to answer this question.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter19: Capital Investment

Section: Chapter Questions

Problem 12E: Refer to Exercise 19.11. 1. Compute the payback period for each project. Assume that the manager of...

Related questions

Question

Phoenix Company is considering investments in projects C1 and C2. Both require an initial investment of $270,000 and would yield the following annual net cash flows. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.)

| Net cash flows | Project C1 | Project C2 |

|---|---|---|

| Year 1 | $ 26,000 | $ 110,000 |

| Year 2 | 122,000 | 110,000 |

| Year 3 | 182,000 | 110,000 |

| Totals | $ 330,000 | $ 330,000 |

a. The company requires a 10% return from its investments. Compute

b. Using the answer from part a, is the

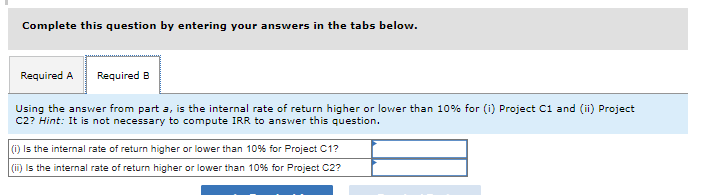

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Required A Required B

Using the answer from part a, is the internal rate of return higher or lower than 10% for (i) Project C1 and (ii) Project

C2? Hint: It is not necessary to compute IRR to answer this question.

(i) Is the internal rate of return higher or lower than 10% for Project C1?

(ii) is the internal rate of return higher or lower than 10% for Project C2?

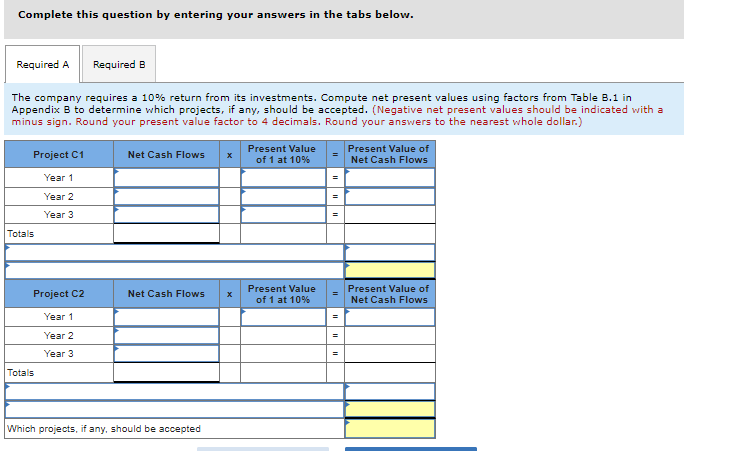

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Required A Required B

The company requires a 10% return from its investments. Compute net present values using factors from Table B.1 in

Appendix B to determine which projects, if any, should be accepted. (Negative net present values should be indicated with a

minus sign. Round your present value factor to 4 decimals. Round your answers to the nearest whole dollar.)

Project C1

Year 1

Year 2

Year 3

Totals

Project C2

Year 1

Year 2

Year 3

Totals

Net Cash Flows x

Net Cash Flows

Which projects, if any, should be accepted

x

Present Value

of 1 at 10%

Present Value

of 1 at 10%

=

=

Present Value of

Net Cash Flows

Present Value of

Net Cash Flows

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning