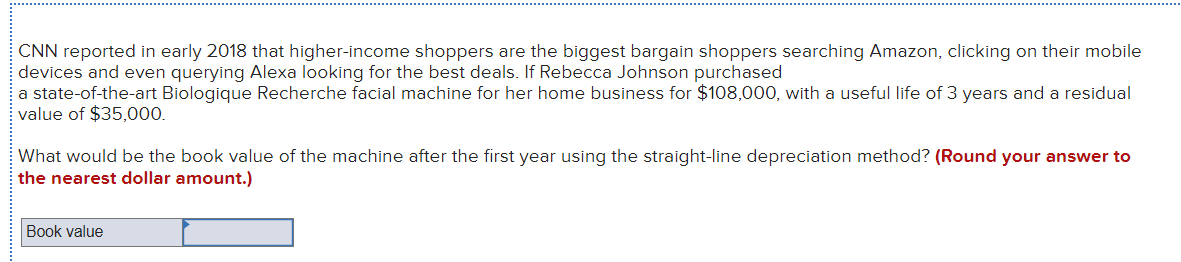

CNN reported in early 2018 that higher-income shoppers are the biggest bargain shoppers searching Amazon, clicking on their mobile devices and even querying Alexa looking for the best deals. If Rebecca Johnson purchased a state-of-the-art Biologique Recherche facial machine for her home business for $108,000, with a useful life of 3 years and a residual value of $35,000. What would be the book value of the machine after the first year using the straight-line depreciation method? (Round your answer to the nearest dollar amount.) Book value

CNN reported in early 2018 that higher-income shoppers are the biggest bargain shoppers searching Amazon, clicking on their mobile devices and even querying Alexa looking for the best deals. If Rebecca Johnson purchased a state-of-the-art Biologique Recherche facial machine for her home business for $108,000, with a useful life of 3 years and a residual value of $35,000. What would be the book value of the machine after the first year using the straight-line depreciation method? (Round your answer to the nearest dollar amount.) Book value

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 8PB: Montello Inc. purchases a delivery truck for $25,000. The truck has a salvage value of $6,000 and is...

Related questions

Question

Practice Pack

Transcribed Image Text:CNN reported in early 2018 that higher-income shoppers are the biggest bargain shoppers searching Amazon, clicking on their mobile

devices and even querying Alexa looking for the best deals. If Rebecca Johnson purchased

a state-of-the-art Biologique Recherche facial machine for her home business for $108,000, with a useful life of 3 years and a residual

value of $35,000.

| What would be the book value of the machine after the first year using the straight-line depreciation method? (Round your answer to

the nearest dollar amount.)

Book value

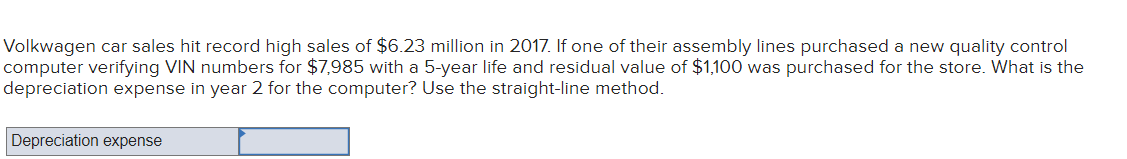

Transcribed Image Text:Volkwagen car sales hit record high sales of $6.23 million in 2017. If one of their assembly lines purchased a new quality control

computer verifying VIN numbers for $7,985 with a 5-year life and residual value of $1,100 was purchased for the store. What is the

depreciation expense in year 2 for the computer? Use the straight-line method.

Depreciation expense

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Includes step-by-step video

Trending now

This is a popular solution!

Learn your way

Includes step-by-step video

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning