Co. for $ 6,290 cash. The cost of the merchandise sold was $ 4,760. 3 Purchased merchandise for $ 7,330 from J. Moskos using check no. 101. 14 Paid salary to H. Rivera $ 760 by issuing check no. 102. 16 Sold merchandise on account t

Co. for $ 6,290 cash. The cost of the merchandise sold was $ 4,760. 3 Purchased merchandise for $ 7,330 from J. Moskos using check no. 101. 14 Paid salary to H. Rivera $ 760 by issuing check no. 102. 16 Sold merchandise on account t

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter10: Cash Receipts And Cash Payments

Section: Chapter Questions

Problem 5PA: The following transactions were completed by Nelsons Boutique, a retailer, during July. Terms of...

Related questions

Question

R. Crane Co. uses special journals and a general journal. The following transactions occurred during May 2020.

| May 1 | R. Crane invested $ 48,700 cash in the business. | |

|---|---|---|

| 2 | Sold merchandise to Lawrie Co. for $ 6,290 cash. The cost of the merchandise sold was $ 4,760. | |

| 3 | Purchased merchandise for $ 7,330 from J. Moskos using check no. 101. | |

| 14 | Paid salary to H. Rivera $ 760 by issuing check no. 102. | |

| 16 | Sold merchandise on account to K. Stanton for $ 955, terms n/30. The cost of the merchandise sold was $ 585. | |

| 22 | A check of $ 9,130 is received from M. Mangini in full for invoice 101; no discount given. |

(a)

- Your Answer

- Correct Answer

Correct answer icon

Your answer is correct.

Prepare a multiple-column cash receipts journal and record the transactions for May that should be journalized. (Record entries in the order presented in the problem statement.)

|

R. CRANE CO.

Cash Receipts Journal |

|||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

CR1

|

|||||||||||||||

|

Date

|

Account

Credited |

Ref.

|

Cash

Dr. |

Sales

Discounts Dr. |

Accounts

Receivable Cr. |

Sales

Revenue Cr. |

Other

Accounts Cr. |

Cost of Goods Sold

Dr. Inventory Cr. |

|||||||

| 2020 | |||||||||||||||

| Choose a transaction date |

Select an account title

|

|

Enter a dollar amount

|

Enter a dollar amount

|

Enter a dollar amount

|

Enter a dollar amount

|

Enter a dollar amount

|

Enter a dollar amount

|

|||||||

| Choose a transaction date |

Select an account title

|

|

Enter a dollar amount

|

Enter a dollar amount

|

Enter a dollar amount

|

Enter a dollar amount

|

Enter a dollar amount

|

Enter a dollar amount | |||||||

| Choose a transaction date |

Select an account title

|

|

Enter a dollar amount

|

Enter a dollar amount

|

Enter a dollar amount |

Enter a dollar amount

|

Enter a dollar amount

|

Enter a dollar amount

|

|||||||

|

Enter a total amount for this column

|

Enter a total amount for this column

|

Enter a total amount for this column |

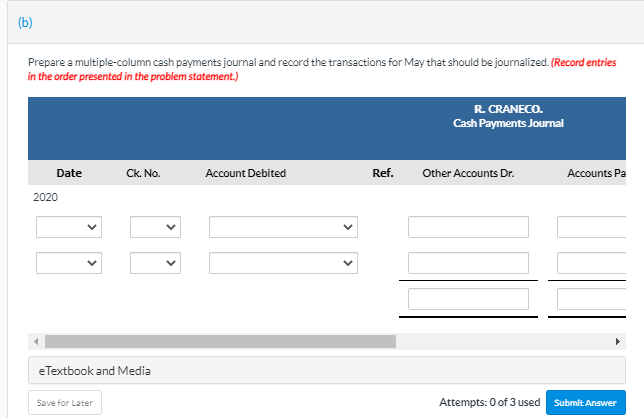

Transcribed Image Text:(b)

Prepare a multiple-column cash payments journal and record the transactions for May that should be journalized. (Record entries

in the order presented in the problem statement.)

R. CRANECO.

Cash Payments Journal

Date

Ck. No.

Account Debited

Ref.

Other Accounts Dr.

Accounts Pa

2020

eTextbook and Media

Save for Later

Attempts: 0 of 3 used

Submit Answer

>

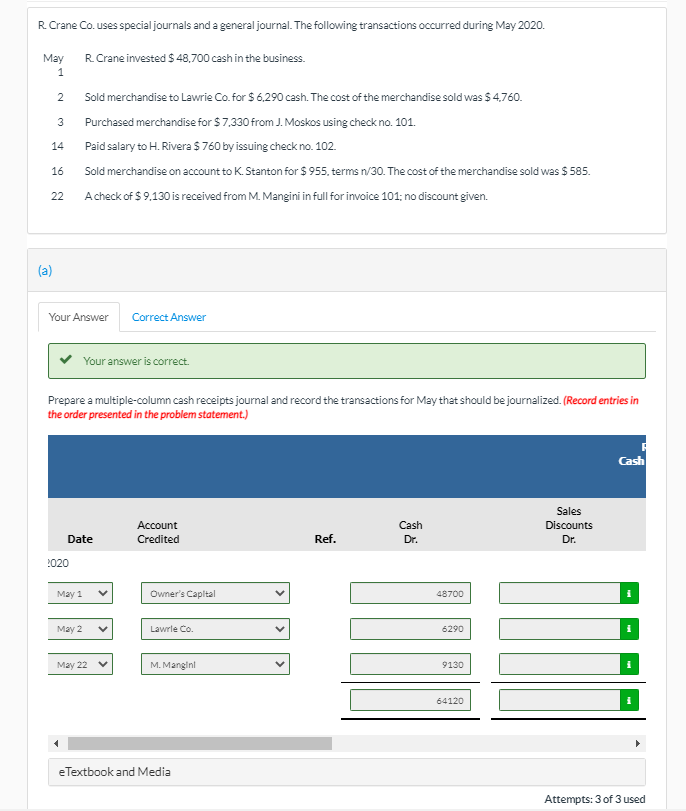

Transcribed Image Text:R. Crane Co. uses special journals and a general journal. The following transactions occurred during May 2020.

May

R. Crane invested S 48,700 cash in the business.

Sold merchandise to Lawrie Co. for $ 6.290 cash. The cost of the merchandise sold was $ 4.760.

3

Purchased merchandise for $ 7,330 from J. Moskos using check no. 101.

14

Paid salary to H. Rivera $ 760 by issuing check no. 102.

16

Sold merchandise on account to K. Stanton for $ 955, terms n/30. The cost of the merchandise sold was $ 585.

22

Acheck of $ 9,130 is received from M. Mangini in full for invoice 101; no discount given.

(a)

Your Answer

Correct Answer

Your answer is correct.

Prepare a multiple-column cash receipts journal and record the transactions for May that should be journalized. (Record entries in

the order presented in the problem statement.)

Cash

Sales

Account

Cash

Discounts

Date

Credited

Ref.

Dr.

Dr.

2020

May 1

Owner's Capltal

48700

May 2

Lawrle Co.

6290

May 22

M. Manginl

9130

64120

eTextbook and Media

Attempts: 3 of 3 used

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT