COGM & INCOME STATEMENT PT AMBARWATI plans to compile a Cost Of Goods Manufactured and Income Statement in September 2020. The following is the cost data needed in preparing the report: a. Purchase of raw materials of 2,000 units at a price of Rp. 18,000 / unit. Transportation costs are 1.5% of the purchase b. Employee working hours are 4,800 direct work hours at a rate of IDR 5,000 / direct work hour c. Transactions that occurred in September: Indirect material used Rp 7.000.000 Electricity ( 70% used for factories) Rp 2.000.000 Factory Maintenance Rp 1.000.000 Depreciation (40 used for office) Rp 4.000.000 Property tax ( 80% used for factories) Rp 6.000.000 Utilities ( 65% used for factories) Rp 8.000.000 Office Salaries Rp 12.000.000 Gross profit Rp 93.500.000 d. Sales of Rp. 181,000,000 with sales returns and discounts of 0.5% of gross sales e. Selling expenses were 2.5% of net sales, administrative and general expenses were 2% of gross sales f. Estimated inventory balance: Beginning Ending Finished Goods Rp 1.650.000 ? Work in Process Rp 3.000.000 Rp 1.500.000 Materials Rp 2.000.000 Rp 2.500.000 REQUESTED: Briefly describe what is called Prime Cost & Conversion Cost! Mention Direct Material, Indirect Material, Direct Labor, and Indirect Labor in this garment (jeans) company! Make a COGM Statement and Income Statement for September 2020!

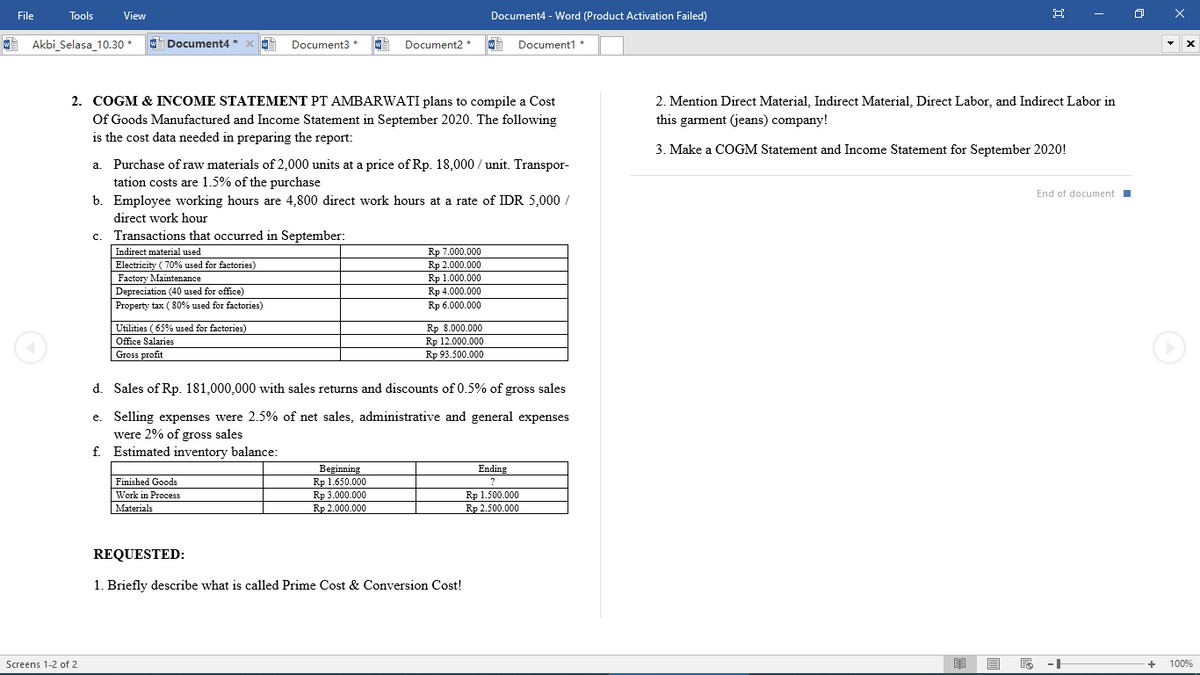

COGM & INCOME STATEMENT PT AMBARWATI plans to compile a Cost Of Goods Manufactured and Income Statement in September 2020. The following is the cost data needed in preparing the report:

a. Purchase of raw materials of 2,000 units at a price of Rp. 18,000 / unit. Transportation costs are 1.5% of the purchase

b. Employee working hours are 4,800 direct work hours at a rate of IDR 5,000 / direct work hour

c. Transactions that occurred in September:

|

Indirect material used |

Rp 7.000.000 |

|

Electricity ( 70% used for factories) |

Rp 2.000.000 |

|

Factory Maintenance |

Rp 1.000.000 |

|

|

Rp 4.000.000 |

|

Property tax ( 80% used for factories) |

Rp 6.000.000 |

|

Utilities ( 65% used for factories) |

Rp 8.000.000 |

|

Office Salaries |

Rp 12.000.000 |

|

Gross profit |

Rp 93.500.000 |

d. Sales of Rp. 181,000,000 with sales returns and discounts of 0.5% of gross sales

e. Selling expenses were 2.5% of net sales, administrative and general expenses were 2% of gross sales

f. Estimated inventory balance:

|

|

Beginning |

Ending |

|

Finished Goods |

Rp 1.650.000 |

? |

|

Work in Process |

Rp 3.000.000 |

Rp 1.500.000 |

|

Materials |

Rp 2.000.000 |

Rp 2.500.000 |

REQUESTED:

- Briefly describe what is called Prime Cost & Conversion Cost!

- Mention Direct Material, Indirect Material, Direct Labor, and Indirect Labor in this garment (jeans) company!

- Make a COGM Statement and Income Statement for September 2020!

Step by step

Solved in 3 steps with 3 images