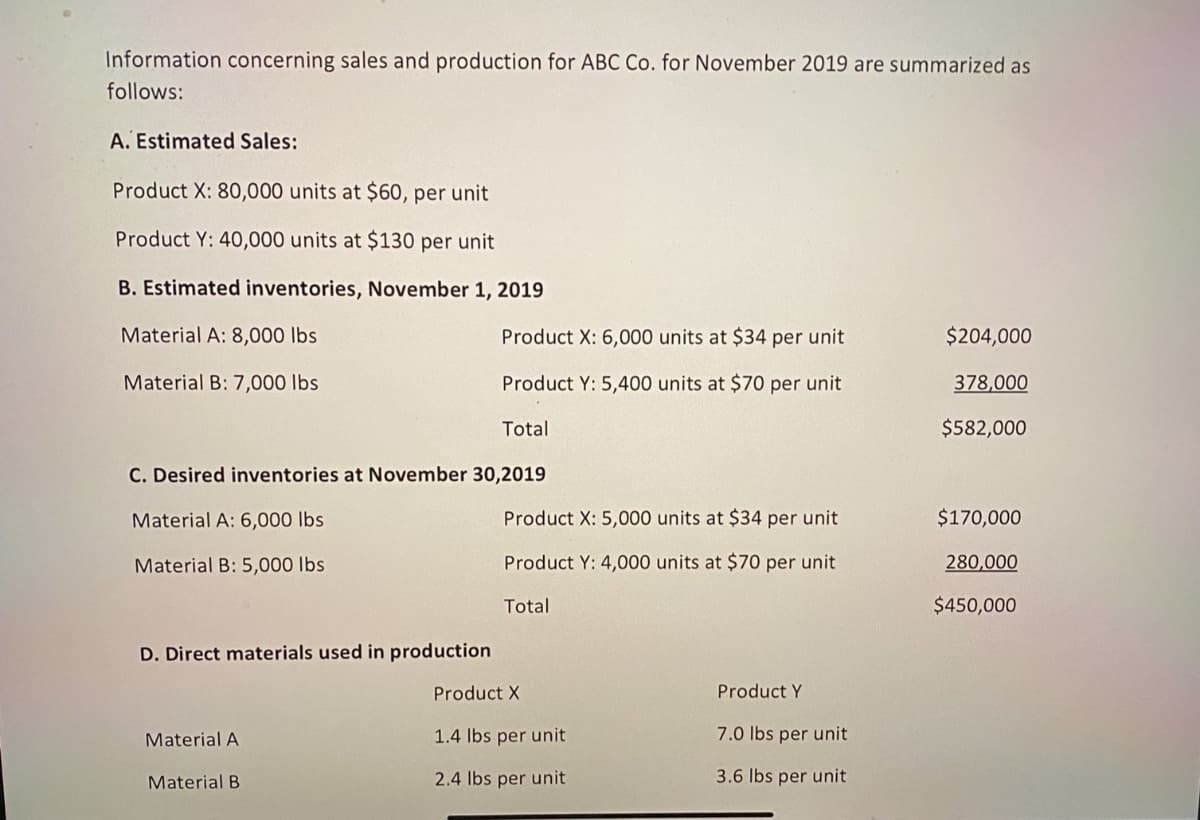

Information concerning sales and production for ABC Co. for November 2019 are summarized as follows: A. Estimated Sales: Product X: 80,000 units at $60, per unit Product Y: 40,000 units at $130 per unit B. Estimated inventories, November 1, 2019 Material A: 8,000 lbs Product X: 6,000 units at $34 per unit $204,000 Material B: 7,000 lbs Product Y: 5,400 units at $70 per unit 378,000 Total $582,000 C. Desired inventories at November 30,2019 Material A: 6,000 lbs Product X: 5,000 units at $34 per unit $170,000 Material B: 5,000 Ibs Product Y: 4,000 units at $70 per unit 280,000 Total $450,000 D. Direct materials used in production Product X Product Y Material A 1.4 lbs per unit 7.0 lbs per unit Material B 2.4 lbs per unit 3.6 lbs per unit

Information concerning sales and production for ABC Co. for November 2019 are summarized as follows: A. Estimated Sales: Product X: 80,000 units at $60, per unit Product Y: 40,000 units at $130 per unit B. Estimated inventories, November 1, 2019 Material A: 8,000 lbs Product X: 6,000 units at $34 per unit $204,000 Material B: 7,000 lbs Product Y: 5,400 units at $70 per unit 378,000 Total $582,000 C. Desired inventories at November 30,2019 Material A: 6,000 lbs Product X: 5,000 units at $34 per unit $170,000 Material B: 5,000 Ibs Product Y: 4,000 units at $70 per unit 280,000 Total $450,000 D. Direct materials used in production Product X Product Y Material A 1.4 lbs per unit 7.0 lbs per unit Material B 2.4 lbs per unit 3.6 lbs per unit

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter7: The Master Budget And Flexible Budgeting

Section: Chapter Questions

Problem 5E: Prepare a cost of goods sold budget for MacLaren Manufacturing Inc. for the year ended December 31,...

Related questions

Question

Do 1 and 2 only.

Transcribed Image Text:Information concerning sales and production for ABC Co. for November 2019 are summarized as

follows:

A. Estimated Sales:

Product X: 80,000 units at $60, per unit

Product Y: 40,000 units at $130 per unit

B. Estimated inventories, November 1, 2019

Material A: 8,000 lbs

Product X: 6,000 units at $34 per unit

$204,000

Material B: 7,000 Ibs

Product Y: 5,400 units at $70 per unit

378,000

Total

$582,000

C. Desired inventories at November 30,2019

Material A: 6,000 lbs

Product X: 5,000 units at $34 per unit

$170,000

Material B: 5,000 lbs

Product Y: 4,000 units at $70 per unit

280,000

Total

$450,000

D. Direct materials used in production

Product X

Product Y

Material A

1.4 lbs per unit

7.0 Ibs per unit

Material B

2.4 lbs per unit

3.6 Ibs per unit

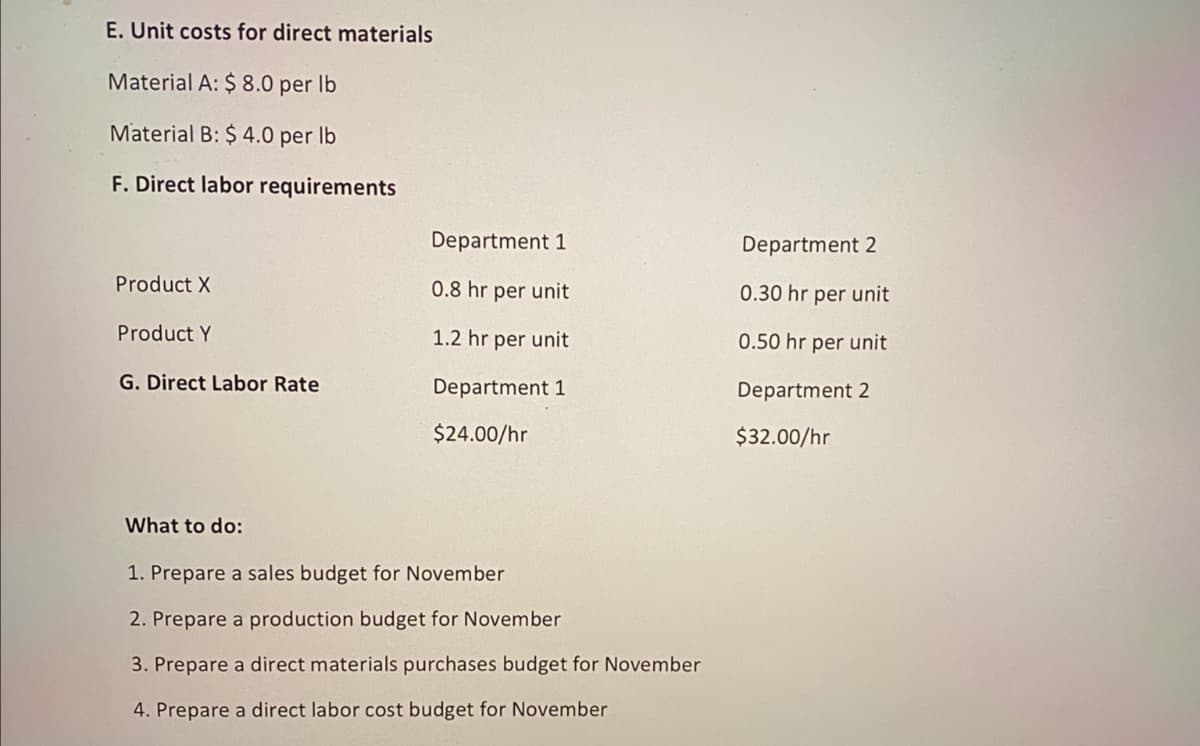

Transcribed Image Text:E. Unit costs for direct materials

Material A: $ 8.0 per Ib

Material B: $ 4.0 per Ib

F. Direct labor requirements

Department 1

Department 2

Product X

0.8 hr per unit

0.30 hr per unit

Product Y

1.2 hr per unit

0.50 hr per unit

G. Direct Labor Rate

Department 1

Department 2

$24.00/hr

$32.00/hr

What to do:

1. Prepare a sales budget for November

2. Prepare a production budget for November

3. Prepare a direct materials purchases budget for November

4. Prepare a direct labor cost budget for November

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning