Collins Corporation purchased office equipment at the beginning of 2016 and capitalized a cost of $2,116,000. This cost figure included the following expenditures: Purchase price Freight charges Installation charges Annual maintenance charge $1,930,000 38,000 28,000 120,000 Total $2,116,000 The company estimated an eight-year useful life for the equipment. No residual value is anticipated. The double-declining-balance method was used to determine depreciation expense for 2016 and 2017. In 2018, after the 2017 financial statements were issued, the company decided to switch to the straight-line depreciation method for this equipment. At that time, the company's controller discovered that the original cost of the equipment incorrectly included one year of annual maintenance charges for the equipment. Required: 1. Ignoring income taxes, prepare the appropriate correcting entry for the equipment capitalization error discovered in 2018. 2. Ignoring income taxes, prepare any 2018 journal entry(s) related to the change in depreciation methods. Required 1 Required 2 Ignoring income taxes, prepare the appropriate correcting entry for the equipment capitalization error discovered in 2018. no entry is required for a transaction/event, select "No journal entry required" in the first account field.) No Event General Journal Debit Credit Retained earnings Accumulated depreciation Equipment 67,500 52,500 120,000

Collins Corporation purchased office equipment at the beginning of 2016 and capitalized a cost of $2,116,000. This cost figure included the following expenditures: Purchase price Freight charges Installation charges Annual maintenance charge $1,930,000 38,000 28,000 120,000 Total $2,116,000 The company estimated an eight-year useful life for the equipment. No residual value is anticipated. The double-declining-balance method was used to determine depreciation expense for 2016 and 2017. In 2018, after the 2017 financial statements were issued, the company decided to switch to the straight-line depreciation method for this equipment. At that time, the company's controller discovered that the original cost of the equipment incorrectly included one year of annual maintenance charges for the equipment. Required: 1. Ignoring income taxes, prepare the appropriate correcting entry for the equipment capitalization error discovered in 2018. 2. Ignoring income taxes, prepare any 2018 journal entry(s) related to the change in depreciation methods. Required 1 Required 2 Ignoring income taxes, prepare the appropriate correcting entry for the equipment capitalization error discovered in 2018. no entry is required for a transaction/event, select "No journal entry required" in the first account field.) No Event General Journal Debit Credit Retained earnings Accumulated depreciation Equipment 67,500 52,500 120,000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 14P: Hunter Company purchased a light truck on January 2, 2019 for 18,000. The truck, which will be used...

Related questions

Question

2. Ignoring income taxes, prepare any 2018

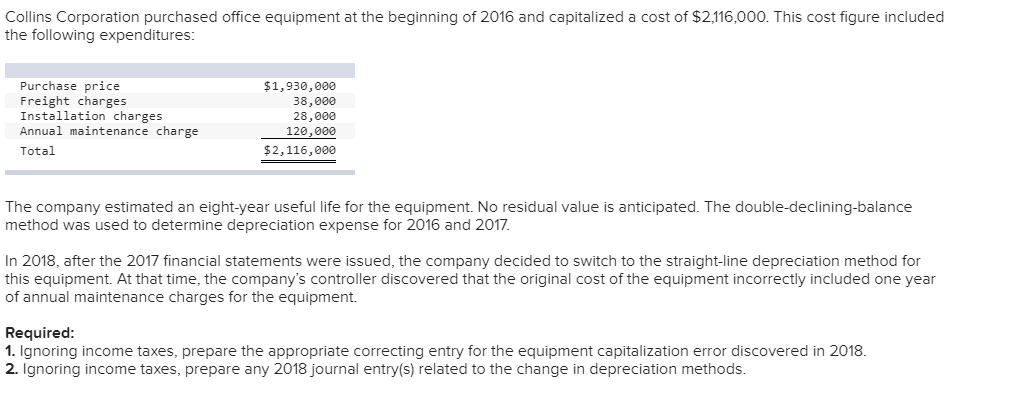

Transcribed Image Text:Collins Corporation purchased office equipment at the beginning of 2016 and capitalized a cost of $2,116,000. This cost figure included

the following expenditures:

Purchase price

Freight charges

Installation charges

Annual maintenance charge

$1,930,000

38,000

28,000

120,000

Total

$2,116,000

The company estimated an eight-year useful life for the equipment. No residual value is anticipated. The double-declining-balance

method was used to determine depreciation expense for 2016 and 2017.

In 2018, after the 2017 financial statements were issued, the company decided to switch to the straight-line depreciation method for

this equipment. At that time, the company's controller discovered that the original cost of the equipment incorrectly included one year

of annual maintenance charges for the equipment.

Required:

1. Ignoring income taxes, prepare the appropriate correcting entry for the equipment capitalization error discovered in 2018.

2. Ignoring income taxes, prepare any 2018 journal entry(s) related to the change in depreciation methods.

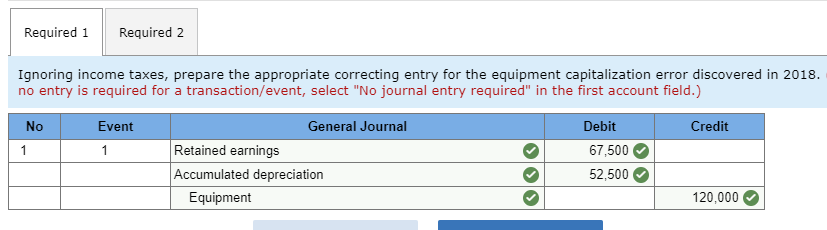

Transcribed Image Text:Required 1

Required 2

Ignoring income taxes, prepare the appropriate correcting entry for the equipment capitalization error discovered in 2018.

no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

No

Event

General Journal

Debit

Credit

Retained earnings

Accumulated depreciation

Equipment

67,500

52,500

120,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning