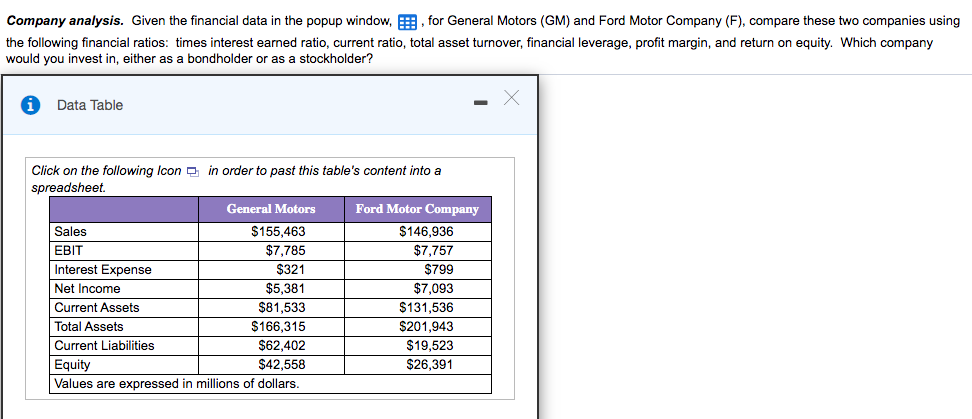

Company analysis. Given the financial data in the popup window, E, for General Motors (GM) and Ford Motor Company (F), compare these two companies using the following financial ratios: times interest earned ratio, current ratio, total asset turnover, financial leverage, profit margin, and return on equity. Which company would you invest in, either as a bondholder or as a stockholder? Data Table Click on the following Icon in order to past this table's content into a spreadsheet. General Motors Ford Motor Company Sales $155,463 $146,936 EBIT $7,785 $7,757 Interest Expense $321 $799 Net Income $5,381 $7,093 Current Assets $81,533 $131,536 $201.943 Total Assets $166,315 Current Liabilities $62,402 $19,523 $26,391 Equity Values are expressed in millions of dollars. $42,558

Company analysis. Given the financial data in the popup window, E, for General Motors (GM) and Ford Motor Company (F), compare these two companies using the following financial ratios: times interest earned ratio, current ratio, total asset turnover, financial leverage, profit margin, and return on equity. Which company would you invest in, either as a bondholder or as a stockholder? Data Table Click on the following Icon in order to past this table's content into a spreadsheet. General Motors Ford Motor Company Sales $155,463 $146,936 EBIT $7,785 $7,757 Interest Expense $321 $799 Net Income $5,381 $7,093 Current Assets $81,533 $131,536 $201.943 Total Assets $166,315 Current Liabilities $62,402 $19,523 $26,391 Equity Values are expressed in millions of dollars. $42,558

Chapter5: Evaluating Operating And Financial Performance

Section: Chapter Questions

Problem 4EP

Related questions

Question

Chapter 14, Question 6

Transcribed Image Text:Company analysis. Given the financial data in the popup window, E, for General Motors (GM) and Ford Motor Company (F), compare these two companies using

the following financial ratios: times interest earned ratio, current ratio, total asset turnover, financial leverage, profit margin, and return on equity. Which company

would you invest in, either as a bondholder or as a stockholder?

Data Table

Click on the following Icon in order to past this table's content into a

spreadsheet.

General Motors

Ford Motor Company

Sales

$155,463

$146,936

EBIT

$7,785

$7,757

Interest Expense

$321

$799

Net Income

$5,381

$7,093

Current Assets

$81,533

$131,536

$201.943

Total Assets

$166,315

Current Liabilities

$62,402

$19,523

Equity

$42,558

$26,391

Values are expressed in millions of dollars.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning