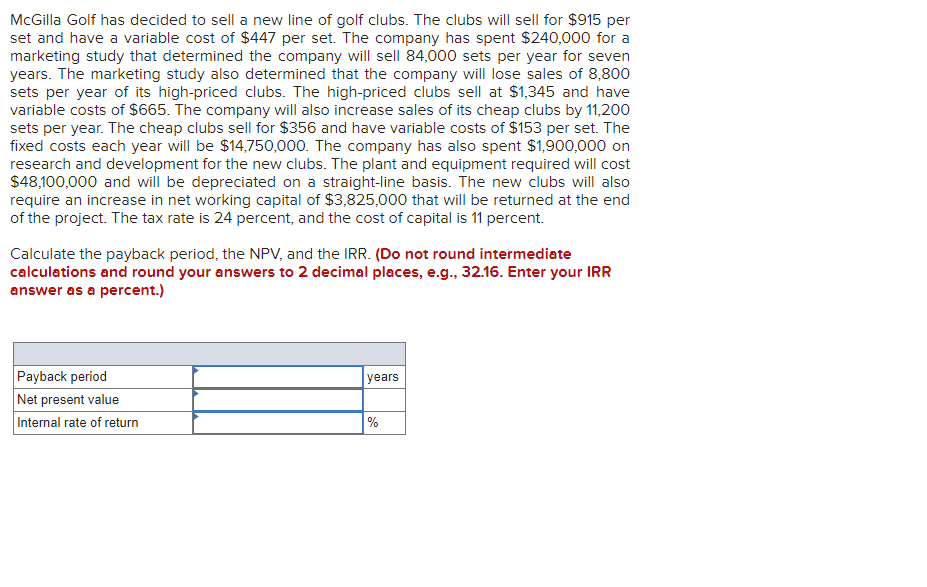

McGilla Golf has decided to sell a new line of golf clubs. The clubs will sell for $915 per set and have a variable cost of $447 per set. The company has spent $240,000 for a marketing study that determined the company will sell 84,000 sets per year for seven years. The marketing study also determined that the company will lose sales of 8,800 sets per year of its high-priced clubs. The high-priced clubs sell at $1,345 and have variable costs of $665. The company will also increase sales of its cheap clubs by 11,200 sets per year. The cheap clubs sell for $356 and have variable costs of $153 per set. The fixed costs each year will be $14,750,000. The company has also spent $1,900,000 on research and development for the new clubs. The plant and equipment required will cost $48,100,000 and will be depreciated on a straight-line basis. The new clubs will also require an increase in net working capital of $3,825,000 that will be returned at the end of the project. The tax rate is 24 percent, and the cost of capital is 11 percent. Calculate the payback period, the NPV, and the IRR. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. Enter your IRR answer as a percent.) Payback period Net present value years Internal rate of return %

McGilla Golf has decided to sell a new line of golf clubs. The clubs will sell for $915 per set and have a variable cost of $447 per set. The company has spent $240,000 for a marketing study that determined the company will sell 84,000 sets per year for seven years. The marketing study also determined that the company will lose sales of 8,800 sets per year of its high-priced clubs. The high-priced clubs sell at $1,345 and have variable costs of $665. The company will also increase sales of its cheap clubs by 11,200 sets per year. The cheap clubs sell for $356 and have variable costs of $153 per set. The fixed costs each year will be $14,750,000. The company has also spent $1,900,000 on research and development for the new clubs. The plant and equipment required will cost $48,100,000 and will be depreciated on a straight-line basis. The new clubs will also require an increase in net working capital of $3,825,000 that will be returned at the end of the project. The tax rate is 24 percent, and the cost of capital is 11 percent. Calculate the payback period, the NPV, and the IRR. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. Enter your IRR answer as a percent.) Payback period Net present value years Internal rate of return %

Chapter3: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 5EB: Cadre, Inc., sells a single product with a selling price of $120 and variable costs per unit of $90....

Related questions

Concept explainers

Question

Transcribed Image Text:McGilla Golf has decided to sell a new line of golf clubs. The clubs will sell for $915 per

set and have a variable cost of $447 per set. The company has spent $240,000 for a

marketing study that determined the company will sell 84,000 sets per year for seven

years. The marketing study also determined that the company will lose sales of 8,800

sets per year of its high-priced clubs. The high-priced clubs sell at $1,345 and have

variable costs of $665. The company will also increase sales of its cheap clubs by 11,200

sets per year. The cheap clubs sell for $356 and have variable costs of $153 per set. The

fixed costs each year will be $14,750,000. The company has also spent $1,900,000 on

research and development for the new clubs. The plant and equipment required will cost

$48,100,000 and will be depreciated on a straight-line basis. The new clubs will also

require an increase in net working capital of $3,825,000 that will be returned at the end

of the project. The tax rate is 24 percent, and the cost of capital is 11 percent.

Calculate the payback period, the NPV, and the IRR. (Do not round intermediate

calculations and round your answers to 2 decimal places, e.g., 32.16. Enter your IRR

answer as a percent.)

Payback period

years

Net present value

Internal rate of return

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Essentials Of Business Analytics

Statistics

ISBN:

9781285187273

Author:

Camm, Jeff.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning