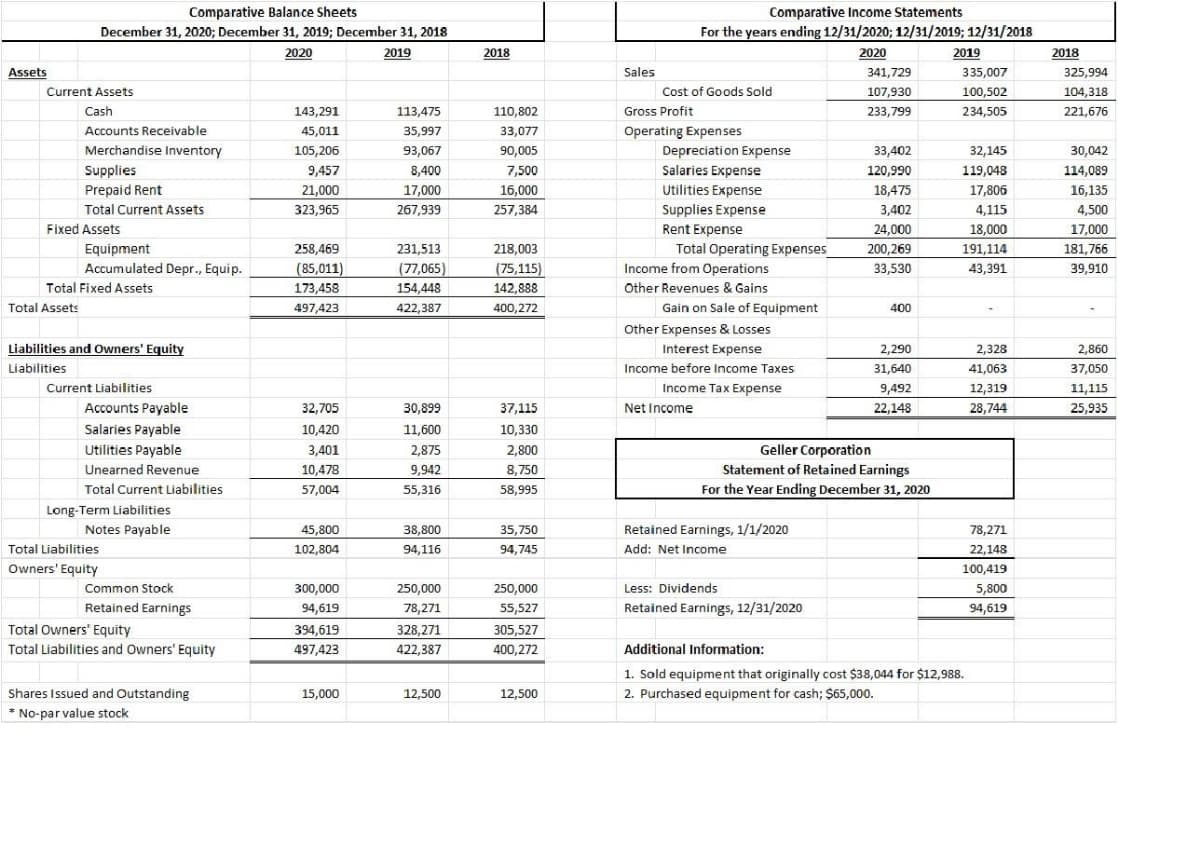

Comparative Income Statements For the years ending 12/31/2020; 12/31/2019; 12/31/2018 Comparative Balance Sheets December 31, 2020; December 31, 2019; December 31, 2018 2020 2019 2018 2020 2019 2018 Assets Sales 341,729 335,007 325,994 Current Assets Cost of Goods Sold 107,930 100,502 104,318 Cash 143,291 113,475 110,802 Gross Profit 233,799 234,505 221,676 Accounts Receivable 45,011 35,997 Operating Expenses Depreciation Expense Salaries Expense 33,077 Merchandise Inventory 105,206 93,067 90,005 33,402 32,145 30,042 Supplies 9,457 8,400 7,500 120,990 119,048 114,089 Prepaid Rent 21,000 17,000 16,000 Utilities Expense 18,475 17,806 16,135 Total Current Assets Supplies Expense Rent Expense Total Operating Expenses 323,965 267,939 257,384 3,402 4,115 4,500 Fixed Assets 24,000 18,000 17,000 Equipment 258.469 231,513 218,003 200,269 191.114 181,766 Accumulated Depr., Equip. (85,011) (77,065) (75,115) Income from Operations 33,530 43,391 39,910 Total Fixed Assets 173,458 154,448 142,888 Other Revenues & Gains Total Assets 497,423 422,387 400,272 Gain on Sale of Equipment 400 Other Expenses & Losses Liabilities and Owners' Equity Interest Expense 2,290 2,328 2,860 Liabilities Income before Income Taxes 31,640 41,063 37,050 Current Liabilities Income Tax Expense 9,492 12,319 11,115 Accounts Payable 32,705 30,899 37,115 Net Income 22,148 28,744 25,935 Salaries Payable 10,420 11,600 10,330 Utilities Payable 3,401 2,875 2,800 Geller Corporation Unearned Revenue 10,478 9,942 8,750 Statement of Retained Earnings Total Current Liabilities 57,004 55,316 58,995 For the Year Ending December 31, 2020 Long-Term Liabilities Notes Payable 45,800 38,800 35,750 Retained Earnings, 1/1/2020 78,271 Total Liabilities 102,804 94,116 94,745 Add: Net Income 22,148 Owners' Equity 100,419 Common Stock 300,000 250,000 250,000 Less: Dividends 5,800 Retained Earnings 94,619 78,271 55,527 Retained Earnings, 12/31/2020 94,619 Total Owners' Equity 394,619 328,271 305,527 Total Liabilities and Owners' Equity 497,423 422,387 400,272 Additional Information: 1. Sold equipment that originally cost $38,044 for $12,988. 2. Purchased equipment for cash; $65,000. Shares Issued and Outstanding 15,000 12,500 12,500 * No-par value stock

Comparative Income Statements For the years ending 12/31/2020; 12/31/2019; 12/31/2018 Comparative Balance Sheets December 31, 2020; December 31, 2019; December 31, 2018 2020 2019 2018 2020 2019 2018 Assets Sales 341,729 335,007 325,994 Current Assets Cost of Goods Sold 107,930 100,502 104,318 Cash 143,291 113,475 110,802 Gross Profit 233,799 234,505 221,676 Accounts Receivable 45,011 35,997 Operating Expenses Depreciation Expense Salaries Expense 33,077 Merchandise Inventory 105,206 93,067 90,005 33,402 32,145 30,042 Supplies 9,457 8,400 7,500 120,990 119,048 114,089 Prepaid Rent 21,000 17,000 16,000 Utilities Expense 18,475 17,806 16,135 Total Current Assets Supplies Expense Rent Expense Total Operating Expenses 323,965 267,939 257,384 3,402 4,115 4,500 Fixed Assets 24,000 18,000 17,000 Equipment 258.469 231,513 218,003 200,269 191.114 181,766 Accumulated Depr., Equip. (85,011) (77,065) (75,115) Income from Operations 33,530 43,391 39,910 Total Fixed Assets 173,458 154,448 142,888 Other Revenues & Gains Total Assets 497,423 422,387 400,272 Gain on Sale of Equipment 400 Other Expenses & Losses Liabilities and Owners' Equity Interest Expense 2,290 2,328 2,860 Liabilities Income before Income Taxes 31,640 41,063 37,050 Current Liabilities Income Tax Expense 9,492 12,319 11,115 Accounts Payable 32,705 30,899 37,115 Net Income 22,148 28,744 25,935 Salaries Payable 10,420 11,600 10,330 Utilities Payable 3,401 2,875 2,800 Geller Corporation Unearned Revenue 10,478 9,942 8,750 Statement of Retained Earnings Total Current Liabilities 57,004 55,316 58,995 For the Year Ending December 31, 2020 Long-Term Liabilities Notes Payable 45,800 38,800 35,750 Retained Earnings, 1/1/2020 78,271 Total Liabilities 102,804 94,116 94,745 Add: Net Income 22,148 Owners' Equity 100,419 Common Stock 300,000 250,000 250,000 Less: Dividends 5,800 Retained Earnings 94,619 78,271 55,527 Retained Earnings, 12/31/2020 94,619 Total Owners' Equity 394,619 328,271 305,527 Total Liabilities and Owners' Equity 497,423 422,387 400,272 Additional Information: 1. Sold equipment that originally cost $38,044 for $12,988. 2. Purchased equipment for cash; $65,000. Shares Issued and Outstanding 15,000 12,500 12,500 * No-par value stock

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter12: Intangibles

Section: Chapter Questions

Problem 10MC

Related questions

Question

Part A. Using the numbers from the comparative financial statements, complete a statement of cash flow for the most recent year. Use the indirect format for operating cash flows .

Part B. Write a Brief analysis about the company's performance during the last 3 years.

Transcribed Image Text:Comparative Balance Sheets

Comparative Income Statements

December 31, 2020; December 31, 2019; December 31, 2018

For the years ending 12/31/2020; 12/31/2019; 12/31/2018

2020

2019

2018

2020

2019

2018

Assets

Sales

341,729

335,007

325,994

Current Assets

Cost of Goods Sold

107,930

100,502

104,318

Cash

143,291

113,475

110,802

Gross Profit

233,799

234,505

221,676

Accounts Receivable

45,011

35,997

33,077

Operating Expenses

Merchandise Inventory

105,206

93,067

90,005

Depreciation Expense

33,402

32,145

30,042

Supplies

9,457

8,400

7,500

Salaries Expense

120,990

119,048

114,089

Prepaid Rent

Utilities Expense

21,000

323,965

17,000

16,000

18,475

17,806

16,135

Total Current Assets

267,939

257,384

Supplies Expense

3,402

4,115

4,500

Fixed Assets

Rent Expense

24,000

18,000

17,000

Equipment

258,469

231,513

218,003

Total Operating Expenses

200,269

191,114

181,766

Accumulated Depr., Equip.

(85,011)

(77,065)

(75,115)

Income from Operations

Other Revenues & Gains

33,530

43,391

39,910

Total Fixed Assets

173,458

154,448

142,888

Total Assets

497,423

422,387

400,272

Gain on Sale of Equipment

400

Other Expenses & Losses

Liabilities and Owners' Equity

Interest Expense

2,290

2,328

2,860

Liabilities

Income before Income Taxes

31,640

41.063

37,050

Current Liabilities

Income Tax Expense

9,492

12,319

11,115

Accounts Payable

32,705

30,899

37,115

Net Income

22,148

28,744

25,935

Salaries Payable

10,420

11,600

10,330

Geller Corporation

Statement of Retained Earnings

Utilities Payable

3,401

2,875

2,800

Unearned Revenue

10,478

9,942

8,750

Total Current Liabilities

57,004

55,316

58,995

For the Year Ending December 31, 2020

Long-Term Liabilities

Notes Payable

45,800

38,800

35,750

Retained Earnings, 1/1/2020

78,271

Total Liabilities

102,804

94,116

94,745

Add: Net Income

22,148

Owners' Equity

100,419

Common Stock

300,000

250,000

250,000

Less: Dividends

5,800

Retained Earnings

94,619

78,271

55,527

Retained Earnings, 12/31/2020

94,619

Total Owners' Equity

394,619

328,271

305,527

Total Liabilities and Owners' Equity

497,423

422,387

400,272

Additional Information:

1. Sold equipment that originally cost $38,044 for $12,988.

Shares Issued and Outstanding

15,000

12,500

12,500

2. Purchased equipment for cash; $65,000.

* No-par value stock

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College