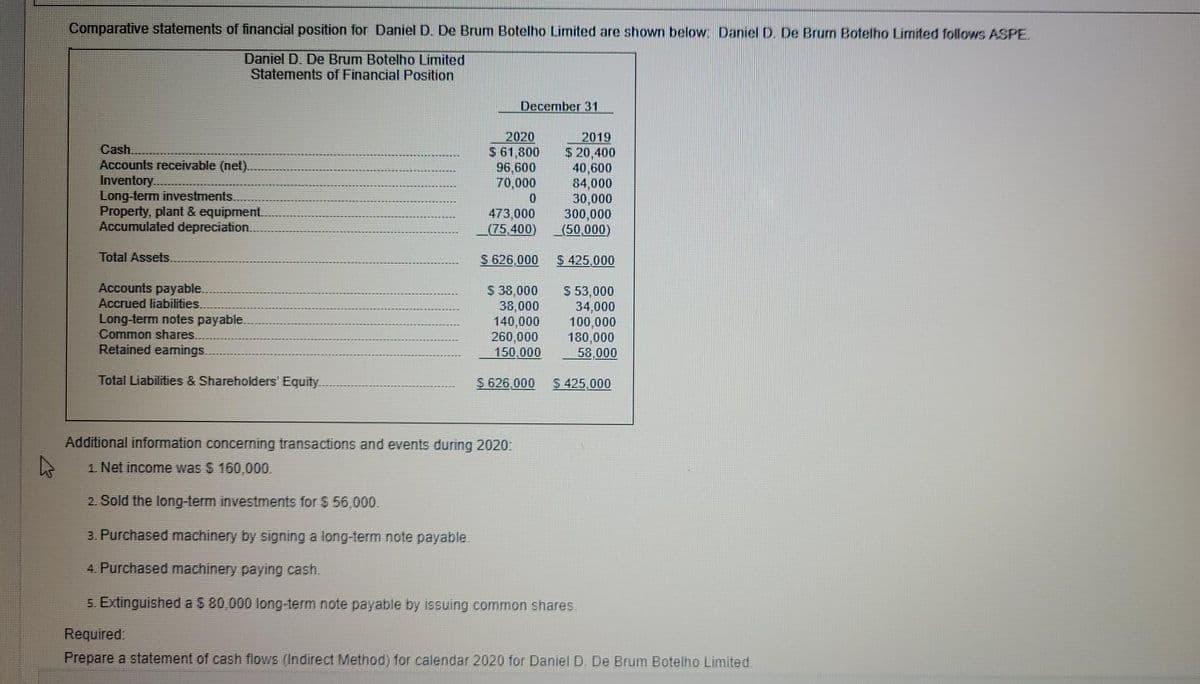

Comparative statements of financial position for Daniel D. De Brum Botelho Limited are shown below: Daniel D. De Brum Botelho Limited follows ASPE. Daniel D. De Brum Botelho Limited Statements of Financial Position December 31 Cash. Accounts receivable (net). Inventory.. Long-term investments. Property, plant & equipment. Accumulated depreciation. 2019 $ 20,400 40,600 84,000 30,000 300,000 (75.400) (50,000) 2020 $ 61,800 96,600 70,000 473,000 Total Assets. $ 626.000 $ 425.000 Accounts payable. Accrued liabilities. $ 38,000 38,000 140,000 260,000 150,000 $ 53,000 Long-term notes payable. Common shares. Retained eamings 34,000 100,000 180,000 58.000 Total Liabilities & Shareholders' Equity. $ 626,000 $ 425.000 Additional information concerning transactions and events during 2020: 1. Net income was $ 160,000. 2. Sold the long-term investments for $ 56,000. 3. Purchased machinery by signing a long-term note payable. 4. Purchased machinery paying cash. 5. Extinguished a $ 80,000 long-term note payable by issuing common shares. Required: Prepare a statement of cash flows (Indirect Method) for calendar 2020 for Daniel D. De Brum Botelho Limited.

Comparative statements of financial position for Daniel D. De Brum Botelho Limited are shown below: Daniel D. De Brum Botelho Limited follows ASPE. Daniel D. De Brum Botelho Limited Statements of Financial Position December 31 Cash. Accounts receivable (net). Inventory.. Long-term investments. Property, plant & equipment. Accumulated depreciation. 2019 $ 20,400 40,600 84,000 30,000 300,000 (75.400) (50,000) 2020 $ 61,800 96,600 70,000 473,000 Total Assets. $ 626.000 $ 425.000 Accounts payable. Accrued liabilities. $ 38,000 38,000 140,000 260,000 150,000 $ 53,000 Long-term notes payable. Common shares. Retained eamings 34,000 100,000 180,000 58.000 Total Liabilities & Shareholders' Equity. $ 626,000 $ 425.000 Additional information concerning transactions and events during 2020: 1. Net income was $ 160,000. 2. Sold the long-term investments for $ 56,000. 3. Purchased machinery by signing a long-term note payable. 4. Purchased machinery paying cash. 5. Extinguished a $ 80,000 long-term note payable by issuing common shares. Required: Prepare a statement of cash flows (Indirect Method) for calendar 2020 for Daniel D. De Brum Botelho Limited.

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter15: Investments And Fair Value Accounting

Section: Chapter Questions

Problem 2PB

Related questions

Question

I need full answers please

Transcribed Image Text:Comparative statements of financial position for Daniel D. De Brum Botelho Limited are shown below Daniel D. De Brum Botelho Limited follows ASPE.

Daniel D. De Brum Botelho Limited

Statements of Financial Position

December 31

Cash.

Accounts receivable (net).

Inventory....

Long-term investments.

Property, plant & equipment

Accumulated depreciation.

2020

S 61,800

96,600

70,000

0.

473,000

(75,400)

2019

$ 20,400

40,600

84,000

30,000

300,000

_(50,000)

Total Assets.

S 626.000

$ 425.000

Accounts payable.

Accrued liabilities.

Long-term notes payable.

Common shares.

Retained eamings..

S 38,000

38,000

140,000

260,000

150,000

$ 53,000

34,000

100,000

180,000

58.000

Total Liabilities & Shareholders' Equity.

S 626.000

S 425,000

Additional information concerning transactions and events during 2020:

1. Net income was $ 160,000.

2. Sold the long-term investments for $ 56,000.

3. Purchased machinery by signing a long-term note payable.

4. Purchased machinery paying cash.

5. Extinguished a $ 80,000 long-term note payable by issuing common shares.

Required.

Prepare a statement of cash flows (Indirect Method) for calendar 2020 for Daniel D. De Brum Botelho Limited.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning