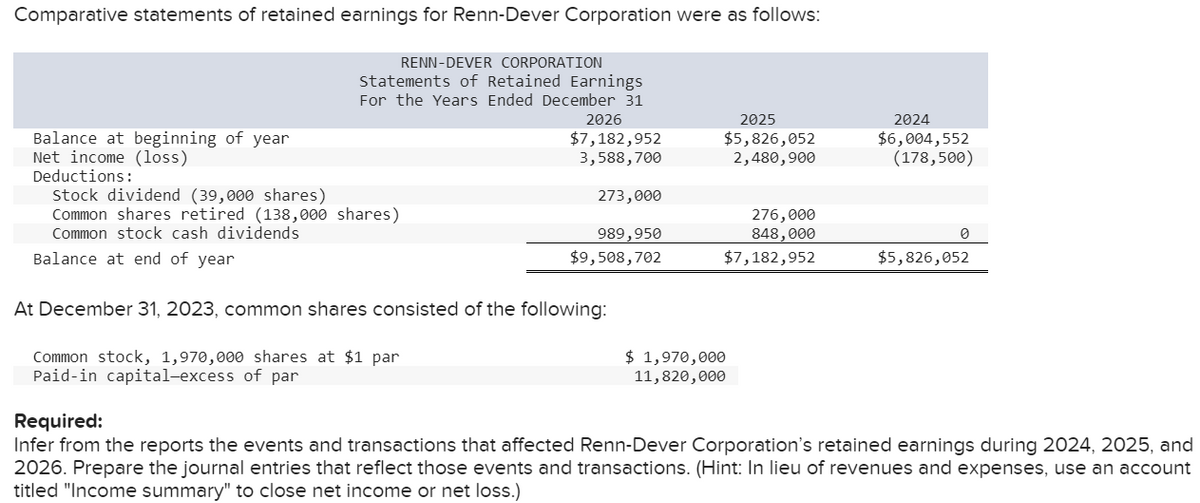

Comparative statements of retained earnings for Renn-Dever Corporation were as follows: RENN-DEVER CORPORATION Statements of Retained Earnings For the Years Ended December 31 2026 $7,182,952 3,588,700 273,000 989,950 $9,508,702 Balance at beginning of year Net income (loss) Deductions: Stock dividend (39,000 shares) Common shares retired (138,000 shares) Common stock cash dividends Balance at end of year At December 31, 2023, common shares consisted of the following: Common stock, 1,970,000 shares at $1 par Paid-in capital-excess of par 2025 $5,826,052 2,480,900 276,000 848,000 $7,182,952 $ 1,970,000 11,820,000 2024 $6,004,552 (178,500) $5,826,052 Required: Infer from the reports the events and transactions that affected Renn-Dever Corporation's retained earnings during 2024, 2025, and 2026. Prepare the journal entries that reflect those events and transactions. (Hint: In lieu of revenues and expenses, use an account titled "Income summary" to close net income or net loss.)

Comparative statements of retained earnings for Renn-Dever Corporation were as follows: RENN-DEVER CORPORATION Statements of Retained Earnings For the Years Ended December 31 2026 $7,182,952 3,588,700 273,000 989,950 $9,508,702 Balance at beginning of year Net income (loss) Deductions: Stock dividend (39,000 shares) Common shares retired (138,000 shares) Common stock cash dividends Balance at end of year At December 31, 2023, common shares consisted of the following: Common stock, 1,970,000 shares at $1 par Paid-in capital-excess of par 2025 $5,826,052 2,480,900 276,000 848,000 $7,182,952 $ 1,970,000 11,820,000 2024 $6,004,552 (178,500) $5,826,052 Required: Infer from the reports the events and transactions that affected Renn-Dever Corporation's retained earnings during 2024, 2025, and 2026. Prepare the journal entries that reflect those events and transactions. (Hint: In lieu of revenues and expenses, use an account titled "Income summary" to close net income or net loss.)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 19E: Lyon Company shows the following condensed income statement information for the year ended December...

Related questions

Question

Every entry should have narration please

Transcribed Image Text:Comparative statements of retained earnings for Renn-Dever Corporation were as follows:

RENN-DEVER CORPORATION

Statements of Retained Earnings

For the Years Ended December 31

2026

$7,182,952

3,588,700

Balance at beginning of year

Net income (loss)

Deductions:

Stock dividend (39,000 shares)

Common shares retired (138,000 shares)

Common stock cash dividends

Balance at end of year

273,000

989,950

$9,508,702

At December 31, 2023, common shares consisted of the following:

Common stock, 1,970,000 shares at $1 par

Paid-in capital-excess of par

2025

$5,826,052

2,480,900

276,000

848,000

$7,182,952

$ 1,970,000

11,820,000

2024

$6,004,552

(178,500)

0

$5,826,052

Required:

Infer from the reports the events and transactions that affected Renn-Dever Corporation's retained earnings during 2024, 2025, and

2026. Prepare the journal entries that reflect those events and transactions. (Hint: In lieu of revenues and expenses, use an account

titled "Income summary" to close net income or net loss.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning