compute the adjusted balances of the following accounts: 4. General and administrative expenses 5. Total operating expenses 6. Gain or loss on sale of land

compute the adjusted balances of the following accounts: 4. General and administrative expenses 5. Total operating expenses 6. Gain or loss on sale of land

Auditing: A Risk Based-Approach (MindTap Course List)

11th Edition

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter13: Auditing Debt, Equity, And Long-term Liabilities Requiring Management Estimates

Section: Chapter Questions

Problem 28RQSC

Related questions

Question

compute the adjusted balances of the following accounts:

4. General and administrative expenses

5. Total operating expenses

6. Gain or loss on sale of land

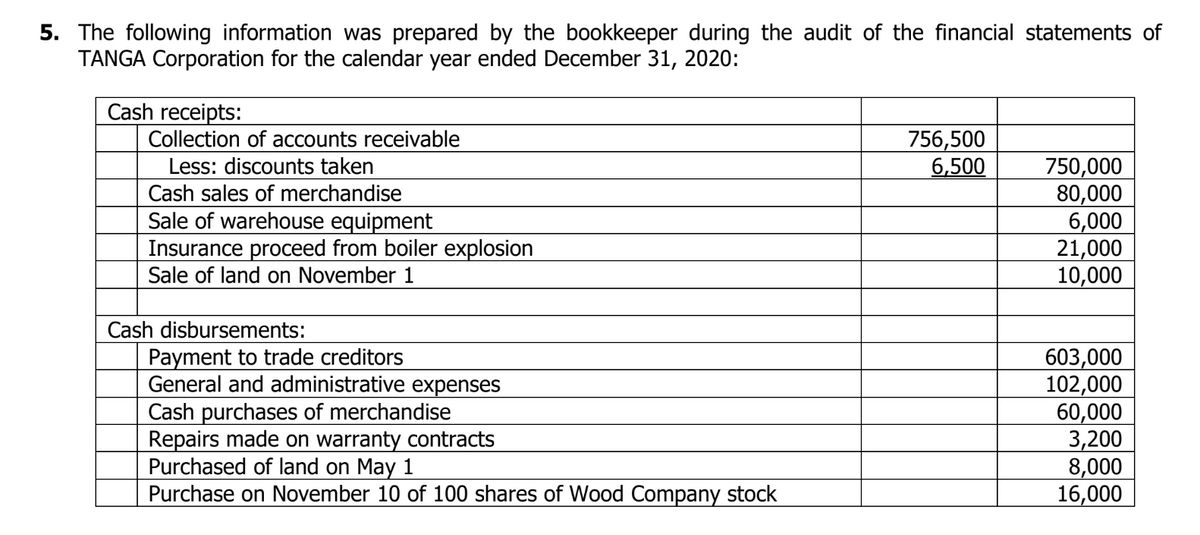

Transcribed Image Text:5. The following information was prepared by the bookkeeper during the audit of the financial statements of

TANGA Corporation for the calendar year ended December 31, 2020:

Cash receipts:

Collection of accounts receivable

Less: discounts taken

Cash sales of merchandise

Sale of warehouse equipment

Insurance proceed from boiler explosion

Sale of land on November 1

Cash disbursements:

Payment to trade creditors

General and administrative expenses

Cash purchases of merchandise

Repairs made on warranty contracts

Purchased of land on May 1

Purchase on November 10 of 100 shares of Wood Company stock

756,500

6,500

750,000

80,000

6,000

21,000

10,000

603,000

102,000

60,000

3,200

8,000

16,000

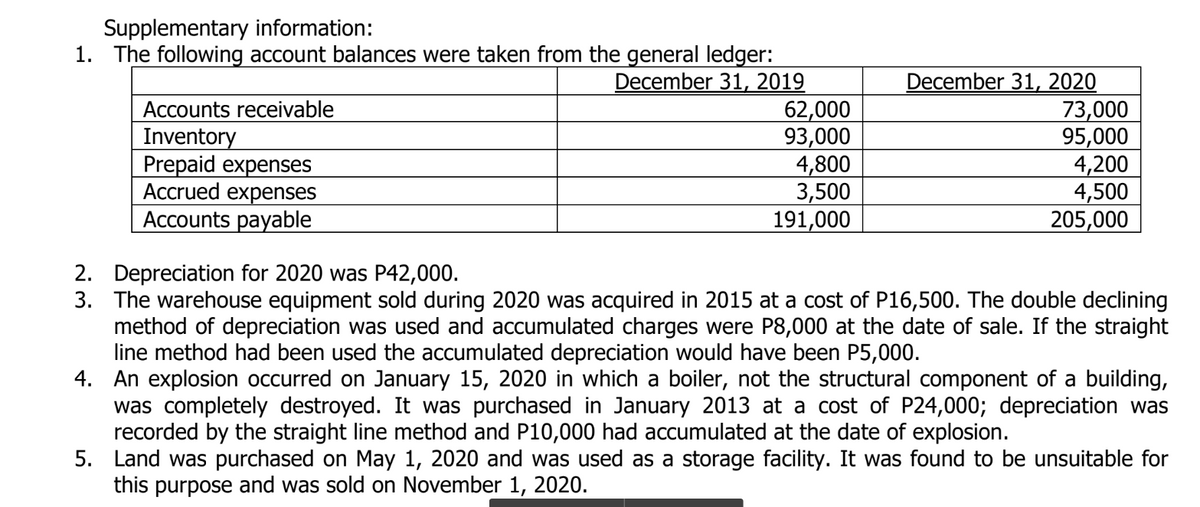

Transcribed Image Text:Supplementary information:

1. The following account balances were taken from the general ledger:

December 31, 2019

Accounts receivable

Inventory

Prepaid expenses

Accrued expenses

Accounts payable

62,000

93,000

4,800

3,500

191,000

December 31, 2020

73,000

95,000

4,200

4,500

205,000

2.

Depreciation for 2020 was P42,000.

3. The warehouse equipment sold during 2020 was acquired in 2015 at a cost of P16,500. The double declining

method of depreciation was used and accumulated charges were P8,000 at the date of sale. If the straight

line method had been used the accumulated depreciation would have been P5,000.

4. An explosion occurred on January 15, 2020 in which a boiler, not the structural component of a building,

was completely destroyed. It was purchased in January 2013 at a cost of P24,000; depreciation was

recorded by the straight line method and P10,000 had accumulated at the date of explosion.

5. Land was purchased on May 1, 2020 and was used as a storage facility. It was found to be unsuitable for

this purpose and was sold on November 1, 2020.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub