Concept explainers

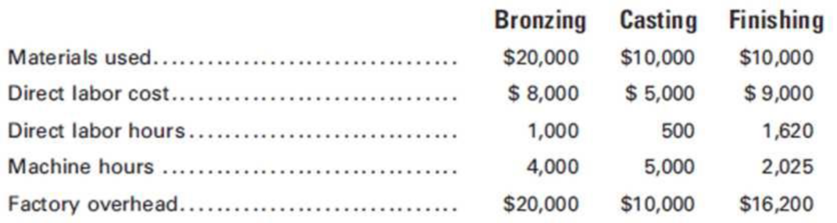

The following information, taken from the books of Herman Brothers Manufacturing represents the operations for January:

The

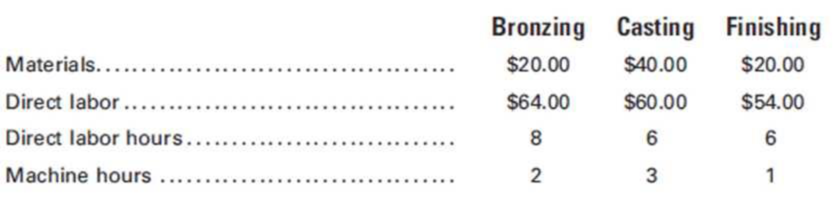

The following actual information was accumulated during February:

Required:

- 1. Using the January data, ascertain the predetermined factory

overhead rates to be used during February, based on the following:- a. Direct labor cost

- b. Direct labor hours

- c. Machine hours

- 2. Prepare a schedule showing the total production cost of Job M45 under each method of applying factory overhead.

- 3. Prepare the entries to record the following for February operations:

- a. The liability for total factory overhead.

- b. Distribution of factory overhead to the departments.

- c. Application of factory overhead to the work in process in each department, using direct labor hours. (Use the predetermined rate calculated in Requirement 1.)

- d. Closing of the applied factory overhead accounts.

- e. Recording under- and overapplied factory overhead and closing the actual factory overhead accounts.

1.

Ascertain the predetermined factory overhead rates to be used during February, based on the following:

- a. Direct labor cost

- b. Direct labor hours

- c. Machine hours

Explanation of Solution

- a. Compute the predetermined rate using direct labor cost:

- b. Compute the predetermined rate using direct labor hour rate:

- c. Compute the predetermined rate using machine hour rate:

2.

Prepare a schedule showing the total production cost of Job M45 under each method of applying factory overhead.

Explanation of Solution

Prepare a schedule showing the total production cost of Job M45 under each method of applying factory overhead:

| Cost of Production | ||||

| Job M45—Direct Labor Cost Method | Bronzing | Casting | Finishing | Total |

| Materials | $ 20.00 | $ 40.00 | $ 20.00 | $ 80.00 |

| Direct labor cost | 64 | 60 | 54 | 178 |

| Factory overhead: | ||||

| 160 | ||||

| 120 | ||||

| 97.2 | ||||

| Total | 377.2 | |||

| Total production cost | $ 244.00 | $ 220.00 | $ 171.20 | $ 635.20 |

Table (1)

| Cost of Production | ||||

| Job M45—Direct Labor Hour Method | Bronzing | Casting | Finishing | Total |

| Materials | $ 20 | $ 40 | $ 20 | $ 80 |

| Direct labor cost | 64 | 60 | 54 | 178 |

| Factory overhead: | ||||

| 160 | ||||

| 120 | ||||

| 60 | ||||

| Total | 340 | |||

| Total production cost | $ 244 | $ 220 | $ 134 | $598 |

Table (2)

| Cost of Production | ||||

| Job M45—Machine Hour Method | Bronzing | Casting | Finishing | Total |

| Materials | $ 20 | $ 40 | $ 20 | $ 80 |

| Direct labor cost | 64 | 60 | 54 | 178 |

| Factory overhead: | ||||

| 10 | ||||

| 6 | ||||

| 8 | ||||

| Total | 24 | |||

| Total production cost | $94 | $106 | $82 | $282 |

Table (3)

3.

Prepare journal entries to record the given transaction for February operations.

Explanation of Solution

Prepare journal entries to record the given transaction for February operations:

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| a. | Factory Overhead | 89,500 | ||

| Accounts Payable | 89,500 | |||

| (To record the Factory Overhead) | ||||

| b. | Factory Overhead-Bronzing | 35,000 | ||

| Factory Overhead-Casting | 22,000 | |||

| Factory Overhead-Finishing | 32,500 | |||

| Factory Overhead | 89,500 | |||

| (To record the distribution of total factory overhead cost to other departments.) | ||||

| c. | Work in Process | 69,600 | ||

| Applied Factory Overhead- Bronzing | 30,000 | |||

| Applied Factory Overhead- Casting | 19,600 | |||

| Applied Factory Overhead- Finishing | 20,000 | |||

| (To record the work in process) | ||||

| d. | Applied Factory Overhead- Bronzing | 30,000 | ||

| Applied Factory Overhead- Casting | 19,600 | |||

| Applied Factory Overhead- Finishing | 20,000 | |||

| Factory Overhead-Bronzing | 30,000 | |||

| Factory Overhead-Casting | 19,600 | |||

| Factory Overhead-Finishing | 20,000 | |||

| (To record the applied factory overhead) | ||||

| e | Under- and Over applied Overhead | 19,900 | ||

| Factory Overhead-Bronzing | 5,000 | |||

| Factory Overhead-Casting | 2,400 | |||

| Factory Overhead-Finishing | 12,500 | |||

| (To record the Under- and Over applied overhead) |

Table (4)

Want to see more full solutions like this?

Chapter 4 Solutions

Principles of Cost Accounting

- Channel Products Inc. uses the job order cost system of accounting. The following is a list of the jobs completed during March, showing the charges for materials issued to production and for direct labor. Assume that factory overhead is applied on the basis of direct labor costs and that the predetermined rate is 200%. Required: Compute the amount of overhead to be added to the cost of each job completed during the month. Compute the total cost of each job completed during the month. Compute the total cost of producing all the jobs finished during the month.arrow_forwardBangor Products Co. obtained the following information from its records for April: Required: 1. Prepare, in summary form, the journal entries that would have been made during the month to record issuing materials to production, the distribution of labor, and overhead costs; the completion of the jobs; and the sale of the jobs. 2. Prepare schedules computing the following for April: a. The gross profit or loss for each job completed and for the business as a whole. b. For each job, the gross profit or loss per unit. (Round to the nearest cent.)arrow_forwardSpokane Production Co. obtained the following information from its records for July: Required: 1. Prepare, in summary form, the journal entries that would have been made during the month to record issuing materials to production, the distribution of labor, and overhead costs; the completion of the jobs; and the sale of the jobs. 2. Prepare schedules computing the following for July: a. The gross profit or loss for each job completed and sold, and for the business as a whole. b. For each job, the gross profit or loss per unit. (Round to the nearest cent.)arrow_forward

- Gerken Fabrication Inc. uses the job order cost system of accounting. The following information was taken from the companys books after all posting had been completed at the end of March: a. Compute the total production cost of each job. b. Prepare the journal entries to charge the costs of materials, labor, and factory overhead to Work in Process. c. Prepare the journal entry to transfer the cost of jobs completed to Finished Goods. d. Compute the unit cost of each job. e. Compute the selling price per unit for each job, assuming a mark-on percentage of 50%.arrow_forwardThe cost accountant for River Rock Beverage Co. estimated that total factory overhead cost for the Blending Department for the coming fiscal year beginning February 1 would be 3,150,000, and total direct labor costs would be 1,800,000. During February, the actual direct labor cost totalled 160,000, and factory overhead cost incurred totaled 283,900. a. What is the predetermined factory overhead rate based on direct labor cost? b. Journalize the entry to apply factory overhead to production for February. c. What is the February 28 balance of the account Factory OverheadBlending Department? d. Does the balance in part (c) represent over- or underapplied factory overhead?arrow_forwardAbbey Products Company is studying the results of applying factory overhead to production. The following data have been used: estimated factory overhead, 60,000; estimated materials costs, 50,000; estimated direct labor costs, 60,000; estimated direct labor hours, 10,000; estimated machine hours, 20,000; work in process at the beginning of the month, none. The actual factory overhead incurred for November was 80,000, and the production statistics on November 30 are as follows: Required: 1. Compute the predetermined rate, based on the following: a. Direct labor cost b. Direct labor hours c. Machine hours 2. Using each of the methods, compute the estimated total cost of each job at the end of the month. 3. Determine the under-or overapplied factory overhead, in total, at the end of the month under each of the methods. 4. Which method would you recommend? Why?arrow_forward

- Terrills Transmissions uses a job order cost system. A partial list of the accounts being maintained by the company, with their balances as of November 1, follows: The following transactions were completed during November: a. Materials purchases on account during the month, 74,000. b. Materials requisitioned during the month: 1. Direct materials, 57,000. 2. Indirect materials, 11,000. c. Direct materials returned by factory to storeroom during the month, 1,100. d. Materials returned to vendors during the month prior to payment, 2,500. e. Payments to vendors during the month, 68,500. Required: 1. Prepare general journal entries for each of the transactions. 2. Post the general journal entries to T-accounts. 3. Balance the accounts and report the balances of November 30 for the following: a. Cash b. Materials c. Accounts Payablearrow_forwardLorrimer Company has a job-order cost system. The following debits (credits) appeared in the Work-in-Process account for the month of June. During the month of June, direct labor totaled 30,000 and 24,000 of overhead was applied to production. Finished Goods was debited 100,000 during June. Lorrimer Company applies overhead at a predetermined rate of 80% of direct labor cost. Job number 83, the only job still in process at the end of June, has been charged with manufacturing overhead of 3,400. What was the amount of direct materials charged to Job number 83? a. 3,400 b. 4,250 c. 8,350 d. 7,580arrow_forwardJob cost sheets show the following information: What are the balances in the work in process inventory, finished goods inventory, and cost of goods sold for January, February, and March?arrow_forward

- Prepare Job-Order Cost Sheets, Predetermined Overhead Rate, Ending Balance of WIP, Finished Goods, and COGS At the beginning of March, Mendez Company had two jobs in process, Job 86 and Job 87, with the following accumulated cost information: During March, two more jobs (88 and 89) were started. The following direct materials and direct labor costs were added to the four jobs during the month of March: At the end of March, Jobs 86, 87, and 89 were completed. Only Job 87 was sold. On March 1, the balance in Finished Goods was zero. Required: 1. Calculate the overhead rate based on direct labor cost. (Note: Round to three decimal places.) 2. Prepare a brief job-order cost sheet for the four jobs. Show the balance as of March 1 as well as direct materials and direct labor added in March. Apply overhead to the four jobs for the month of March, and show the ending balances. 3. Calculate the ending balances of Work in Process and Finished Goods as of March 31. 4. Calculate the Cost of Goods Sold for March.arrow_forwardUse the space provided below to prepare six summary journal entries for the month of August. These entries record (1) cost of direct materials used, (2) cost of direct labor, (3) cost of applied overhead, (4) cost of jobs completed, (5) cost of goods sold, and (6) total sales on account. Then set up T-accounts for Work in Process, Finished Goods, Cost of Goods Sold, and Sales. Post the entries to the appropriate accounts and then balance each account. Finally, prepare a supporting schedule by job number showing the cost of ending work in process, finished goods, and cost of goods sold.arrow_forwardSummary information from a companys job cost sheets shows the following information: What are the balances in the work in process inventory, finished goods Inventory, and cost of goods sold for April, May, and June?arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning