Complete this question by entering your answers in the tabs below. Req A Req B and C b. What is the overall impact on net income over the two accounting periods? (Negative amounts should be entered with a minus sign.) c. What is the net cash outflow to acquire the raw materials? Impact on Net Income b. Impact on net income in 2020 Impact on net income in 2021

Complete this question by entering your answers in the tabs below. Req A Req B and C b. What is the overall impact on net income over the two accounting periods? (Negative amounts should be entered with a minus sign.) c. What is the net cash outflow to acquire the raw materials? Impact on Net Income b. Impact on net income in 2020 Impact on net income in 2021

Chapter11: Managing Transaction Exposure

Section: Chapter Questions

Problem 41QA

Related questions

Question

Looking for help with Requriement B

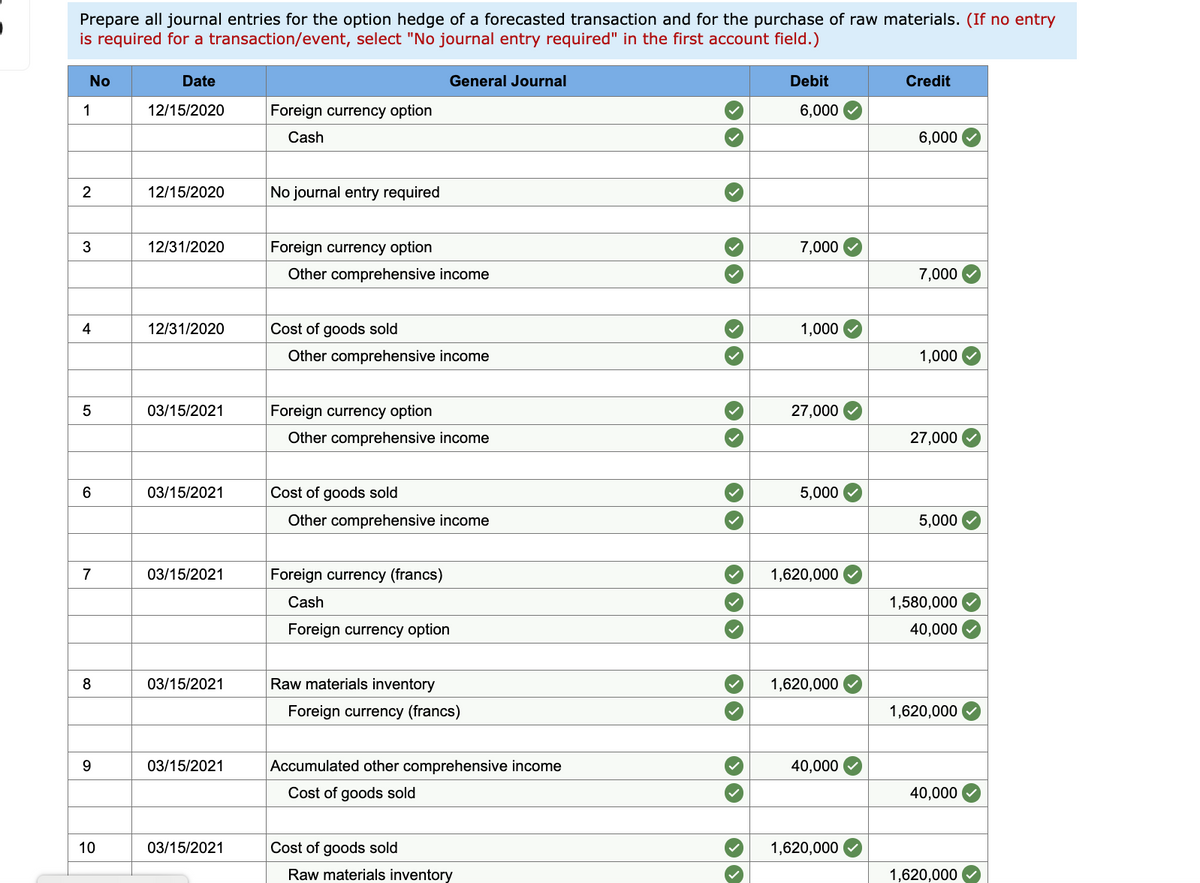

Transcribed Image Text:Prepare all journal entries for the option hedge of a forecasted transaction and for the purchase of raw materials. (If no entry

is required for a transaction/event, select "No journal entry required" in the first account field.)

No

Date

General Journal

Debit

Credit

1

12/15/2020

Foreign currency option

6,000

Cash

6,000

2

12/15/2020

No journal entry required

3

12/31/2020

Foreign currency option

7,000

Other comprehensive income

7,000

4

12/31/2020

Cost of goods sold

1,000

Other comprehensive income

1,000

03/15/2021

Foreign currency option

27,000

Other comprehensive income

27,000

03/15/2021

Cost of goods sold

5,000

Other comprehensive income

5,000

7

03/15/2021

Foreign currency (francs)

1,620,000

Cash

1,580,000

Foreign currency option

40,000

03/15/2021

Raw materials inventory

1,620,000

Foreign currency (francs)

1,620,000

9.

03/15/2021

Accumulated other comprehensive income

40,000

Cost of goods sold

40,000

10

03/15/2021

Cost of goods sold

1,620,000

Raw materials inventory

1,620,000

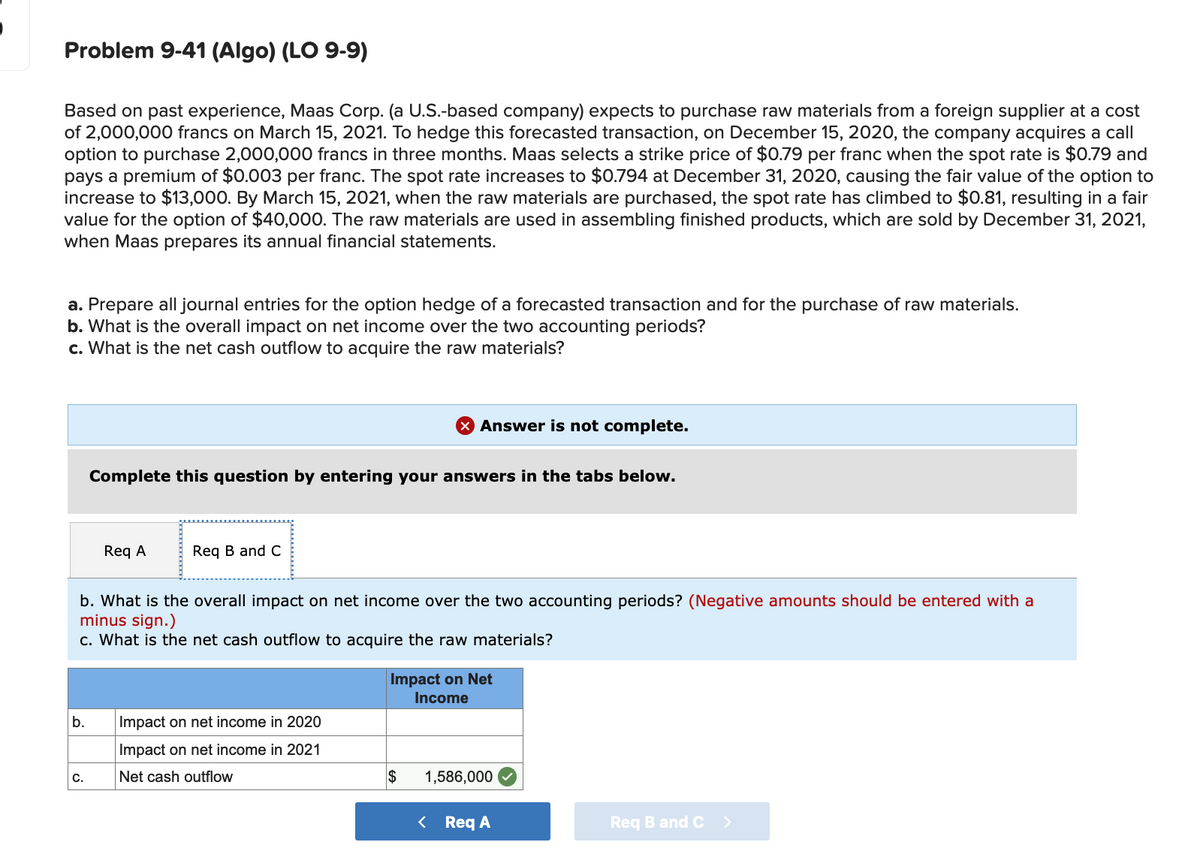

Transcribed Image Text:Problem 9-41 (Algo) (LO 9-9)

Based on past experience, Maas Corp. (a U.S.-based company) expects to purchase raw materials from a foreign supplier at a cost

of 2,000,000 francs on March 15, 2021. To hedge this forecasted transaction, on December 15, 2020, the company acquires a call

option to purchase 2,000,000 francs in three months. Maas selects a strike price of $0.79 per franc when the spot rate is $0.79 and

pays a premium of $0.003 per franc. The spot rate increases to $0.794 at December 31, 2020, causing the fair value of the option to

increase to $13,000. By March 15, 2021, when the raw materials are purchased, the spot rate has climbed to $0.81, resulting in a fair

value for the option of $40,000. The raw materials are used in assembling finished products, which are sold by December 31, 2021,

when Maas prepares its annual financial statements.

a. Prepare all journal entries for the option hedge of a forecasted transaction and for the purchase of raw materials.

b. What is the overall impact on net income over the two accounting periods?

c. What

the net cash outflo

to acquire the raw materials?

X Answer is not complete.

Complete this question by entering your answers in the tabs below.

Req A

Req B and C

b. What is the overall impact on net income over the two accounting periods? (Negative amounts should be entered with a

minus sign.)

c. What is the net cash outflow to acquire the raw materials?

Impact on Net

Income

b.

Impact on net income in 2020

Impact on net income in 2021

C.

Net cash outflow

$

1,586,000

< Req A

Req B and C >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you