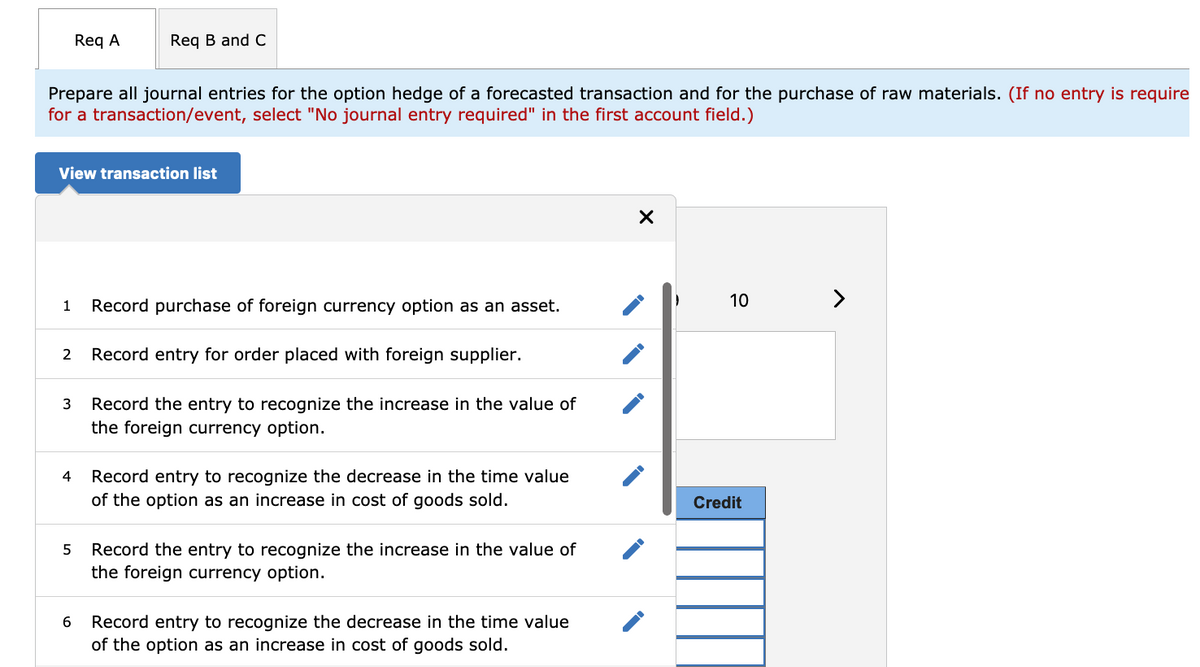

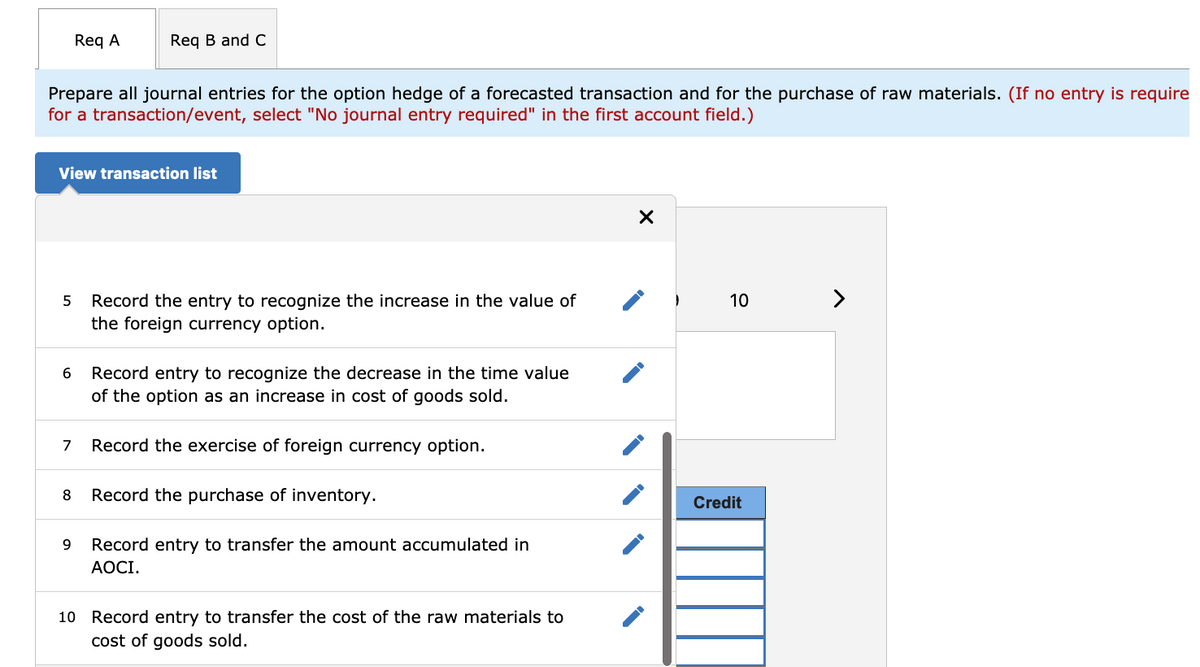

Prepare all journal entries for the option hedge of a forecasted transaction and for the purchase of raw materials.

Based on past experience, Maas Corp. (a U.S.-based company) expects to purchase raw materials from a foreign supplier at a cost of 2,000,000 francs on March 15, 2021. To hedge this

-

Prepare all

journal entries for the option hedge of a forecasted transaction and for the purchase of raw materials.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps