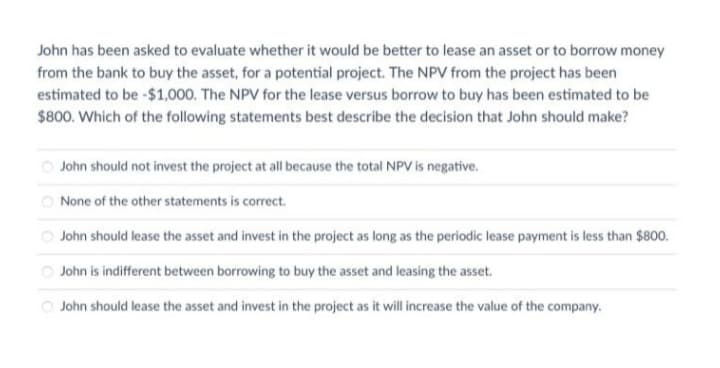

John has been asked to evaluate whether it would be better to lease an asset or to borrow money from the bank to buy the asset, for a potential project. The NPV from the project has been estimated to be-$1,000. The NPV for the lease versus borrow to buy has been estimated to be $800. Which of the following statements best describe the decision that John should make? O John should not invest the project at all because the total NPV is negative. O None of the other statements is correct. O John should lease the asset and invest in the project as long as the periodic lease payment is less than $800. O John is indifferent between borrowing to buy the asset and leasing the asset. O John should lease the asset and invest in the project as it will increase the value of the company.

John has been asked to evaluate whether it would be better to lease an asset or to borrow money from the bank to buy the asset, for a potential project. The NPV from the project has been estimated to be-$1,000. The NPV for the lease versus borrow to buy has been estimated to be $800. Which of the following statements best describe the decision that John should make? O John should not invest the project at all because the total NPV is negative. O None of the other statements is correct. O John should lease the asset and invest in the project as long as the periodic lease payment is less than $800. O John is indifferent between borrowing to buy the asset and leasing the asset. O John should lease the asset and invest in the project as it will increase the value of the company.

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter26: Capital Investment Analysis

Section: Chapter Questions

Problem 2CMA: Staten Corporation is considering two mutually exclusive projects. Both require an initial outlay of...

Related questions

Question

M1

Transcribed Image Text:John has been asked to evaluate whether it would be better to lease an asset or to borrow money

from the bank to buy the asset, for a potential project. The NPV from the project has been

estimated to be -$1,000. The NPV for the lease versus borrow to buy has been estimated to be

$800. Which of the following statements best describe the decision that John should make?

O John should not invest the project at all because the total NPV is negative.

O None of the other statements is correct.

O John should lease the asset and invest in the project as long as the periodic lease payment is less than $800.

O John is indifferent between borrowing to buy the asset and leasing the asset.

O John should lease the asset and invest in the project as it will increase the value of the company.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning