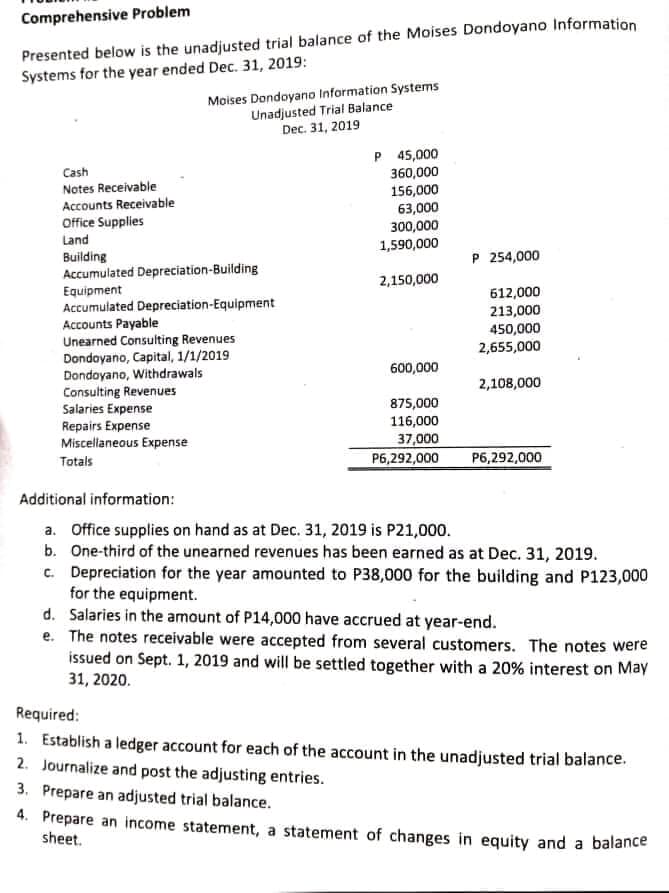

Compreh Presented below is the unadjusted trial balance of the Moises Dondoyano Information Systems for the year ended Dec. 31, 2019: Moises Dondoyano Information Systems Unadjusted Trial Balance Dec. 31, 2019 P 45,000 360,000 156,000 63,000 300,000 1,590,000 Cash Notes Receivable Accounts Receivable Office Supplies Land P 254,000 Building Accumulated Depreciation-Building Equipment Accumulated Depreciation-Equipment Accounts Payable Unearned Consulting Revenues Dondoyano, Capital, 1/1/2019 Dondoyano, Withdrawals Consulting Revenues Salaries Expense Repairs Expense Miscellaneous Expense 2,150,000 612,000 213,000 450,000 2,655,000 600,000 2,108,000 875,000 116,000 37,000 P6,292,000 Totals P6,292,000 Additional information: a. Office supplies on hand as at Dec. 31, 2019 is P21,000. b. One-third of the unearned revenues has been earned as at Dec. 31, 2019. c. Depreciation for the year amounted to P38,000 for the building and P123,000 for the equipment. d. Salaries in the amount of P14,000 have accrued at year-end. e. The notes receivable were accepted from several customers. The notes were issued on Sept. 1, 2019 and will be settled together with a 20% interest on May 31, 2020. Required: 1. Establish a ledger account for each of the account in the unadjusted trial balance. 2. Journalize and post the adjusting entries. 3. Prepare an adjusted trial balance. 4. Prepare an income statement, a statement of changes in equity and a balance sheet.

Compreh Presented below is the unadjusted trial balance of the Moises Dondoyano Information Systems for the year ended Dec. 31, 2019: Moises Dondoyano Information Systems Unadjusted Trial Balance Dec. 31, 2019 P 45,000 360,000 156,000 63,000 300,000 1,590,000 Cash Notes Receivable Accounts Receivable Office Supplies Land P 254,000 Building Accumulated Depreciation-Building Equipment Accumulated Depreciation-Equipment Accounts Payable Unearned Consulting Revenues Dondoyano, Capital, 1/1/2019 Dondoyano, Withdrawals Consulting Revenues Salaries Expense Repairs Expense Miscellaneous Expense 2,150,000 612,000 213,000 450,000 2,655,000 600,000 2,108,000 875,000 116,000 37,000 P6,292,000 Totals P6,292,000 Additional information: a. Office supplies on hand as at Dec. 31, 2019 is P21,000. b. One-third of the unearned revenues has been earned as at Dec. 31, 2019. c. Depreciation for the year amounted to P38,000 for the building and P123,000 for the equipment. d. Salaries in the amount of P14,000 have accrued at year-end. e. The notes receivable were accepted from several customers. The notes were issued on Sept. 1, 2019 and will be settled together with a 20% interest on May 31, 2020. Required: 1. Establish a ledger account for each of the account in the unadjusted trial balance. 2. Journalize and post the adjusting entries. 3. Prepare an adjusted trial balance. 4. Prepare an income statement, a statement of changes in equity and a balance sheet.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 6MC: Prior to adjustments, Barrett Companys account balances at December 31, 2019, for Accounts...

Related questions

Question

Transcribed Image Text:Comprehensive Problem

Presented below is the unadjusted trial balance of the Moises Dondoyano Information

Systems for the year ended Dec. 31, 2019:

Moises Dondoyano Information Systems

Unadjusted Trial Balance

Dec. 31, 2019

Cash

Notes Receivable

Accounts Receivable

Office Supplies

Land

P 45,000

360,000

156,000

63,000

300,000

1,590,000

P 254,000

Building

Accumulated Depreciation-Building

Equipment

Accumulated Depreciation-Equipment

Accounts Payable

Unearned Consulting Revenues

Dondoyano, Capital, 1/1/2019

Dondoyano, Withdrawals

Consulting Revenues

Salaries Expense

Repairs Expense

Miscellaneous Expense

2,150,000

612,000

213,000

450,000

2,655,000

600,000

2,108,000

875,000

116,000

37,000

Totals

P6,292,000

P6,292,000

Additional information:

a. Office supplies on hand as at Dec. 31, 2019 is P21,000.

b. One-third of the unearned revenues has been earned as at Dec. 31, 2019.

c. Depreciation for the year amounted to P38,000 for the building and P123,000

for the equipment.

d. Salaries in the amount of P14,000 have accrued at year-end.

e. The notes receivable were accepted from several customers. The notes were

issued on Sept. 1, 2019 and will be settled together with a 20% interest on May

31, 2020.

Required:

1. Establish a ledger account for each of the account in the unadjusted trial balance.

2. Journalize and post the adjusting entries.

3. Prepare an adjusted trial balance.

4. Prepare an income statement, a statement of changes in equity and a balance

sheet.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning