Compute for the reported net income of GHI Company from its own operation, if the net income of ABC from its own operation for 2024 amounted to P157,500.

Compute for the reported net income of GHI Company from its own operation, if the net income of ABC from its own operation for 2024 amounted to P157,500.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 19E

Related questions

Question

Compute for the reported net income of GHI Company from its own operation, if the net income of ABC from its own operation for 2024 amounted to P157,500. Do not forget if there is any upstream and downstream.

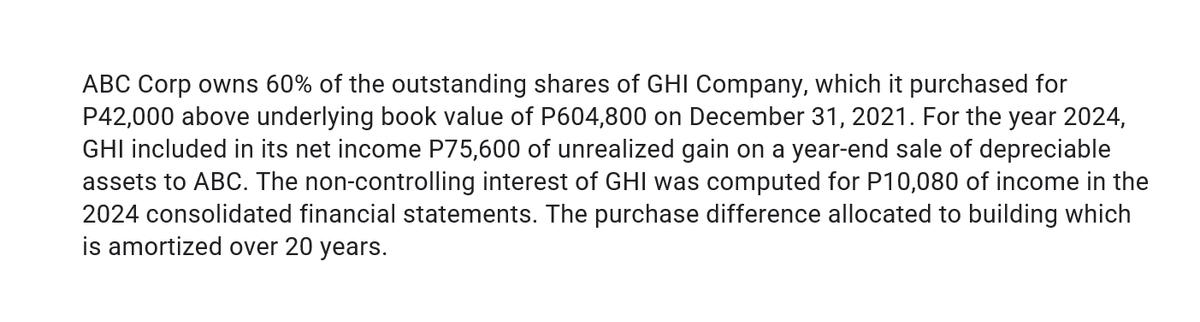

Transcribed Image Text:ABC Corp owns 60% of the outstanding shares of GHI Company, which it purchased for

P42,000 above underlying book value of P604,800 on December 31, 2021. For the year 2024,

GHI included in its net income P75,600 of unrealized gain on a year-end sale of depreciable

assets to ABC. The non-controlling interest of GHI was computed for P10,080 of income in the

2024 consolidated financial statements. The purchase difference allocated to building which

is amortized over 20 years.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning