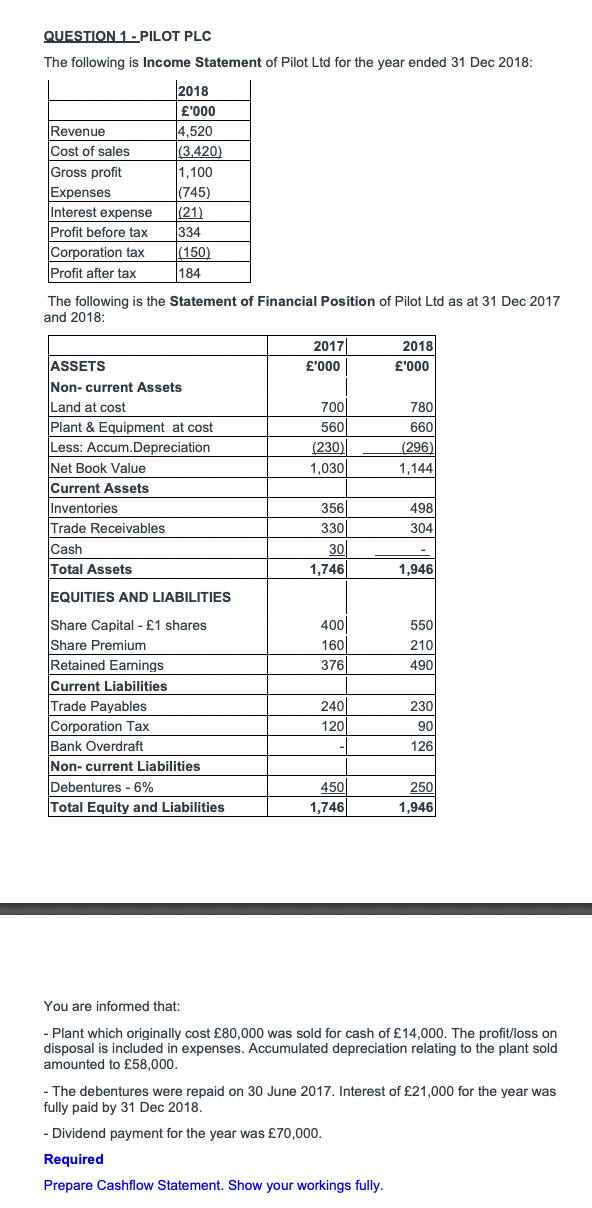

QUESTION 1 - PILOT PLC The following is Income Statement of Pilot Ltd for the year ended 31 Dec 2018: 2018 £'000 Revenue 4,520 (3,420) 1,100 (745) |(21) 334 (150) 184 Cost of sales Gross profit Expenses Interest expense Profit before tax Corporation tax Profit after tax The following is the Statement of Financial Position of Pilot Ltd as at 31 Dec 2017 and 2018: 2017 2018 ASSETS £'000 £'000 Non- current Assets 700 560 Land at cost 780 Plant & Equipment at cost Less: Accum.Depreciation Net Book Value Current Assets 660 (230) (296) 1,030 1,144 Inventories Trade Receivables 356 330 30 1,746 498 304 Cash Total Assets 1.946 EQUITIES AND LIABILITIES Share Capital - £1 shares Share Premium Retained Earnings 550 400 160 210 376 490 Current Liabilities Trade Payables Corporation Tax Bank Overdraft 240 230 120 90 126 Non- current Liabilities Debentures - 6% Total Equity and Liabilities 450 1,746 250 1,946 You are informed that: - Plant which originally cost £80,000 was sold for cash of £14,000. The profit/loss on disposal is included in expenses. Accumulated depreciation relating to the plant sold amounted to £58,000. - The debentures were repaid on 30 June 2017. Interest of £21,000 for the year was fully paid by 31 Dec 2018. - Dividend payment for the year was £70,000. Required Prepare Cashflow Statement. Show your workings fully.

QUESTION 1 - PILOT PLC The following is Income Statement of Pilot Ltd for the year ended 31 Dec 2018: 2018 £'000 Revenue 4,520 (3,420) 1,100 (745) |(21) 334 (150) 184 Cost of sales Gross profit Expenses Interest expense Profit before tax Corporation tax Profit after tax The following is the Statement of Financial Position of Pilot Ltd as at 31 Dec 2017 and 2018: 2017 2018 ASSETS £'000 £'000 Non- current Assets 700 560 Land at cost 780 Plant & Equipment at cost Less: Accum.Depreciation Net Book Value Current Assets 660 (230) (296) 1,030 1,144 Inventories Trade Receivables 356 330 30 1,746 498 304 Cash Total Assets 1.946 EQUITIES AND LIABILITIES Share Capital - £1 shares Share Premium Retained Earnings 550 400 160 210 376 490 Current Liabilities Trade Payables Corporation Tax Bank Overdraft 240 230 120 90 126 Non- current Liabilities Debentures - 6% Total Equity and Liabilities 450 1,746 250 1,946 You are informed that: - Plant which originally cost £80,000 was sold for cash of £14,000. The profit/loss on disposal is included in expenses. Accumulated depreciation relating to the plant sold amounted to £58,000. - The debentures were repaid on 30 June 2017. Interest of £21,000 for the year was fully paid by 31 Dec 2018. - Dividend payment for the year was £70,000. Required Prepare Cashflow Statement. Show your workings fully.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter12: Fainancial Statement Analysis

Section: Chapter Questions

Problem 86PSB

Related questions

Question

Transcribed Image Text:QUESTION 1 - PILOT PLC

The following is Income Statement of Pilot Ltd for the year ended 31 Dec 2018:

2018

£'000

Revenue

Cost of sales

Gross profit

Expenses

Interest expense

4,520

(3.420)

1,100

(745)

(21)

Profit before tax

Corporation tax

Profit after tax

334

(150)

184

The following is the Statement of Financial Position of Pilot Ltd as at 31 Dec 2017

and 2018:

2017

2018

ASSETS

£'000

£'000

Non- current Assets

Land at cost

700

560

780

660

Plant & Equipment at cost

Less: Accum.Depreciation

(230)

(296)

Net Book Value

Current Assets

Inventories

Trade Receivables

1,030

1,144

356

498

304

330

Cash

30

1,746

Total Assets

1,946

EQUITIES AND LIABILITIES

400

Share Capital - £1 shares

Share Premium

Retained Earnings

160

376

550

210

490

Current Liabilities

240

120

Trade Payables

230

Corporation Tax

90

Bank Overdraft

126

Non- current Liabilities

Debentures - 6%

Total Equity and Liabilities

250

450

1,746

1,946

You are informed that:

- Plant which originally cost £80,000 was sold for cash of £14,000. The profit/loss on

disposal is included in expenses. Accumulated depreciation relating to the plant sold

amounted to £58,000.

- The debentures were repaid on 30 June 2017. Interest of £21,000 for the year was

fully paid by 31 Dec 2018.

- Dividend payment for the year was £70,000.

Required

Prepare Cashflow Statement. Show your workings fully.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning