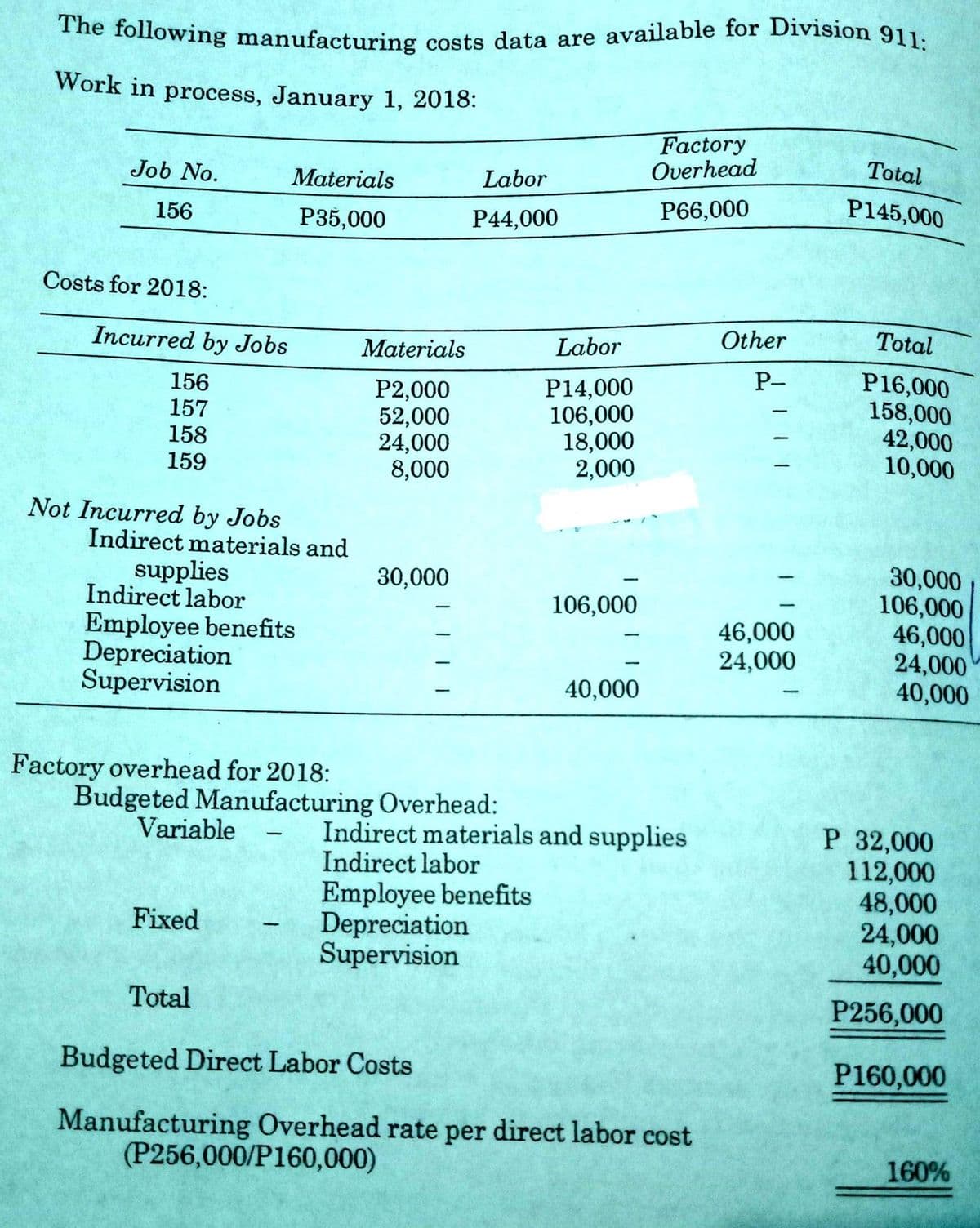

Compute the actual manufacturing overhead and applied manufacturing overhead

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter26: Manufacturing Accounting: The Job Order Cost System

Section: Chapter Questions

Problem 2SEA: SCHEDULE OF COST OF GOODS MANUFACTURED The following information is supplied for Maupin...

Related questions

Question

Compute the actual manufacturing

Transcribed Image Text:The following manufacturing costs data are available for Division 911:

Work in process, January 1, 2018:

Factory

Overhead

Total

Job No.

Materials

Labor

P66,000

P145,000

156

P35,000

P44,000

Costs for 2018:

Incurred by Jobs

Other

Total

Materials

Labor

P16,000

158,000

42,000

10,000

Р-

156

157

158

159

P2,000

52,000

24,000

8,000

P14,000

106,000

18,000

2,000

Not Incurred by Jobs

Indirect materials and

30,000

106,000

46,000

24,000

40,000

supplies

Indirect labor

30,000

106,000

Employee benefits

Depreciation

Supervision

46,000

24,000

40,000

Factory overhead for 2018:

Budgeted Manufacturing Overhead:

Variable

P 32,000

112,000

48,000

24,000

40,000

Indirect materials and supplies

Indirect labor

-

Employee benefits

Depreciation

Supervision

Fixed

Total

P256,000

Budgeted Direct Labor Costs

P160,000

Manufacturing Overhead rate per direct labor cost

(P256,000/P160,000)

160%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning