Manufacturing overhead is

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter3: Process Cost Systems

Section: Chapter Questions

Problem 4E: The cost accountant for River Rock Beverage Co. estimated that total factory overhead cost for the...

Related questions

Question

hello I need help please

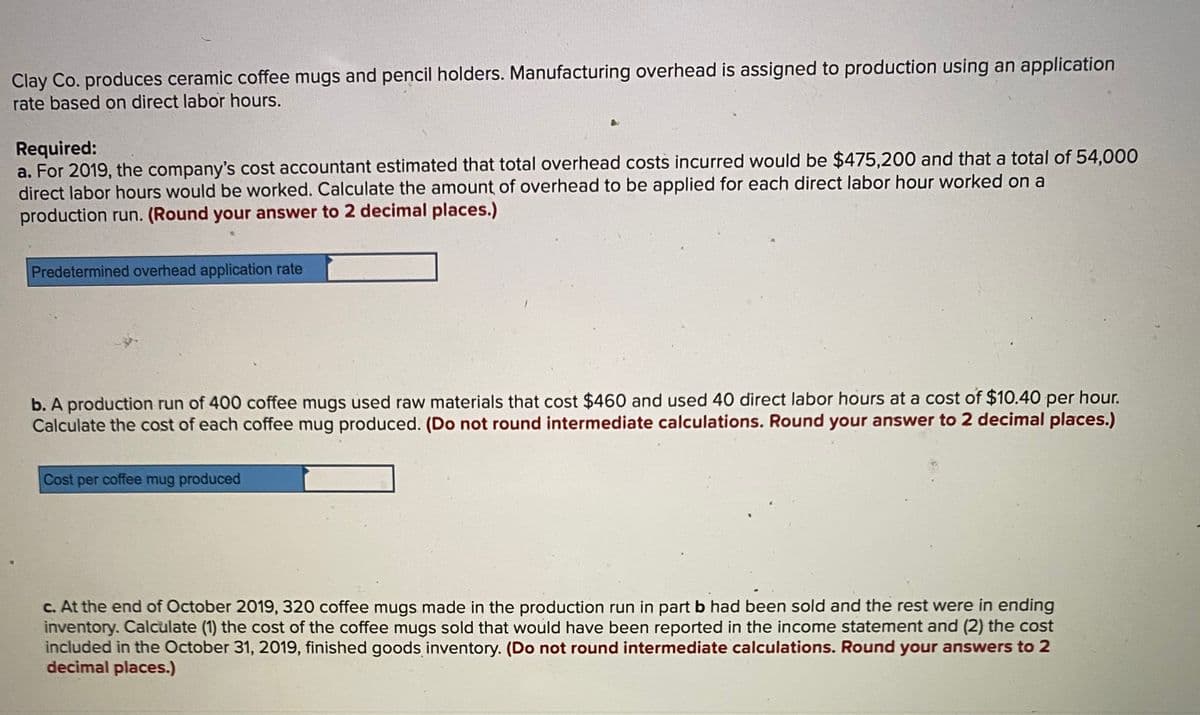

Transcribed Image Text:Clay Co. produces ceramic coffee mugs and pencil holders. Manufacturing overhead is assigned to production using an application

rate based on direct labor hours.

Required:

a. For 2019, the company's cost accountant estimated that total overhead costs incurred would be $475,200 and that a total of 54,000

direct labor hours would be worked. Calculate the amount of overhead to be applied for each direct labor hour worked on a

production run. (Round your answer to 2 decimal places.)

Predetermined overhead application rate

b. A production run of 400 coffee mugs used raw materials that cost $460 and used 40 direct labor hours at a cost of $10.40 per hour.

Calculate the cost of each coffee mug produced. (Do not round intermediate calculations. Round your answer to 2 decimal places.)

Cost per coffee mug produced

c. At the end of October 2019, 320 coffee mugs made in the production run in part b had been sold and the rest were in ending

inventory. Calculate (1) the cost of the coffee mugs sold that would have been reported in the income statement and (2) the cost

included in the October 31, 2019, finished goods inventory. (Do not round intermediate calculations. Round your answers to 2

decimal places.)

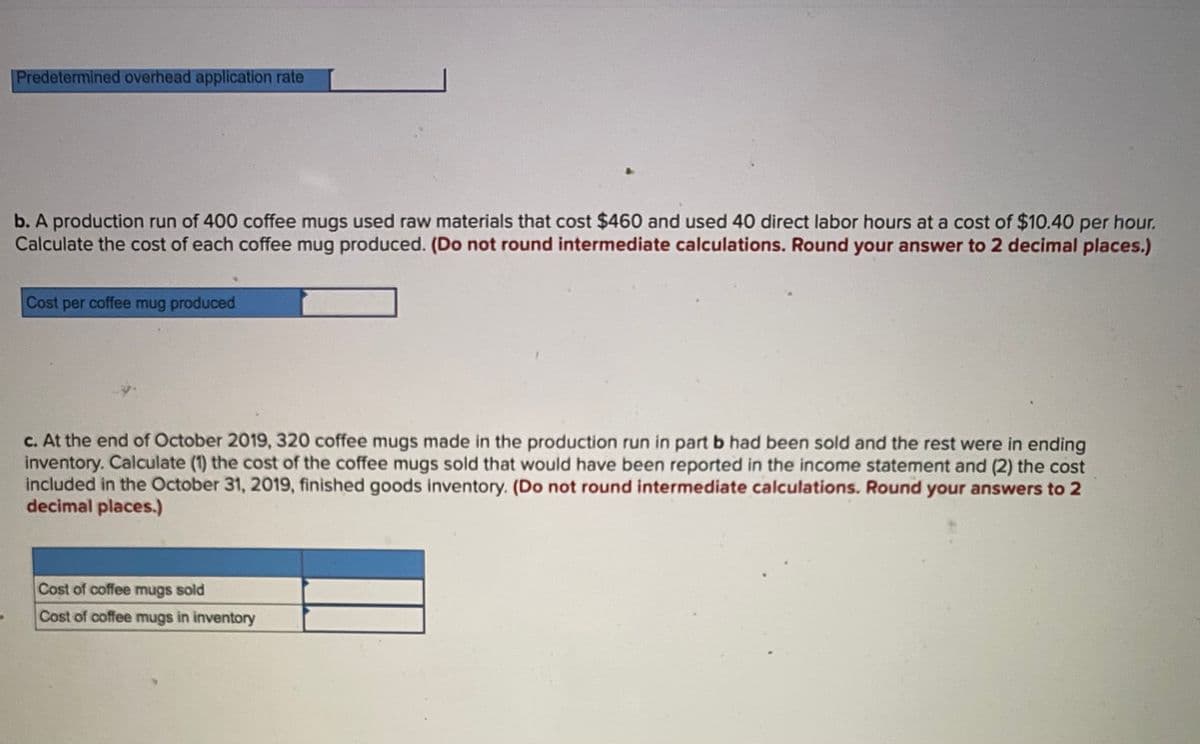

Transcribed Image Text:Predetermined overhead application rate

b. A production run of 400 coffee mugs used raw materials that cost $460 and used 40 direct labor hours at a cost of $10.40 per hour.

Calculate the cost of each coffee mug produced. (Do not round intermediate calculations. Round your answer to 2 decimal places.)

Cost per coffee mug produced

c. At the end of October 2019, 320 coffee mugs made in the production run in part b had been sold and the rest were in ending

inventory. Calculate (1) the cost of the coffee mugs sold that would have been reported in the income statement and (2) the cost

included in the October 31, 2019, finished goods inventory. (Do not round intermediate calculations. Round your answers to 2

decimal places.)

Cost of coffee mugs sold

Cost of coffee mugs in inventory

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,