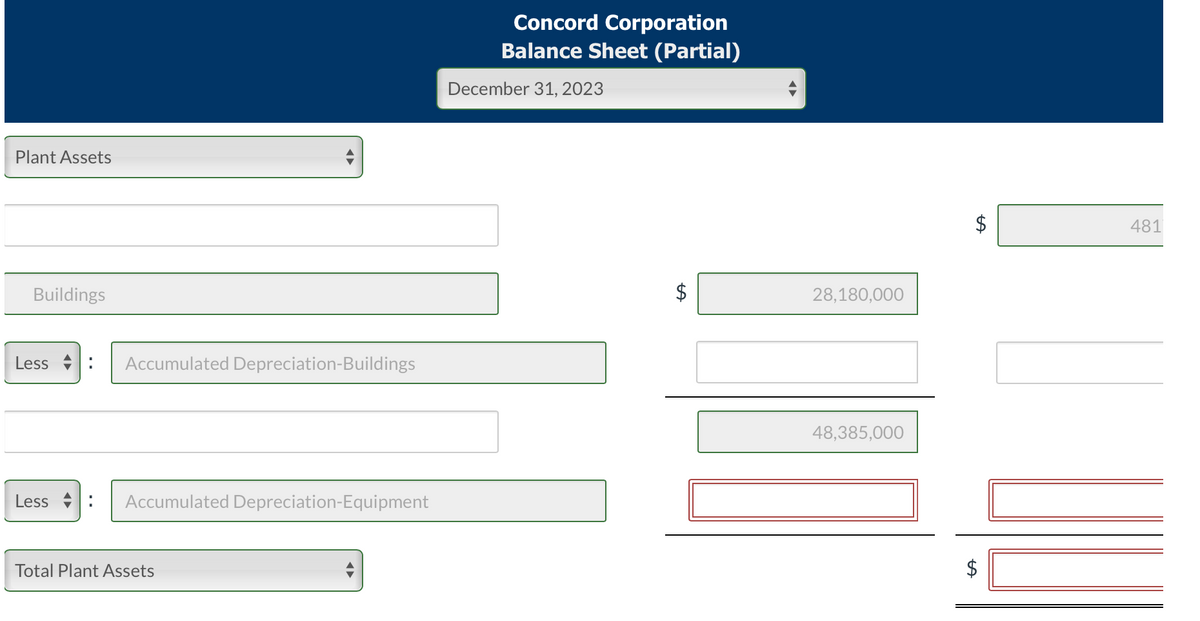

Concord Corporation Balance Sheet (Partial) December 31, 2023 Plant Assets 481 Buildings $ 28,180,000 Less : Accumulated Depreciation-Buildings 48,385,000 Less : Accumulated Depreciation-Equipment Total Plant Assets %24

Concord Corporation Balance Sheet (Partial) December 31, 2023 Plant Assets 481 Buildings $ 28,180,000 Less : Accumulated Depreciation-Buildings 48,385,000 Less : Accumulated Depreciation-Equipment Total Plant Assets %24

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter10: Long-lived Tangible And Intangible Assets

Section: Chapter Questions

Problem 27E

Related questions

Question

Transcribed Image Text:Concord Corporation

Balance Sheet (Partial)

December 31, 2023

Plant Assets

481

Buildings

28,180,000

Less

Accumulated Depreciation-Buildings

48,385,000

Less

Accumulated Depreciation-Equipment

Total Plant Assets

$

%24

%24

%24

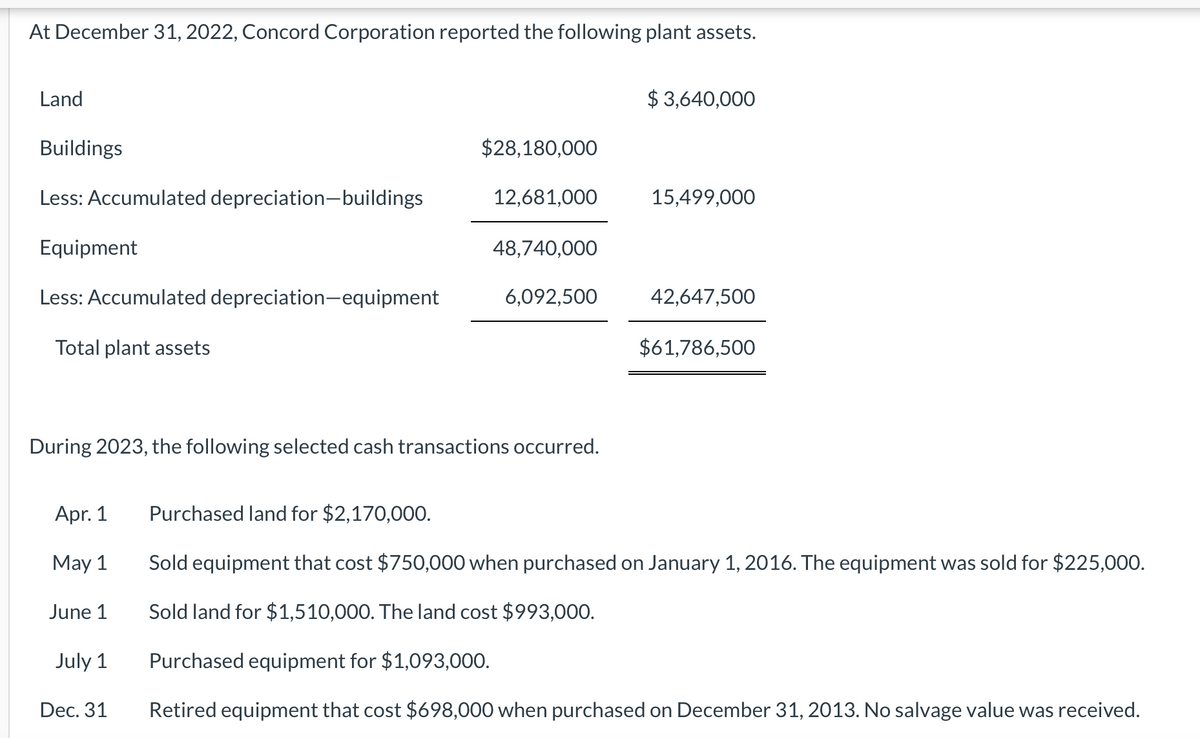

Transcribed Image Text:At December 31, 2022, Concord Corporation reported the following plant assets.

Land

$ 3,640,000

Buildings

$28,180,000

Less: Accumulated depreciation-buildings

12,681,000

15,499,000

Equipment

48,740,000

Less: Accumulated depreciation-equipment

6,092,500

42,647,500

Total plant assets

$61,786,500

During 2023, the following selected cash transactions occurred.

Apr. 1

Purchased land for $2,170,000O.

May 1

Sold equipment that cost $750,000 when purchased on January 1, 2016. The equipment was sold for $225,000.

June 1

Sold land for $1,510,000. The land cost $993,000.

July 1

Purchased equipment for $1,093,000.

Dec. 31

Retired equipment that cost $698,000 when purchased on December 31, 2013. No salvage value was received.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning