Congress would like to increase tax revenues by 11.5 percent. Assume that the average taxpayer in the United States earns $62.00 and pays an average tax rate of 10 percent. a. If the income effect is in effect for all taxpayers, what average tax rate will result in a 11.5 percent increase in tax revenues? (Roun your answer to 2 decimal places.) XAnswer is complete but not entirely correct. Average tax rate 11.50 X%

Congress would like to increase tax revenues by 11.5 percent. Assume that the average taxpayer in the United States earns $62.00 and pays an average tax rate of 10 percent. a. If the income effect is in effect for all taxpayers, what average tax rate will result in a 11.5 percent increase in tax revenues? (Roun your answer to 2 decimal places.) XAnswer is complete but not entirely correct. Average tax rate 11.50 X%

Chapter2: The Domestic And International Financial Marketplace

Section2.A: Taxes

Problem 3P

Related questions

Question

Transcribed Image Text:B.

%24

Mange

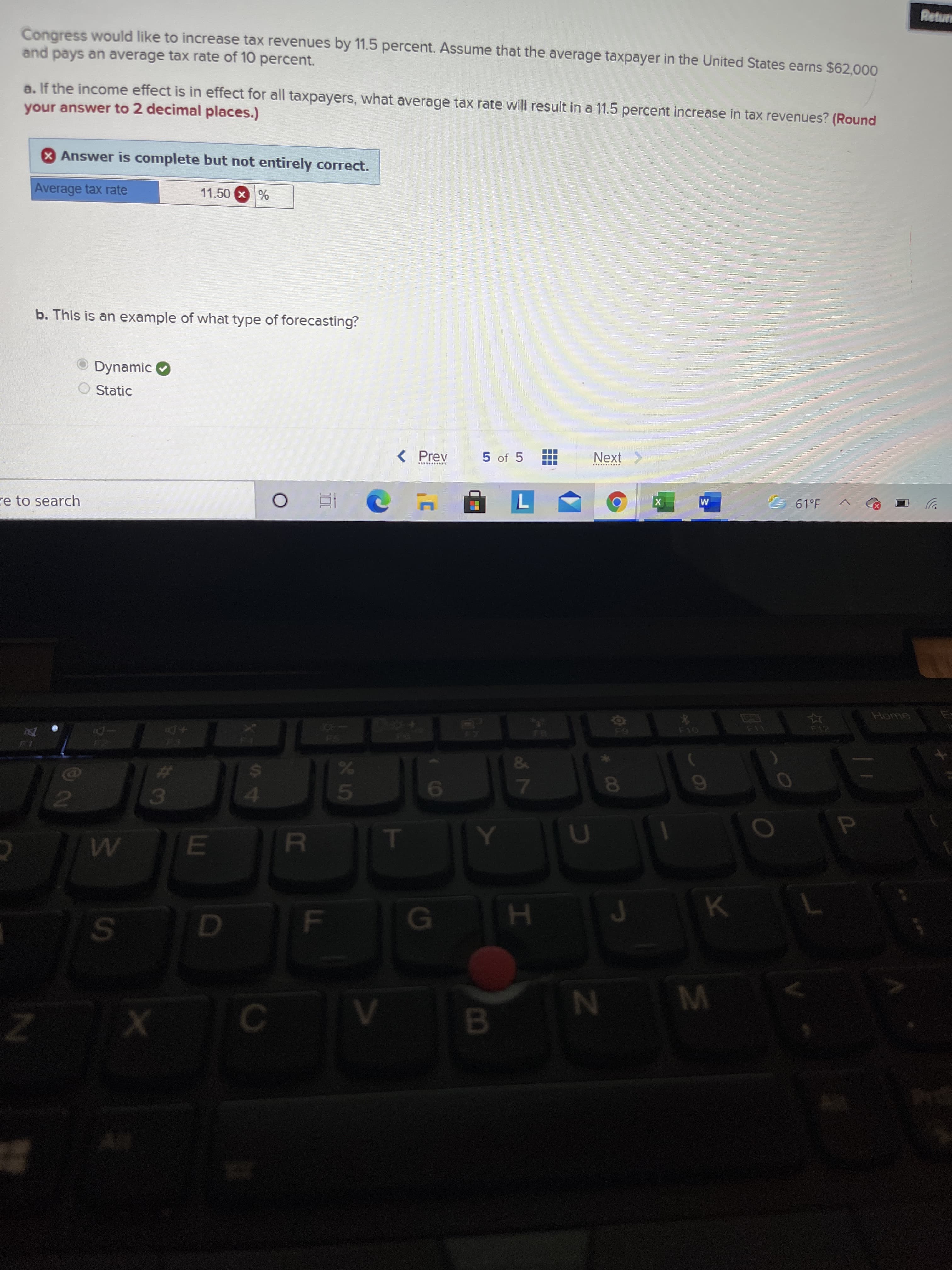

Congress would like to increase tax revenues by 11.5 percent. Assume that the average taxpayer in the United States earns $62,000

and pays an average tax rate of 10 percent.

a. If the income effect is in effect for all taxpayers, what average tax rate will result in a 11.5 percent increase in tax revenues? (Round

your answer to 2 decimal places.)

Answer is complete but not entirely correct.

Average tax rate

11.50 X%

b. This is an example of what type of forecasting?

O Dynamic

O Static

< Prev

5 of 5

Next >

61°F

re to search

M

Home

F12

%23

41

3.

P.

F

M

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT