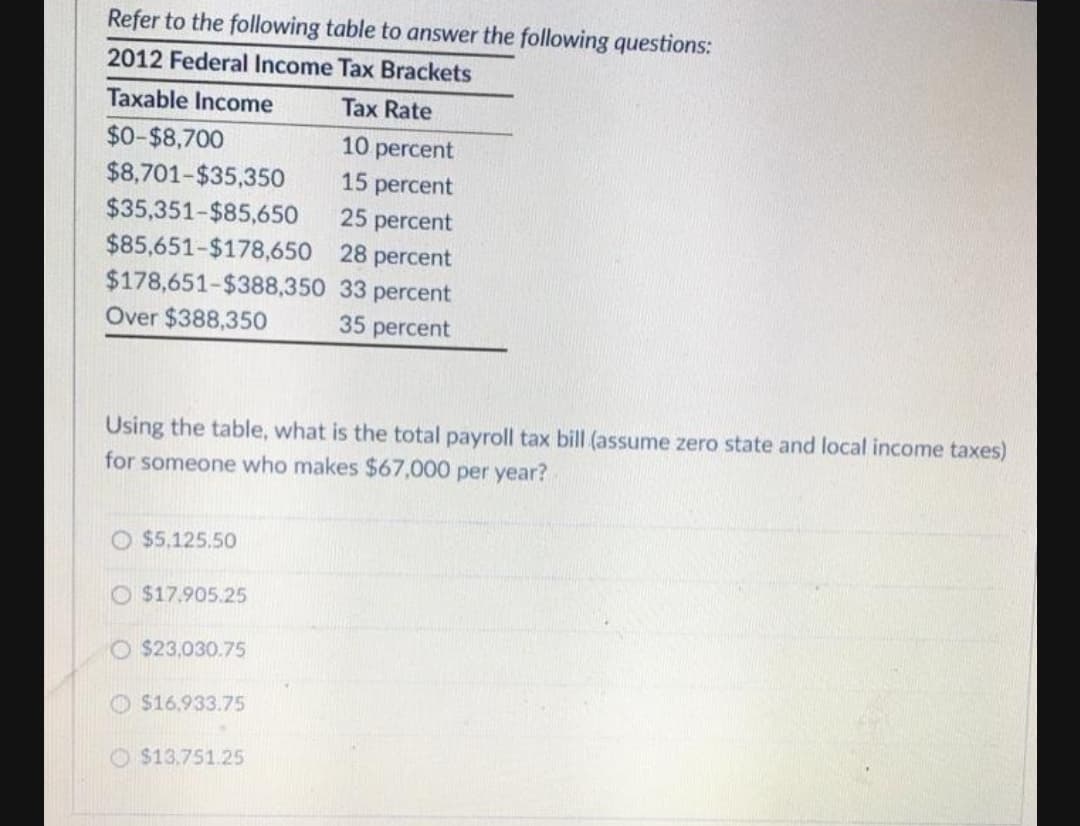

Refer to the following table to answer the following questions: 2012 Federal Income Tax Brackets Taxable Income Tax Rate $0-$8,700 10 percent 15 percent $8,701-$35,350 $35,351-$85,650 $85,651-$178,650 28 percent $178,651-$388,350 33 percent 25 percent Over $388,350 35 percent Using the table, what is the total payroll tax bill (assume zero state and local inm for someone who makes $67,000 per year? O $5,125.50 O $17.905.25 O $23,030.75 O $16.933.75

Refer to the following table to answer the following questions: 2012 Federal Income Tax Brackets Taxable Income Tax Rate $0-$8,700 10 percent 15 percent $8,701-$35,350 $35,351-$85,650 $85,651-$178,650 28 percent $178,651-$388,350 33 percent 25 percent Over $388,350 35 percent Using the table, what is the total payroll tax bill (assume zero state and local inm for someone who makes $67,000 per year? O $5,125.50 O $17.905.25 O $23,030.75 O $16.933.75

Chapter13: Tax Credits And Payment Procedures

Section: Chapter Questions

Problem 25P: LO.2 Oak Corporation has the following general business credit carryovers. If the general business...

Related questions

Question

Transcribed Image Text:Refer to the following table to answer the following questions:

2012 Federal Income Tax Brackets

Taxable Income

Tax Rate

10 percent

$0-$8,700

$8,701-$35,350

15 percent

25 percent

$85,651-$178,650 28 percent

$178,651-$388,350 33 percent

35 percent

$35,351-$85,650

Over $388,350

Using the table, what is the total payroll tax bill (assume zero state and local income taxes)

for someone who makes $67,000 per year?

O $5.125.50

O $17.905.25

O $23,030.75

O $16.933.75

O $13.751.25

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT