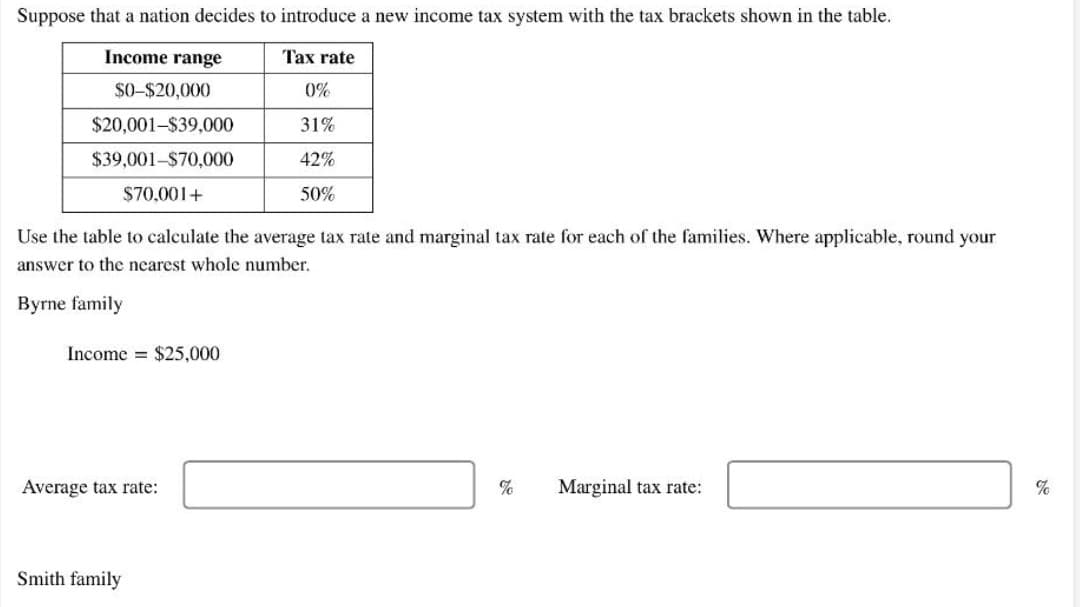

Suppose that a nation decides to introduce a new income tax system with the tax brackets shown in the table. Tax rate Income range $0-$20,000 0% $20,001-$39,000 31% $39,001-$70,000 42% $70,001+ 50% Use the table to calculate the average tax rate and marginal tax rate for each of the families. Where applicable, round your answer to the nearest whole number. Byrne family Income $25,000

Suppose that a nation decides to introduce a new income tax system with the tax brackets shown in the table. Tax rate Income range $0-$20,000 0% $20,001-$39,000 31% $39,001-$70,000 42% $70,001+ 50% Use the table to calculate the average tax rate and marginal tax rate for each of the families. Where applicable, round your answer to the nearest whole number. Byrne family Income $25,000

Chapter1: Federal Income Taxation—an Overview

Section: Chapter Questions

Problem 43P

Related questions

Question

Transcribed Image Text:Suppose that a nation decides to introduce a new income tax system with the tax brackets shown in the table.

Income range

Tax rate

$0-$20,000

0%

$20,001-$39,000

31%

$39,001-$70,000

42%

$70,001+

50%

Use the table to calculate the average tax rate and marginal tax rate for each of the families. Where applicable, round your

answer to the nearest whole number.

Byrne family

Income $25,000

% Marginal tax rate:

%

Average tax rate:

Smith family

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning